A new study from a Japanese crypto exchange showed the country’s crypto fanatics favored Bitcoin ahead of local favorites XRP and Monacoin, with trading volumes for the former significantly higher than the latter two and other altcoins.

Bitcoin saw big bets ahead of alts

Yuya Hasegawa, a Market Analyst at Japanese crypto exchange Bitbank, referred to an April report released by the Japan Virtual and Crypto assets Exchange Association (JVCEA), a Self-Regulatory Organization fully recognized by the country’s Financial Services Agency.

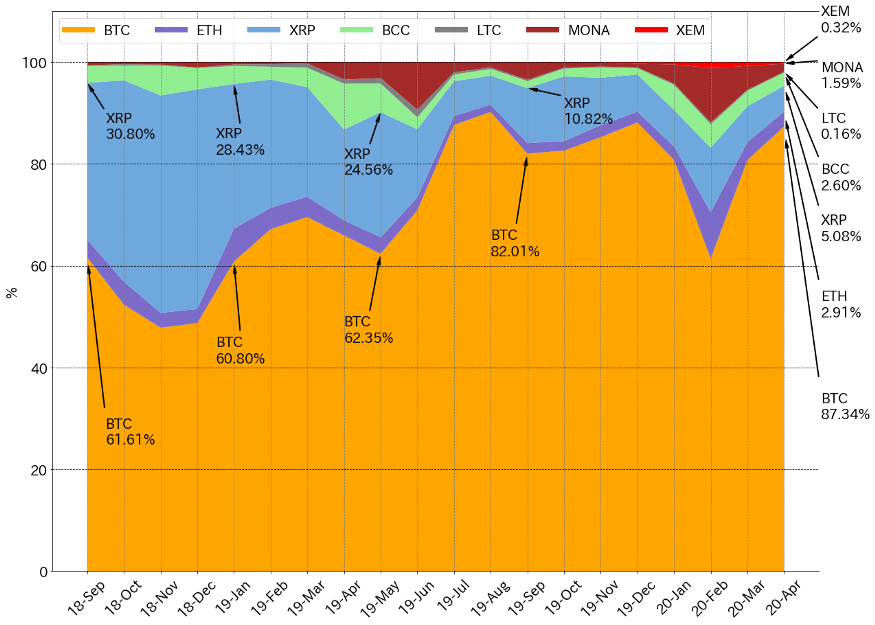

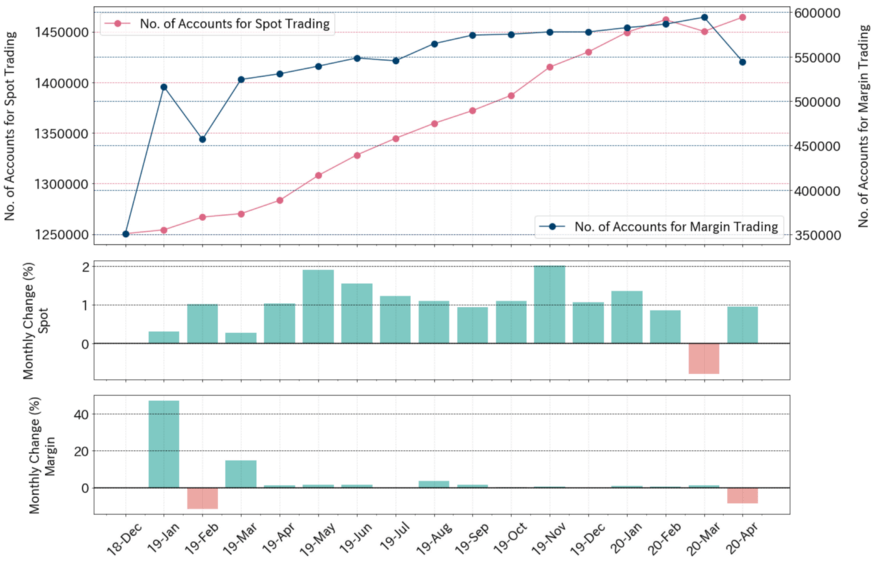

He noted that while the number of active accounts for spot crypto trading reached an all-time high in April, recovering from the dip in March, Bitcoin’s monthly traded value was “back above 87% dominance,” showing that “newer users’ main interest is only in BTC.”

Hasegawa said that for Japanese investors, the overall interest in altcoins has been shrinking over time relative to their interests in Bitcoin. He added the growth in the number of active accounts, the vast majority of the newer market participants in Japan indicated traders are “likely to be interested only in Bitcoin.”

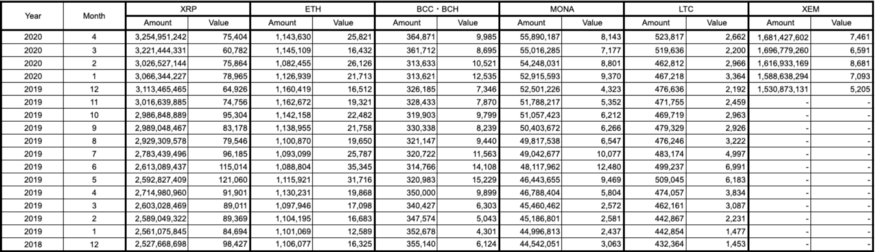

The analyst noted that all figures were taken from officially reported values, which represented true volumes in terms of all JPY exchanged and gave an accurate metric to measure user interest and market size.

Ripple’s XRP once accounted for about 40% of monthly traded value in the Japanese crypto market, the analyst noted, but the dominance structure rapidly changed since the summer of 2019 as Bitcoin rose above 80% (in terms of market share).

Altcoins suffered similarly. Monacoin, a popular token in Japan, saw its volume push Bitcoin’s dominance below 70% earlier in February, but the pioneer quickly recovered and accounted for 87.34% of the crypto market in Japan in April 2020.

However, while traders have shunned the two alts, investors have piled on. The JVCEA’s statistics showed XRP and Monacoin holdings kept an upward trend, even if it did not necessarily translate to the increase in their prices.

Spot markets see a boom in Japan

The report said spot accounts saw a resurgence in April even after dropping off a month earlier in March.

According to the JVCEA, the Japanese spot crypto market added 13,987 active accounts back in April: up 0.96% from 1,450,828 in March, reaching its all-time high, the report noted.

Back in April, the market started to show a major recovery as the worlds’ central banks around the globe announced huge stimulus packages and interest-free loans for citizens in a bid to revive a faltering economy. But while the move may or may not have borne well for the long-term economic health; it did wonders for markets.

Bitcoin pumped over 150% since its sub-$4,000 lows in March, while large-caps like Ethereum and Chainlink grew 300% and 700% respectively. The succeeding months even saw DeFi projects like Compound and Synthetix chalk up their own growth stories, with a newcomer, Yearn Finance, even recorded a 14,000% return for early investors.