Building on CryptoSlate’s recent analysis of the competing Bitcoin inflows and outflows between BlackRock and Grayscale, I extrapolated the data even further to see just how long BlackRock could sustain its current average Bitcoin accumulation.

At a high level, BlackRock’s entry through Bitcoin ETFs is a substantial moment for Bitcoin’s reputation in the United States. Along with the other ‘Newborn Nine‘ ETFs, BlackRock’s endorsement is likely to decrease the liquid and very liquid supplies as more investors gain access to Bitcoin as a long-term investment. Further, it will increase investor confidence for those unfamiliar with blockchain and enhance the credibility of Bitcoin as an asset class, thereby affecting its liquidity and volatility profiles.

Before I go any further, I want to add a very clear disclaimer here. The analysis below is a hypothetical look at possible accumulation levels from spot Bitcoin ETFs. I have used the debut inflows for BlackRock as the yardstick. There is no guarantee these levels will persist, and if they did, it would very likely result in an increase in the price of Bitcoin. The demand for Bitcoin is unlikely to remain consistent at any price, so assuming the same BTC inflows over a prolonged period is improbable.

That said, looking at the numbers from a purely theoretical standpoint does reveal some extremely headline-worthy data points, which can then be used alongside other analyses to identify if and when a supply crunch is on the horizon for Bitcoin.

The longer these new ETFs continue to acquire Bitcoin at these elevated levels, the better for long-term HODLers and laser eyes.

In my opinion, now, more than ever, HODLing Bitcoin has a real purpose. The fewer Bitcoins available for purchase inside ETFs, the closer we come to a MOASS (Mother Of All Supply Squeezes) where Bitcoin moons, not because shorts have to cover, but because institutions have to buy Bitcoin on the open market like the rest of the world.

Liquidity in Bitcoin and BlackRock’s immediate impact.

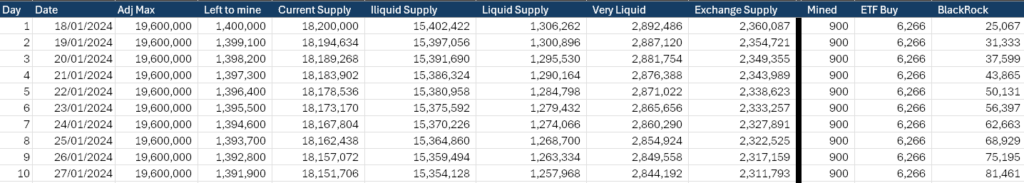

Since the debut of spot Bitcoin ETFs in the US last week, BlackRock has acquired an average of 6,266 BTC daily for a cumulative total of 25,067 BTC as of press time. The total acquired by the Newborn Nine over just four trading days is now at 70,000 BTC ($2.9 Billion.) When we include Grayscale, the total Bitcoin under management is 660,540 BTC ($27.6 billion.)

To understand the analysis, I’ll first outline the buckets used, as defined by Glassnode data.

“The liquidity of an entity is defined as the ratio of cumulative outflows and cumulative inflows over the entity’s lifespan. An entity is considered to be illiquid / liquid / highly liquid if its liquidity L is ≲ 0.25 / 0.25 ≲ L ≲ 0.75 / 0.75 ≲ L, respectively.”

More info on calculating L can be found on Glassnode’s blog.

- Current Supply: The total number of bitcoins that have been mined and are currently in circulation.

- Illiquid Supply: Bitcoins held in wallets without significant movement, suggesting a long-term investment strategy.

- Liquid Supply: Bitcoins that are actively traded or spent, indicating higher market activity.

- Very Liquid Supply: This category represents bitcoins that are not just traded but are readily available for trading on exchanges within a short timeframe.

- Exchange Supply: Bitcoins held in exchange wallets, ready to be traded or sold.

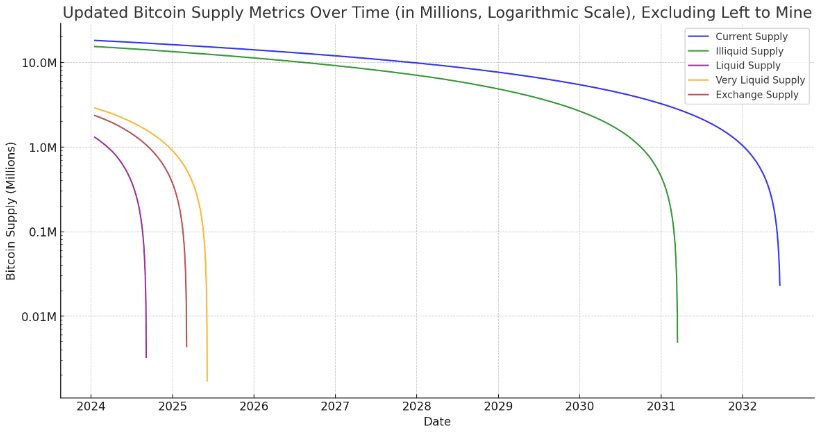

The chart below shows the different liquidity cohorts for Bitcoin across time. The illiquid supply is by far the largest sector. However, interestingly, the highly liquid portion is greater than the liquid portion, indicating a dichotomy among investors. Bitcoin holders are either hodlers or traders, with very few on the fence about whether to hold or transact with Bitcoin.

