Bitcoin has seen a notable uptick in its fundamental strength over the past week. This strength has come from multiple fronts, including increasing network activity, liquidity, and investor sentiment.

This swell in its fundamental vigor has come about after a nearly month-long period of decline.

Based on this data, one indicator is now showing that the cryptocurrency is on the cusp of entering firm bull territory.

Bitcoin sees fundamental growth following period of decline in May

The first week of June proved to be a turbulent one for Bitcoin, with the benchmark cryptocurrency rallying up to highs of $10,400 before plummeting to lows of $8,400.

It has since recovered a good portion of these losses, and its fundamental strength has been able to grow in the face of this heightened price volatility.

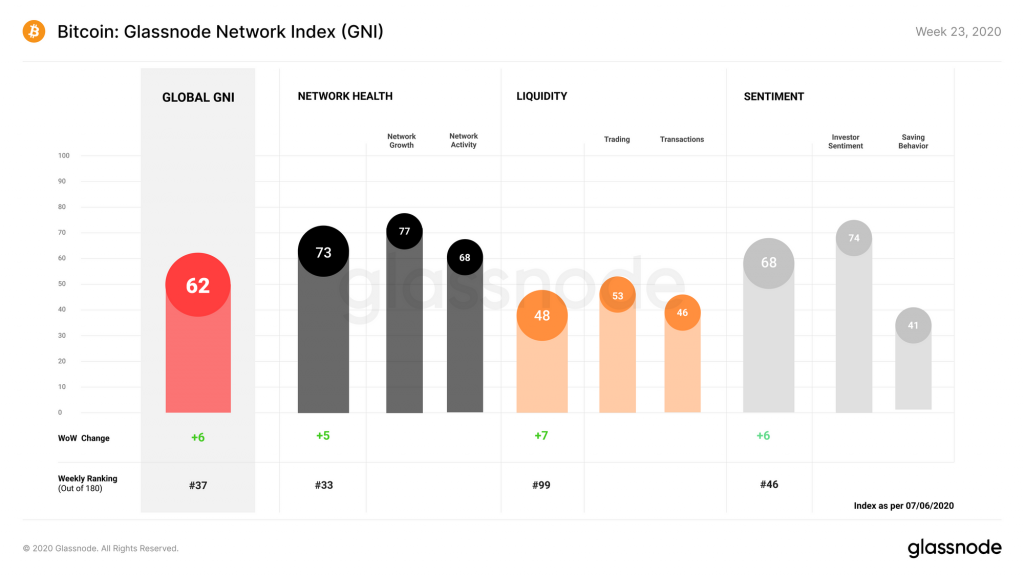

According to analytics platform Glassnode’s latest “Week On-Chain” report, the firm notes that the benchmark cryptocurrency’s GNI Index saw growth across all three of its sub-indices.

This is a sign of fundamental growth and marks a divergence from the firm downtrend seen across these sub-indices throughout the month of May.

One of the most notable changes can be seen while looking towards the cryptocurrency’s liquidity index, which is now in the “neutral” zone after declining to the “weak” zone last week.

“Currently at 48 points, this increase was mainly driven by an 18% increase in transaction liquidity as on-chain transactions increased and fees continued to decrease after experiencing a post-halving spike.”

Sentiment and network activity also climbed higher last week, with investors growing more confident in Bitcoin’s near-term outlook as it consolidates within the upper-$9,000 region.

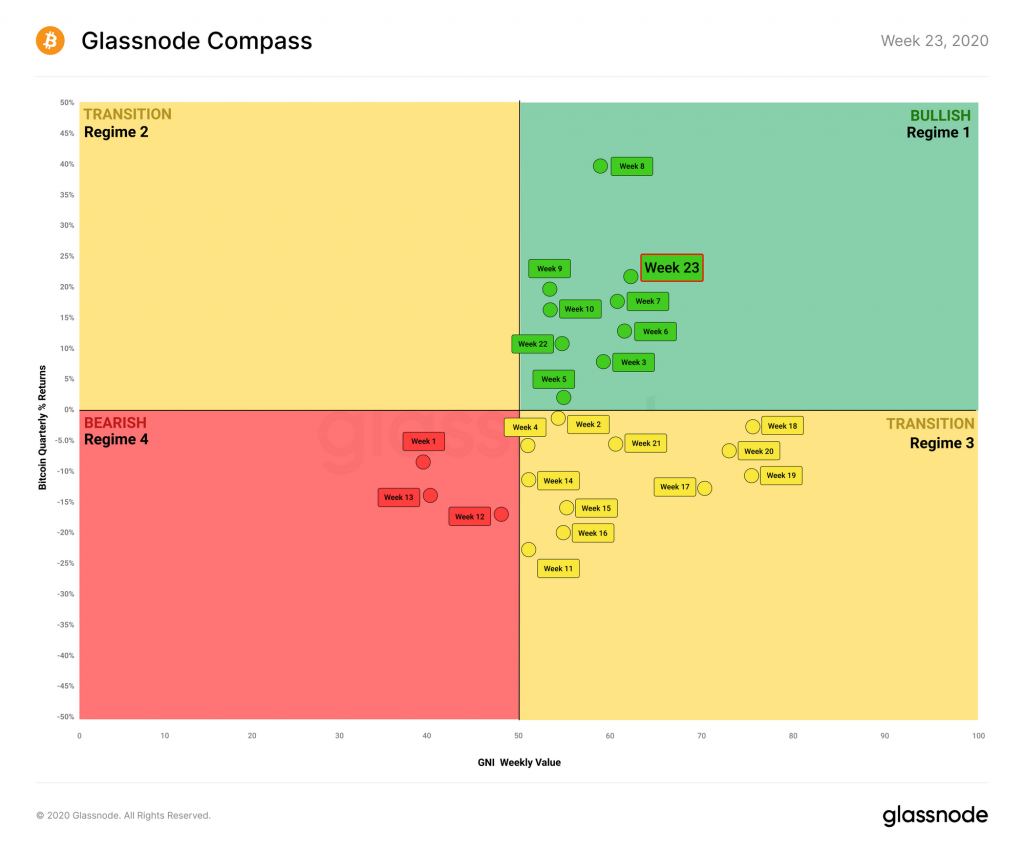

This compass shows BTC is fast approaching bull territory

Bitcoin’s near-term outlook remains unclear due to the seemingly insurmountable resistance that exists within the lower-$10,000 region.

The Glassnode Compass, however, shows that the cryptocurrency is fast approaching bull territory as its fundamental strength begins rebounding.

“With on-chain fundamentals seemingly on the rise and BTC seeing sustained values over $9k, the outlook for bitcoin seems to be stabilizing in the optimistic zone.”

The firm also notes that in order for this indicator to firmly forecast an imminent uptrend, it will require a couple more weeks of fundamental growth – per the GNI Index.

“Market observers should watch for another week or two of continued growth in on-chain activity and adoption to determine whether this is an upwards trend or an isolated period of growth.”

Because the selling pressure around $10,000 is quite strong, BTC will require a robust undercurrent of both technical and fundamental strength in order for it to push higher in the days and weeks ahead.