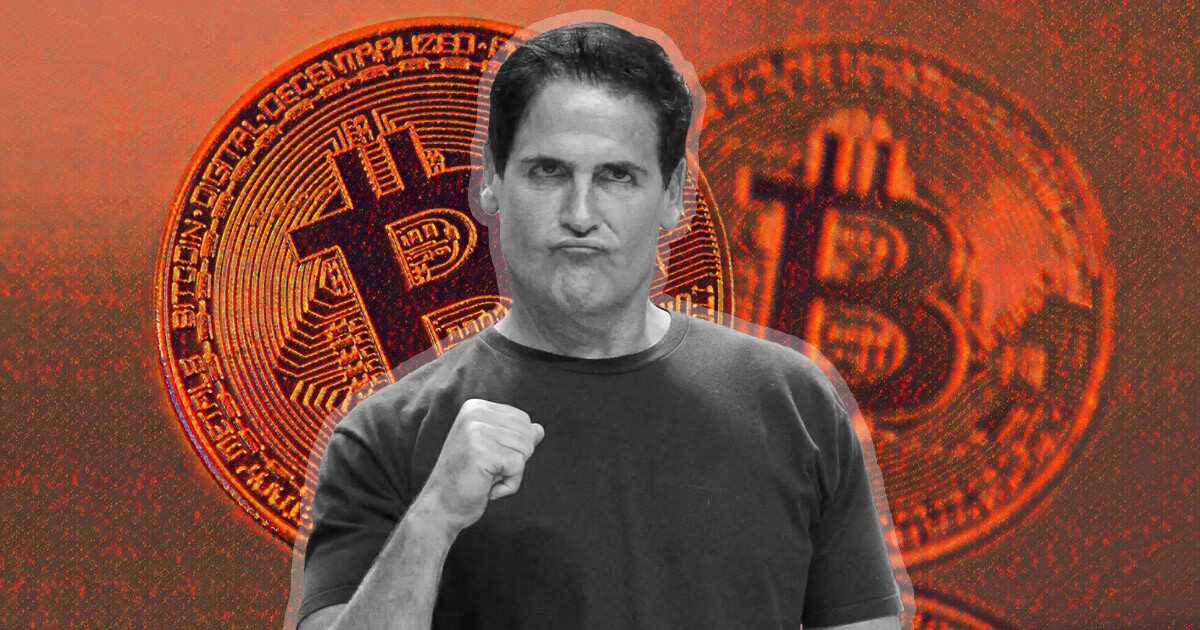

With the attention Bitcoin has received, 2021 has already proven itself to be a year of great change. With one month down, it looks like that will continue as billionaire Mark Cuban increasingly softens his stance towards Bitcoin.

The Dallas Mavericks owner once said he would “rather have bananas than bitcoin.” But based on his latest blog post, it looks like the tech billionaire now sees merit in Bitcoin’s digital store of value narrative.

Entrepreneur Cuban once warned against investing in Bitcoin

Cuban joins the growing list of high profile figures that have reversed their stance on Bitcoin. To his credit, he never went as far as calling the leading cryptocurrency fraudulent or “worse than tulip bulbs,” à la Jamie Dimon.

Several years ago, Cuban’s comparisons of investing in Bitcoin as “gambling” were still less than complimentary. Especially as the comments came during at a time of peak public panic, thanks to ICO scams and the like.

Cuban went on to say it’s okay to invest up to 10 percent of savings into high-risk assets, such as cryptocurrency. But he added that anyone who does so should consider it lost money.

More recently, Cuban said Bitcoin is a “store of value,” but he likened it to a religion. As opposed to it being useful in solving problems or inherently valuable.

“My thoughts haven’t changed. It’s a store of value like gold that is more religion than solution to any problem.”

Cuban says what constitutes a store of value is changing

In his latest blog post, Cuban reminisces about stamp collecting when younger. The reader gets to glimpse at Cuban’s entrepreneurial spirit, even as a child, as he describes taking advantage of price inefficiencies between stamp dealers.

He observed that collectibles worked as stores of value because they required physical ownership as proof of existence and scarcity confirmation. However, he concedes that now, in 2021, the concept of digital turns this observation completely on its head.

“But something changed over the past 3 years, (Crypto enthusiasts will tell a different story saying this has been going on since 2009). The block chain has evolved to support smart contracts and the ability to uniquely identify digital goods and the transactions associated with them.”

Cuban added that digital goods, such as Bitcoin and Ethereum, can define availability or scarcity, even though they lack physicality. This ties together with a decentralized blockchain, which no-one controls, making cryptocurrency a legitimate store of value.

Cuban points out that old schoolers are only now beginning to realize that digital and physical investments are equally valid.