Now we understand the liquidity situation, let’s look at how the different cohorts stack up. The official max supply of Bitcoin is 21,000,000 coins. The current circulating supply is 19,600,000. According to Glassnode, the total amount of lost coins is roughly 1,400,000; this includes Satoshi’s coins, among others. There are other higher estimates of lost coins; however, given that this number has remained relatively consistent since 2012, I think it is the most reliable number.

Interestingly, this means that when we remove the lost coins from the maximum supply, we end up with the same number as the current circulating supply. While this is purely coincidental for this exact moment in time, it gives an idea of how it will feel when all the coins have been mined, at least in terms of market liquidity. Of course, after all coins are mined, the lack of block rewards for miners will add another aspect to the mix I won’t get into right now. I will say that I believe fees will be more than enough to continue to secure the network given the current direction Bitcoin is heading in.

| Metric | Value |

|---|---|

| Max Supply | 21,000,000 |

| Current Supply | 19,600,000 |

| Adj. Max Supply | 19,600,000 |

| Adj. Current Supply | 18,200,000 |

| Illiquid Supply | 15,402,422 |

| Liquid Supply | 1,306,262 |

| Very Liquid Supply | 2,892,486 |

| Exchange Balance | 2,360,087 |

The current supply can also be adjusted to remove lost coins. The three main cohorts to analyze are the liquidity levels, as explained below, and the balance of Bitcoin on crypto exchanges. The total liquid and very liquid coins amount to just 4,198,748 BTC ($175 billion,) which accounts for around 21% of the $815 billion Bitcoin market cap.

What if BlackRock keeps buying up all the Bitcoin?

Now, for the fun part that you are all reading for What if BlackRock inflows were to continue at the level seen during its debut? While some have bemoaned the launch of spot Bitcoin ETFs as a failure, and Bitcoin’s price has even dropped to $0.0413 million from its recent high of nearly $49,000, I think they will surely end up with the ‘egg on their face,’ as we say in the UK. Here’s why!

Currently, 900 new Bitcoins are mined daily, and this will drop to 450 BTC around April 18, 2024. Additionally, as I said previously, BlackRock is acquiring around 6,266 BTC daily. If BlackRock were to attempt to buy directly from miners, this would lead to a net deficit of 5,266 BTC.

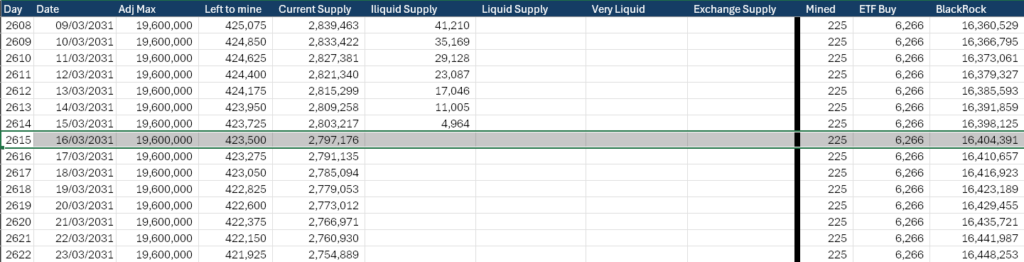

So, it needs to get Bitcoin from somewhere else. So far, the Coinbase OTC desks have had sufficient liquidity to soak up the requirement. However, this cannot last forever; there is no endless liquidity. The table below shows what would happen if BlackRock bought from each cohort with miner participation.

At its current rate, over the next 10 days, BlackRock would achieve around 81,481 BTC with little to no significant impact on any cohort. So, the launch is a failure?

I don’t think so.

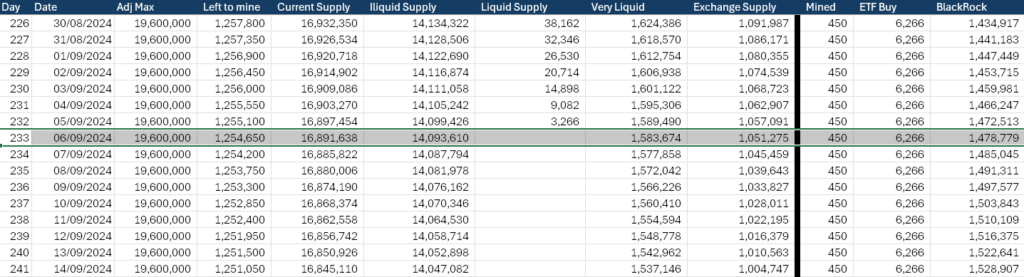

If we extend this down to Sept. 6, 2024, and BlackRock is only buying from the liquid supply, with miners adding to this cohort and reducing the impact, the entire cohort would be absorbed.

