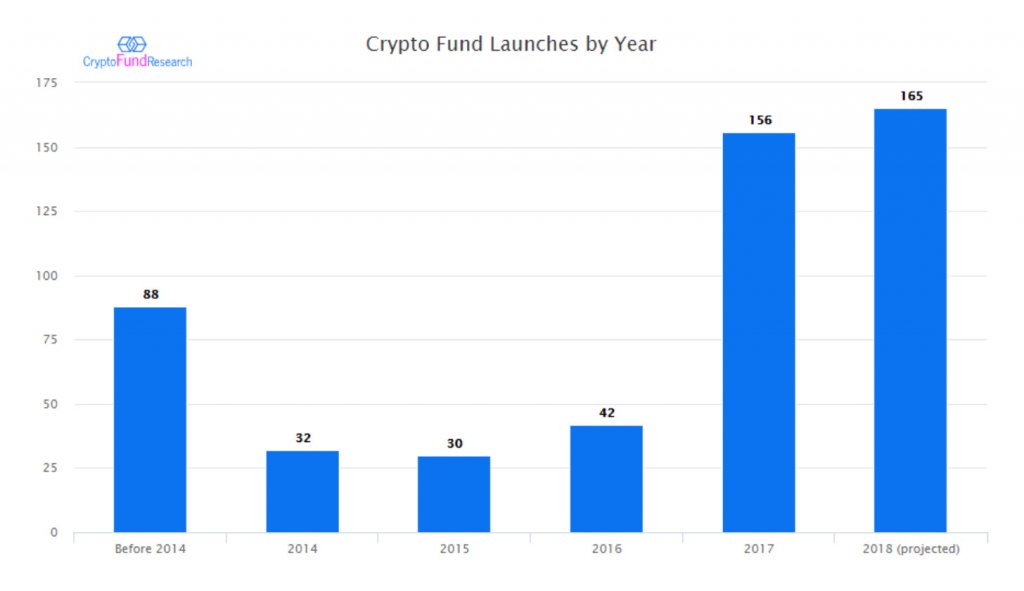

Crypto funds have been launching at a record pace, with more than 90 new crypto funds having launched this year alone. At this rate, there will be 165 new crypto funds launched this year, more than the record 156 launched in 2017. The total number of crypto funds is now approaching 500.

The surge in new funds comes amid what would seem to be an unfavorable environment for new funds. Prices for leading cryptocurrencies like Bitcoin and Ethereum have fallen by more than half since the beginning of the year. Regulators have cracked down on trading in large developing markets like China and India. In developed markets, regulation remains murky. In the U.S., investors eagerly await the approval of a Bitcoin ETF like that proposed by VanEck and SolidX, but aside from declaring a few cryptocurrencies to be commodities, rather than securities, regulators have yet to weigh in on many important issues.

The question then, is why are so many crypto hedge funds and venture capital launching in the current climate? Before addressing this, it’s important to briefly discuss the three broad types of crypto funds.

What is a Crypto Fund?

Crypto funds come in a variety of shapes and sizes, but three key types account for the majority of funds.

- Crypto hedge funds invest primarily in cryptocurrencies like Bitcoin, Ethereum, Ripple and Dash, as well as smaller cryptocurrencies.

- Crypto venture funds invest in blockchain companies either through initial coin offerings (ICOs) or by making traditional seed and early-stage equity investments.

- Hybrid funds invest in cryptocurrencies as well as directly in blockchain companies via ICOs or equity investments. While somewhat rare outside of the crypto world, hybrid funds are common in the crypto space.

There are also a number of more traditional venture funds like Sequoia Capital and a16z that sometimes invest in Blockchain companies, but maintain large portfolios of other venture investments.

Why is the Crypto Market so Conducive to Fund Formation?

Why crypto funds have continued to launch at record rates, even in a bearish market, is a bit of a conundrum. When global stock markets plummeted in 2008 and 2009, so did the number of traditional hedge fund launches. In both years, more funds were liquidated than launched. In fact, in the fourth quarter of 2008, more than 12 times as many funds liquidated as launched.

So what’s different in the crypto market? Why are funds continuing to launch under such bearish conditions? This divergence is driven by a number of factors including regulation, fund manager demographics, lack of competing products and a possible disconnect between retail investors and crypto fund managers.

Regulations May Favor Crypto Funds

While investors typically loathe uncertainty, particularly of the regulatory variety, this may actually be helping to fuel the formation of new funds. And while investors await further clarity, the Howey Test, a 70-year-old court decision, is playing an important role.

The Howey Test is a four-pronged test created by the Supreme Court in 1946 to help determine what constitutes a security. Funds dealing in securities, as determined by this test, are subject to much stricter reporting and disclosure requirements than those that don’t.

In a June speech, SEC Director William Hinman indicated that the SEC intends to treat most ICOs and some cryptocurrencies as securities while treating Bitcoin and Ethereum as commodities. This is an important distinction as crypto funds trading exclusively in cryptocurrencies deemed to be commodities may have extremely modest reporting requirements compared to funds trading in securities. Because of this, fund formation is far easier than for traditional hedge funds, most of which trade securities.

In practice, however, it’s unclear if all crypto fund managers are aware of, or concerned by, the distinction between trading in securities and commodities. Depending on their asset size and the type and number of beneficial owners, some regulatory filings may not be necessary at all. While the vast majority of crypto funds are probably fully or mostly compliant, the number of funds with no paper trail whatsoever does raise some legitimate questions. The SEC subpoenaed several dozen crypto funds earlier in 2018 over similar concerns.

