The past year has been a period of immense growth for Bitcoin from a fundamental perspective, with it now being arguably more strong than ever before.

Multiple metrics highlight this strength, including BTC’s hash rate hovering around an all-time high, transaction volume trending upwards, and the growing number of new wallet addresses.

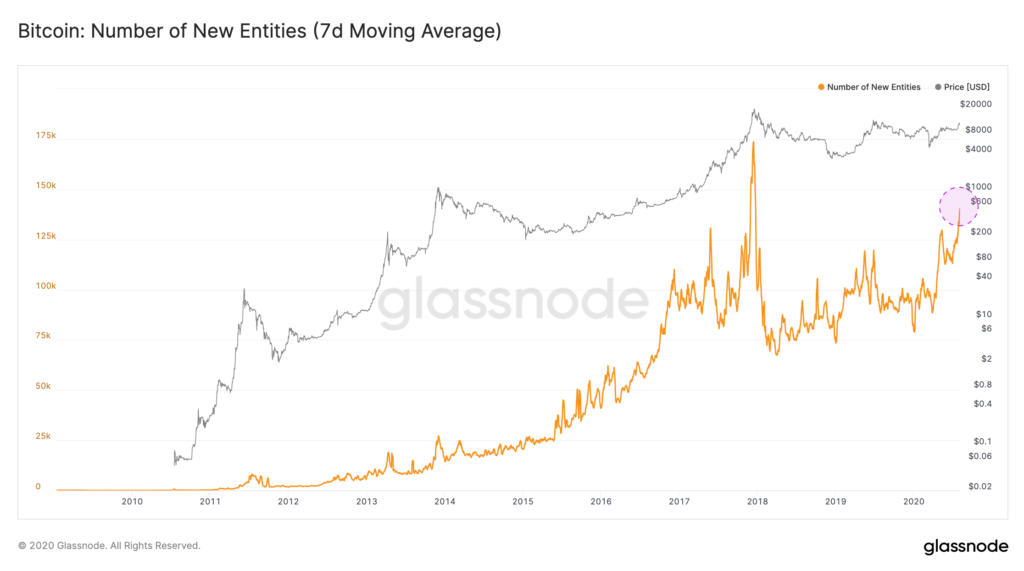

The growth in the number of new addresses comes as the number of “unique entities” interacting with the network also reaches the highest levels it has been since late-2017.

This means that there is an abundance of new users within the crypto ecosystem who are all interacting with Bitcoin and its network.

Analysts at Bloomberg point to this metric as one of the bullish factors currently underpinning the benchmark cryptocurrency.

They believe that as long as this metric continues trending higher, Bitcoin’s price will follow suit.

Unique entities interacting with the Bitcoin network hits fresh post-2017 high

The strong price action seen by Bitcoin – coupled with its growing recognition as being a “hard asset” – has attracted a significant number of new investors and users to the cryptocurrency.

This trend is clearly indicated while looking towards the number of unique entities interacting with the blockchain, which just reached its highest point seen since late-2017.

Analytics platform Glassnode offered insight into this metric’s growth, putting forth a chart showing that it has been surging since the start of the year.

“The number of unique entities appearing for the first time in the Bitcoin network is surging. This growth rate is the largest we have seen since late 2017.”

Because this points to an influx of new market participants, it does not appear that the recent price appreciation seen by Bitcoin is unwarranted.

Bloomberg analysts: BTC price likely to follow active address count

Analysts at Bloomberg believe that Bitcoin’s price will rally higher based on this fundamental growth.

They note that the digital asset’s price is likely to move in sync with the number of active addresses.

In the near-term, they claim that this metric suggests that it has a fair value of $12,000.

“The number of active Bitcoin addresses used… suggests a value closer to $12,000, based on historical patterns. Reflecting greater adoption, the 30-day average of unique addresses from Coinmetrics has breached last year’s peak.”

Bitcoin’s price did reach as high as $12,000 just this past weekend, but it faced a massive influx of selling pressure at this level that caused it to decline back to $11,000.

Nonetheless, the strong fundamental base that Bitcoin is currently sitting upon does seem to warrant it seeing further upside in the months ahead.