Let’s carry on.

To keep it nice and clear, each table going forward will be under the following hypothetical scenario.

What if BlackRock bought exclusively from this cohort at the rate it has during the first four days and newly mined Bitcoin was also included, thus reducing the impact of BlackRock’s buying?

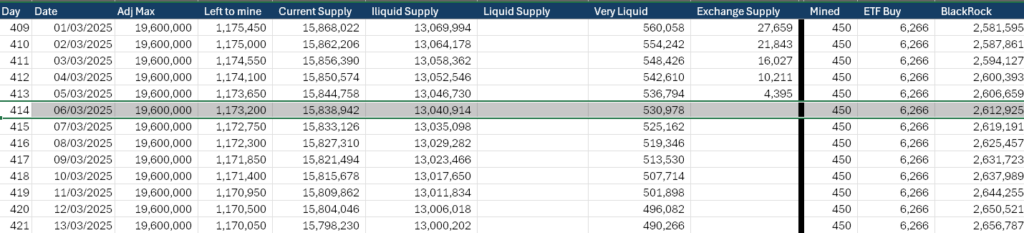

By March 3, 2025, the Bitcoin held on exchanges would be gone, and BlackRock would have 2.6 million BTC.

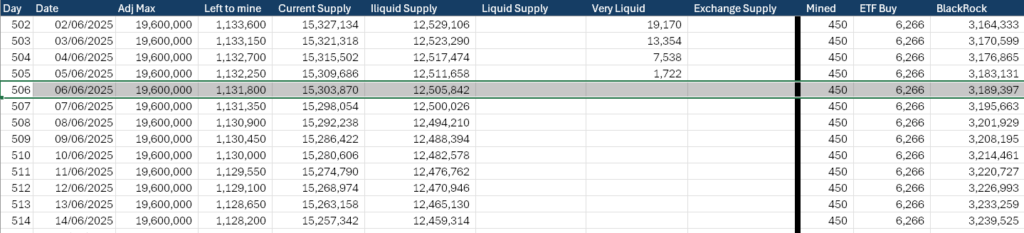

The ‘very liquid’ cohort would be absorbed by June 6, 2025. This group is probably the most easily accessible for BlackRock to find liquidity, and it is still just 18 months away.

In just eight years, by 2032, BlackRock’s Bitcoin holding would be worth $686 billion by today’s standards and consist of 16,404,391 BTC. This would require it to have found a way to buy all of the Bitcoin from the ‘illiquid’ supply and give it around 79% of all Bitcoin in circulation under management.

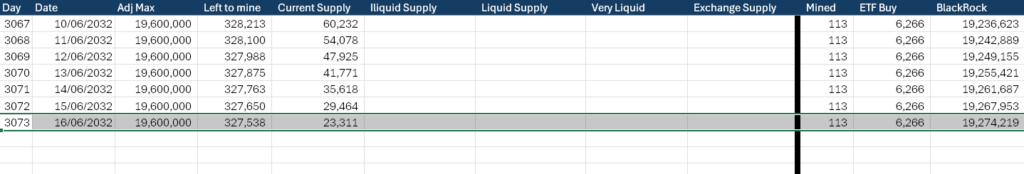

Finally, in just 3,073 short days, on June 16, 2032, BlackRock would have bought all of the Bitcoin in circulation and finally have to stop its 6,266 BTC per day purchase. Going forward, there would only be 113 BTC available each day from newly mined Bitcoin, of which there would be 327,538 BTC left to mine.

Of course, few of the above scenarios are going to happen. BlackRock is unlikely to be able to sustain these levels of inflows in Bitcoin terms without Bitcoin’s price either falling significantly or demand increasing along with price.

For example, 6,266 BTC is worth $262 million at $0.04184 million per Bitcoin. At $0.2 million per Bitcoin, this amount becomes $1.25 billion daily. Conversely, at $0.01, it is only $62.6 million.

So unless Bitcoin stays around $0.04 million for the next eight years, BlackRock is able to convince investors to buy its ETF at the same pace, and it can find HODLers willing to sell, we aren’t going to see BlackRock take custody of all the Bitcoin.

However, we can now start to see what sort of an impact consistent Bitcoin ETF inflows can have on different parts of the supply. Personally, my Bitcoin is illiquid and remains that way. I see the benefits of spot Bitcoin ETFs, and I also see the supply crunch that’s coming in some shape or form. Definitely not today, probably not this quarter, but after that…

CryptoSlate will continue to dig into the numbers and nerd out on chain for you, so if you enjoyed this exploration into Bitcoin supply, please let us know on our X account @cryptoslate or reach out to me directly @akibablade. Also, shout out to Samson Mow for the ‘M’ notation for Bitcoin!