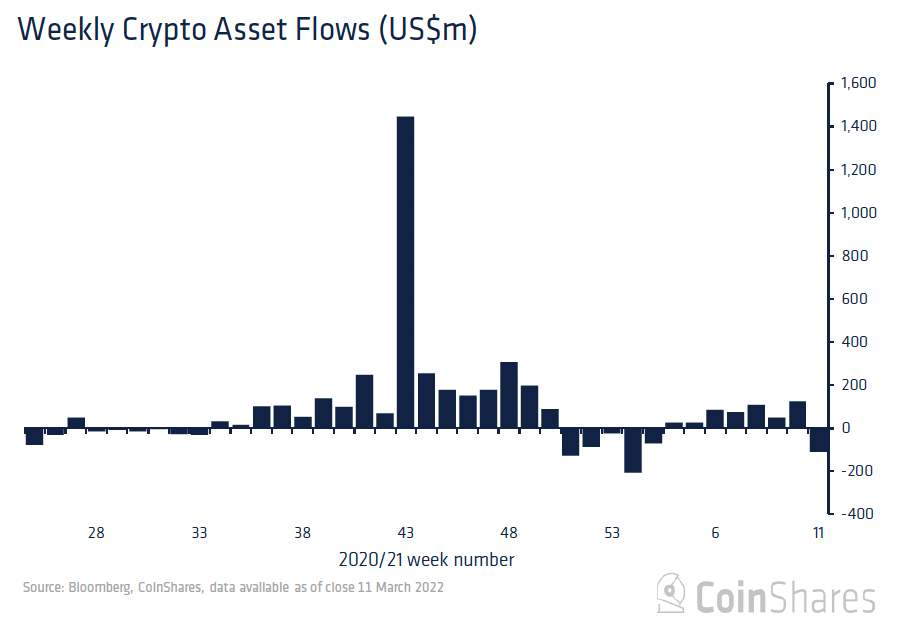

After seven consecutive weeks of inflows, crypto investment products recorded significant outflows last week, according to the latest report by institutional crypto fund manager CoinShares.

The report which analyzes weekly flows into cryptocurrency funds suggests regulatory concerns and geopolitical turmoil have diminished investor interest in both the Americas and Europe.

$80 million of the outflows derived from North America

Beginning at the start of last week, $80 million of the outflows derived from North America could be interpreted as a response to the US Presidential Executive Order to analyze the crypto sector, according to the report.

“Given there has been little price response and that outflows of $30 million were also seen in Europe, highlights the reasons are unclear,” the institutional crypto fund manager noted, adding that both regulatory concerns and geopolitical unrest played a part in corroding the interest in crypto assets in the week ended March 11.

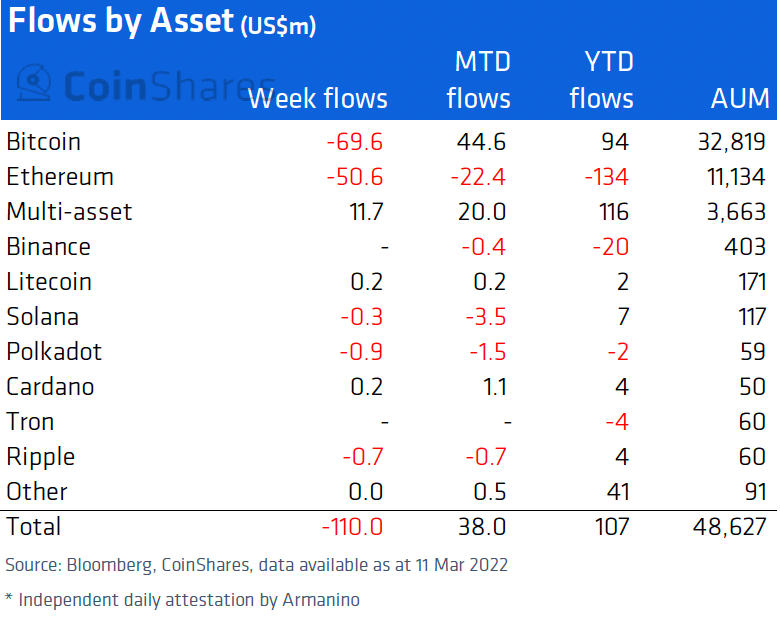

Bitcoin recorded $70 million in outflows last week–” off the back of low volumes”– the report noted.

According to CoinShares:

“Investment products traded $1 billion last week compared the average $1.24 billion, representing just 5% of total Bitcoin trading volumes.”

Multi-asset investment products remain popular

On a relative basis, Ethereum investment products saw the largest outflows last week–totaling $51 million.

Ethereum outflow volumes year-to-date represent 1.2% of assets under management (AuM), the report pointed out.

Meanwhile, altcoin investment products flows were mixed last week.

Zooming into individual asset funds revealed that Wrapped Solana, XRP, and Polkadot all recorded minor outflows–totaling $0.3 million, $0.7 million, and $0.9 million respectively.

At the same time, Cardano and Litecoin investment products saw minor inflows of $0.2 million.

That said, multi-asset investment products saw inflows totaling $12 million, while blockchain equity investment products attracted $4.1 million.

According to CoinShares, both multi-asset and blockchain equity investment products persist as “the most popular amongst investors”– with inflow volumes representing 3.2% and 6.7% of AuM respectively.