The presidential elections have long been looked upon as a serious catalyst for economic trends, with potential changes in power often altering the global markets’ course. Many analysts expect Bitcoin’s price also to be influenced by the elections.

History does show that elections are turning points for Bitcoin, and they typically work in the benchmark cryptocurrency’s favor.

The launch of the cryptocurrency came about just a few months after the 2008 elections, its parabolic cycle in 2012 was kicked off following President Obama’s second-term election, and its 2016 bull trend took place shortly after President Trump’s 2016 election.

Over the past few months, BTC’s price has risen from multi-month lows of $9,900 to highs of $14,100 that were set less than one week ago.

If history rhymes, then the 2020 elections could mark the start of the digital asset’s next parabolic trend, which is already beginning to show some signs of starting.

Bitcoin sees immense growth since the 2016 elections

During the past 4 years, Bitcoin has seen immense growth on multiple fronts, including gaining mainstream adoption amongst retail, institutional, and corporate investors, while also seeing parabolic price gains.

During the November elections in 2016, Bitcoin was trading at $730, while Ethereum was at $10.

This shows just how massive the bull run between 2016 and 2017 truly was, with the subsequent bear market not even coming close to erasing the gains seen over this time frame.

Although Ethereum still has a way to go before it recaptures its 2017 highs in the lower-$1,000 region, Bitcoin is rapidly approaching its all-time highs as bulls take full control of its mid-term outlook.

Elections typically mark a pivoting point for BTC

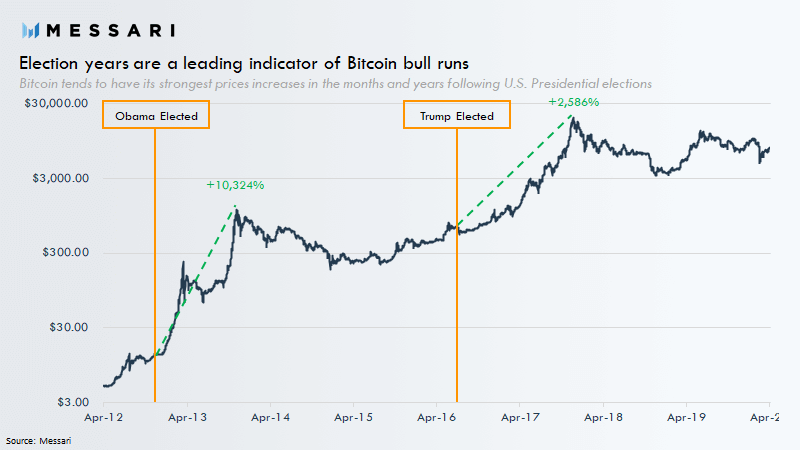

Earlier this year, Messari analyst Ryan Watkins explained that presidential elections in the U.S. have typically taken place at the start of past bull runs – including that seen between late-2012 and early-2014, and between late-2016 and 2017.

“Not a lot of people know this, but US presidential elections are a leading indicator of Bitcoin bull runs. The 2008 election was such a strong catalyst it caused the launch of Bitcoin just 2 months later. The results speak for themselves.”

As for why this is the case, Watkins believes that reduced economic uncertainty “provides fertile ground” for Bitcoin to grow upon.

“The reduced uncertainty following elections provides fertile ground for Bitcoin bulls runs. Presidential Elections > Halvings.”

Because Bitcoin has shown immense strength leading up to the latest election, there’s a strong possibility that it will see further upwards momentum in the months ahead.

Bitcoin Market Data

At the time of press 11:07 pm UTC on Nov. 3, 2020, Bitcoin is ranked #1 by market cap and the price is up 1.52% over the past 24 hours. Bitcoin has a market capitalization of $255.88 billion with a 24-hour trading volume of $28.3 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 11:07 pm UTC on Nov. 3, 2020, the total crypto market is valued at at $398.43 billion with a 24-hour volume of $84.35 billion. Bitcoin dominance is currently at 64.20%. Learn more about the crypto market ›