Traders in the crypto market are increasingly betting on the outcome of the contested U.S. election. So far, the majority of bets are on Joe Biden, the Democratic candidate. Bitcoin is surging on the predicted outcome, as a blue sweep benefits the dominant cryptocurrency.

The betting odds in the crypto prediction markets, primarily augur, are mostly in line with traditional platforms. According to The Guardian, the open interest for the U.S. presidential election has exceeded $1 billion. Both crypto and traditional betting markets have Biden as the favorite.

Across traditional markets, Biden remains the firm favorite to win the election. Matthew Shaddick, Ladbrokes Coral Group’s head of political betting, wrote:

“Florida is one where the polls suggest Biden is the more likely winner, but the [betting] markets have Trump as favourite [there]. The GOP have tended to overperform the polls quite regularly in that state.”

Many people within the crypto sphere are betting on the election

The crypto prediction market’s open interest of around $10 million is nearly 1% of the global open interest of U.S. election betting markets. Comparably, the number of people betting on the election within the crypto sphere is relatively high.

There is all around high interest around the election, as shown by the crypto market’s volatility. According to Ethereum co-creator Vitalik Buterin, prediction markets are a niche space because they are difficult to access for statistical experts and hedge funds. Buterin said:

“Prediction markets are difficult to access for statistical/politics experts, they’re too small for hedge funds to hire those experts, and the people (esp wealthy people) with the most access to PMs are more optimistic about Trump.”

As such, the crypto prediction market securing a high open interest for the election is relatively high.

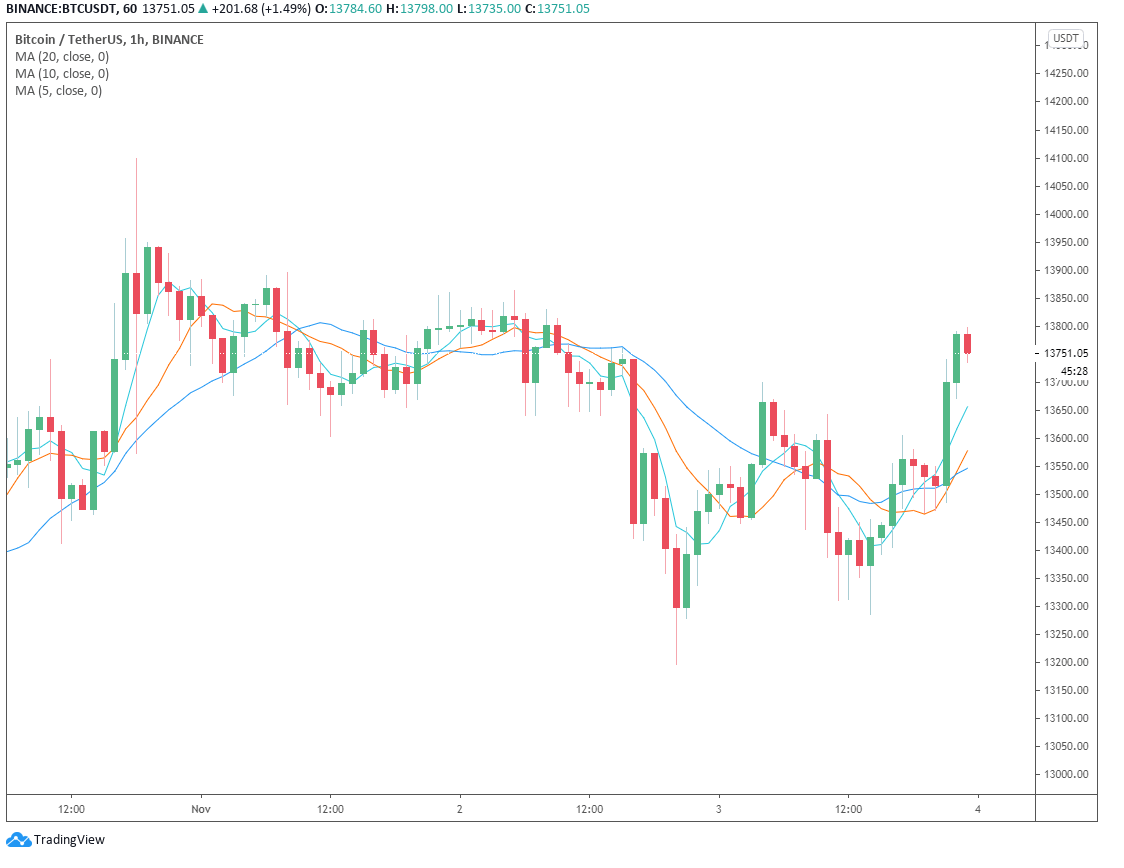

The high level of anticipation towards the U.S. election is also evident in the price of Bitcoin. The price of BTC rose by around 3% in the last two hours as the election began to heat up.

The momentum of Bitcoin could come from the analysis that a Democratic wipeout could fuel BTC.

The Biden presidential campaign has put up two key strategies that could potentially hut the stock market in the short term. First, investors are expecting heightened regulation from the Biden administration. Second, Biden is expected to raise taxes, particularly on the wealthy, which could rattle the markets.

Bitcoin benefits from this uncertainty in the U.S. stock market because it is perceived as an alternative store of value. Alongside gold, Bitcoin has emerged as a strong inflation play, and a part of that is being a safe-haven asset against major macro events.

