Behaviors seen amongst Bitcoin miners can provide insights into the state of the crypto market, as they are the collective group responsible for both running the BTC network and placing a steady stream of selling pressure on the market.

Watching for when miners sell or hold their minted BTC can offer insight into how they feel about the cryptocurrency’s price trend.

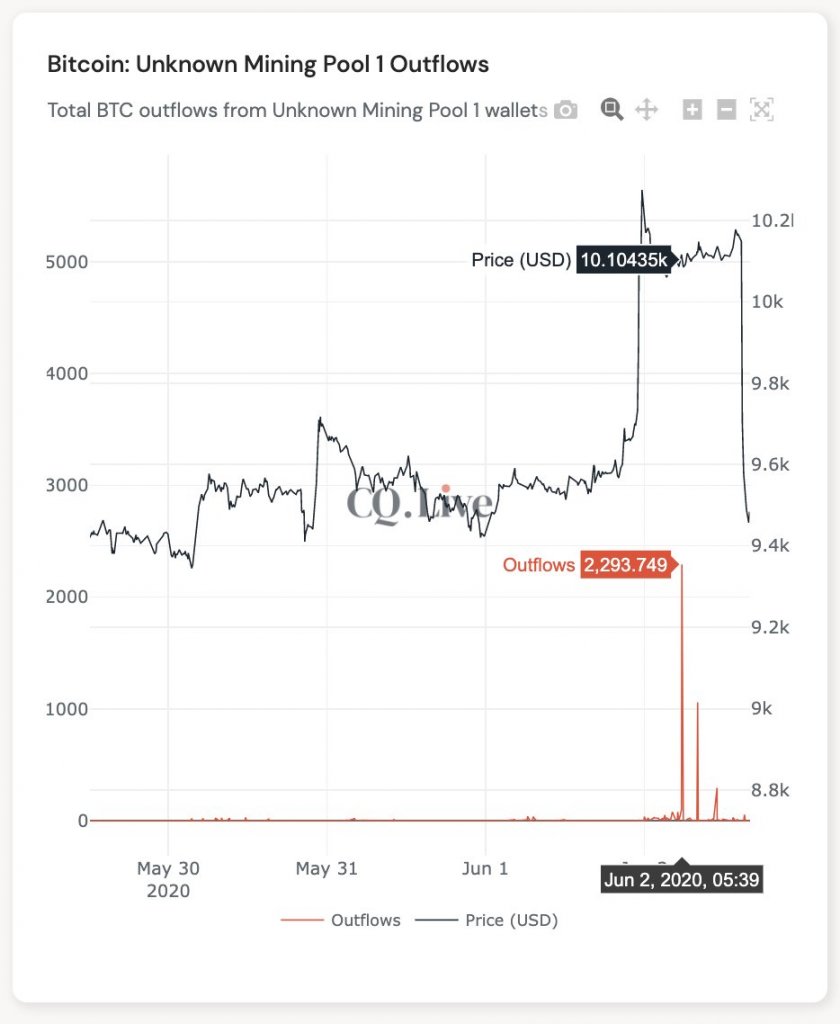

Interestingly, the largest unknown Bitcoin mining pool saw significant outflows in the hours before Bitcoin plummeted from the mid-$10,000 region to lows of $8,600.

This may offer a grim outlook for the cryptocurrency’s mid-term trend, as it signals that this pool – who has sold previous market tops – does not feel that the crypto’s recent uptrend will be sustainable.

Bitcoin miner outflow offers significant insight into the price trend

Although miners may not have too much more predictive power than retail investors do when it comes to Bitcoin’s price, they are able to influence the market through when and at what price they sell their minted BTC.

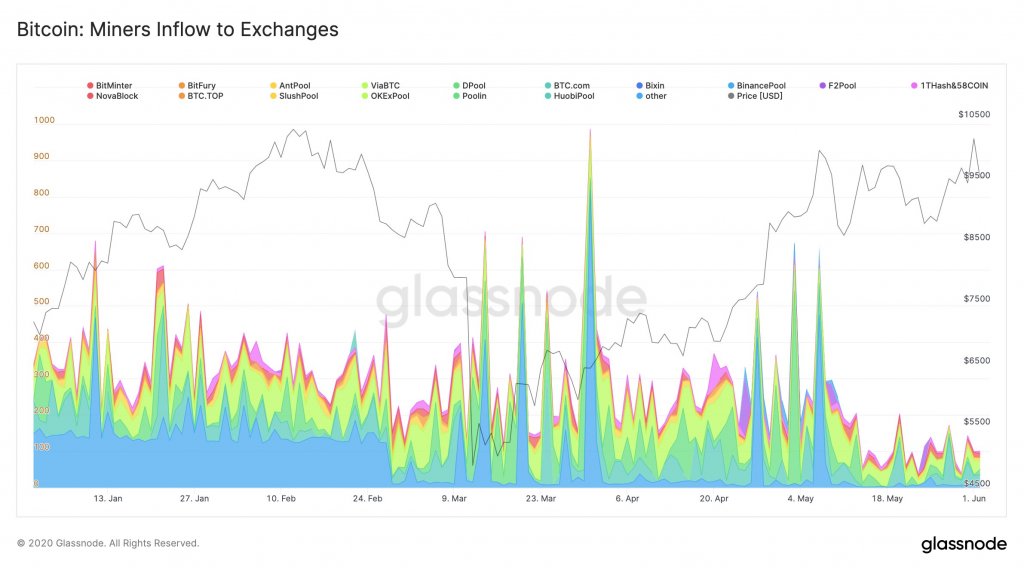

Analytics platform Glassnode spoke about the insight miners can offer into market trends in a recent post, offering a chart showing that miner inflows into exchange, in general, have been declining significantly in the time since the mining rewards halving in early-May.

“Miners play an essential role in the Bitcoin ecosystem. Understanding their behavior gives investors powerful insight into a driving force of the market.”

Many had speculated that the mining rewards halving would help alleviate some of the mining pressure that had previously been placed on the market by miners.

This notion appears to have been proven true by the data presented by Glassnode.

This unknown mining pool’s selling patterns predictive of market outlook

The largest unknown mining pool has established a tendency of selling local market tops in recent times.

Ki Young Ju – the CEO of CryptoQuant – spoke about this in a recent tweet, offering a chart showing that they moved a significant amount of Bitcoin to an exchange just before the market plummeted from over $10,000 to lows in the sub-$9,000 region.

“Significant outflows from the unknown miner before the dip.”

The same mining pool’s wallet also saw a massive outflow on May 20th as well, just before it declined from $9,800 to lows of $8,700.

Ju also spoke about this:

“Major mining pools usually send BTC to exchanges periodically, but this largest unknown mining pool, they only move their Bitcoins when the price reaches THE TOP.”

Their selling around the $10,000 region seems to indicate that this mining pool – which has the fifth-largest hash rate – does not think Bitcoin will easily surmount the five-figure price region.