While the above only applies directly to U.S. funds or those dealing with U.S. persons, the SEC tends to set standards that are largely adopted by other jurisdictions around the world. And to the extent crypto funds face less burdensome compliance than traditional hedge funds, it helps to explain some of the rapid rise in new funds this year.

Competition Remains Mostly Nonexistent

Traditional hedge funds have competition from a range of products including mutual funds, ETFs and registered investment advisors (like your buddy that works for Morgan Stanley but seems to mostly play golf). The $3 trillion hedge fund market is dwarfed by the size of the ETF and mutual fund markets, with assets of $17 trillion and $30 trillion, respectively. Crypto funds, on the other hand, have extremely limited competition for investor wallets.

While there are a few “blockchain” ETFs, they provide exposure to the industry in only the broadest sense. They generally hold publicly traded companies like Overstock and Square that aren’t exactly pure crypto/blockchain investments. There are a couple of futures contracts available for Bitcoin, but these markets are nowhere near as developed as they are for other markets.

In some senses, the ICO is a competing product; but ICOs may have actually made launching a crypto venture fund easier. In addition to conducting extensive due diligence, partners in traditional venture funds usually negotiate the terms of their investments directly with founders. Unknown venture funds often may not even get a seat at the table with promising startups. With ICOs, it’s as easy as reading a few whitepapers and purchasing one of 2018’s more than 700 new ICOs. While this approach may not make for a successful long-term investment strategy, it does eliminate a major hurdle of starting and operating a venture fund.

Crypto Fund Manager Demographics

Who is running most crypto funds? There are many experienced investment managers like Mike Novogratz, who brought a decade and a half of hedge fund experience to his crypto fund, Galaxy Digital. Anecdotally, however, there also seems to be quite a lot of young founders with little or no investment experience.

In April of this year, Bloomberg and several other news outlets covered the launch of a crypto hedge fund called founded by several Harvard undergraduate students, called Plympton Capital. Four months later and Plympton Capital seems to no longer exist and the only remnant of this ambitious project is an abandoned Wix website.

Lack of investment management experience is not bad in and of itself. Many crypto fund founders have valuable expertise outside of traditional investment management. A deep understanding of programming, protocols and underlying Blockchain technology, in general, may be far more critical for investment success than familiarity with traditional equity analysis. But whereas a traditional hedge fund manager might have obtained decades of investment management experience and various professional designations, the prerequisites for starting a crypto fund can be as significantly less onerous.

Is the Crypto Fund Industry Getting Ahead of Itself?

Fewer barriers to entry and a bit of youthful enthusiasm may largely explain the number of new crypto funds, but an important question remains: Is the pace of new fund launches sustainable?

A straightforward measurement of demand for any investment product is assets under management (AUM). By this measure, crypto funds are not in nearly as high of demand as the sheer number of new launches might initially indicate. Nearly 500 crypto funds cumulatively manage about $7 billion, or an average of around $15 million per fund. In fact, nearly half of all crypto funds manage $10 million or less. For comparison, half of all traditional hedge funds have $100 million or more in assets.

It is worth noting, however, that even as cryptocurrencies themselves have declined, crypto assets under management have mostly crept upward.

Evaluating assets under management is critical because they are the key driver of hedge fund and venture fund revenues in bear markets, as performance fees become inconsequential. With a typical 2 percent management fee, a $10 million fund earns only $200,000 in management fees. This is hardly enough to sustain a fund with multiple analysts, traders and salespeople. Heck, these days a fund might need an entire team just to delete the thousands of ICO pitches in their inbox.

Of course, in a cryptocurrency bull market like 2017 when Bitcoin returned more than 1000 percent, performance fees can vastly exceed management fees. A fund that started 2017 with $10 million fully invested in Bitcoin (there were very few) would have ended the year at over $100 million and generated tens of millions in performance-based fees.

It’s not absurd to speculate that the growth of new funds has resulted as much from emerging fund manager’s optimism for future performance fees as from investor demand. In a declining market, many funds may find it difficult to cover expenses from management fees alone.

Conclusion

Over the last 18 or so months, hundreds of managers have taken advantage of comparatively low barriers to entry to launch new crypto funds in spite of lackluster retail and institutional demand for their products, declining prices for their assets and regulatory uncertainty. But low barriers to entry in any industry have a tendency to lend themselves to a lower quality product.

For evidence of this, we need to look no farther than the ICO market, where a coin can be issued almost overnight. Hundreds of companies with questionable business models (to put it gently) can now freely compete with potentially legitimate blockchain startups for investor attention, damaging the reputation of ICOS in general. Likewise, a continued shift to quantity over quality in crypto funds is unlikely to be beneficial to the industry long-term.

The growth in crypto funds also has some similarities to those of the ICO market–both seem to rely on continued favorable regulatory treatment, an eventual end to the bearish market for cryptos, and ever-increasing investor interest in the space. In the absence of these, the pace of new fund launches is likely to decelerate in the near future. Depending on how things shape up, this could be followed by many funds closing their doors and leaving nothing behind but a boilerplate Wix website

Disclaimer: The information contained in this article is provided for informational purposes only, and should not be construed as legal or investment advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this site without seeking legal or other professional advice.