Bitcoin HODLers unfazed by the election

A spike in volatility amidst the U.S. presidential election was expected. But whether the volatility would lean towards the downside or the upside was still up in the air.

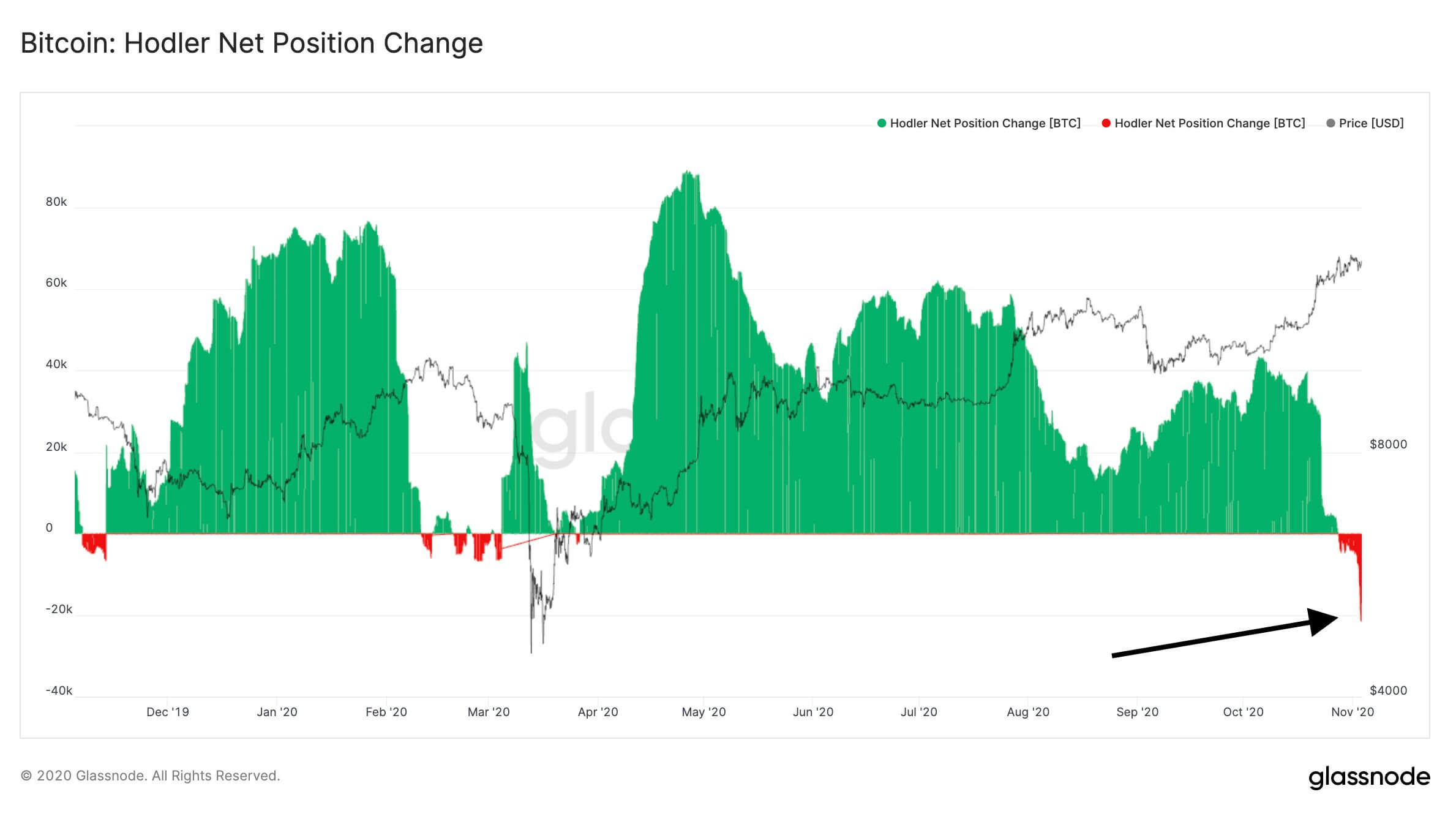

According to analysts at Glassnode, the Bitcoin HODLer Net Position Change negative has been consistently negative. This indicates that long-time investors in BTC have been firmly holding onto their holdings. The analysts wrote:

“Bitcoin Hodler Net Position Change has been negative for the past week. It indicates the monthly position change of long-term investors according to BTC’s Liveliness. It is the first time we see this since March, and the lowest since Aug 2019.”

The optimism towards Bitcoin from HODLers and whales, which have shown little activity in the past week, likely comes from the fact that the election boosts BTC regardless of the outcome.

“BTC at $13.7k despite lot of OTC selling from informed players ahead of the election. What do we think will happen when we have clarity on the election result?,” crypto quant trader Qiao Wang wrote.

Bitcoin Market Data

At the time of press 11:51 am UTC on Nov. 4, 2020, Bitcoin is ranked #1 by market cap and the price is up 1.69% over the past 24 hours. Bitcoin has a market capitalization of $254.51 billion with a 24-hour trading volume of $32.48 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 11:51 am UTC on Nov. 4, 2020, the total crypto market is valued at at $395.29 billion with a 24-hour volume of $86.77 billion. Bitcoin dominance is currently at 64.32%. Learn more about the crypto market ›