Bitcoin is only 117 days away from a block rewards reduction event that affects the number of tokens that can be generated every 10 minutes. Based on historical data, this event tends to serve as a catalyst that propels the flagship cryptocurrency into new all-time highs.

The Halving Event

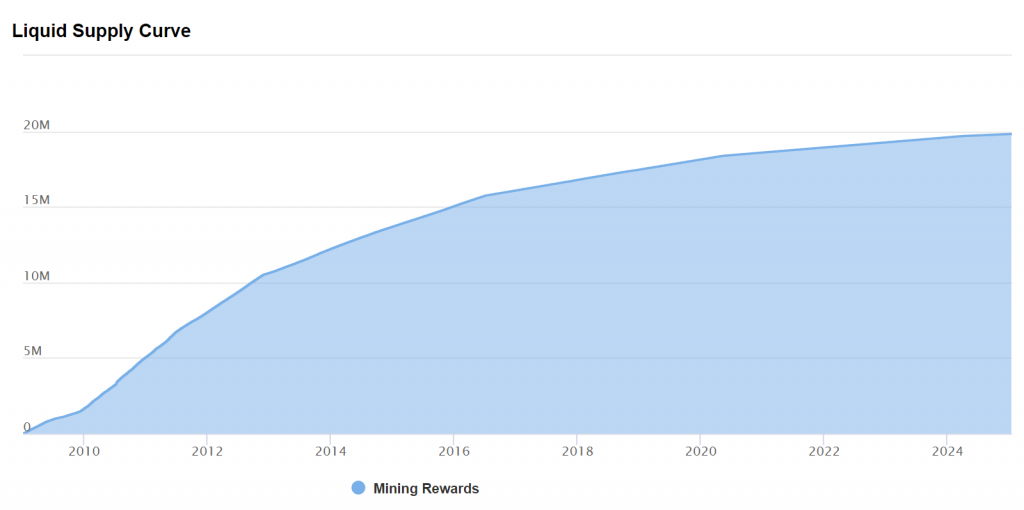

Bitcoin goes through a fixed process known as the halving every time 210,000 BTC blocks are mined. This is considered the core economic model in BTC’s protocol that guarantees that coins are issued at a steady pace. The halving takes place, approximately, every four years. It cuts in half the rewards miners get for mining a block, consequently, decreasing the rate of issuance.

Around May 12, 2020, at exactly block 630,000, miners who are currently being awarded 12.5 new BTC for every block they solve will only be rewarded with 6.25 BTC per block. The inflation rate of this cryptocurrency will also be impacted for an extended period of time as the reduction in future supply increases.

The series of block rewards reduction events are scheduled to occur until the total supply of 21 million BTC are mined. These events could prolong until 2140 when the block reward would drop below 1 satoshi, assuming that miners will be around in the next 120 years.

Previous Block Rewards Reduction Events

To date, there have only been two halving events since Bitcoin was launched on Jan. 3, 2009. These events have proven to be an important catalyst that pushes the price of this crypto up before and after they take place. BTC’s disinflationary monetary policy has allowed its value to enhance significantly as it becomes more scarce.

The 2012 Halving

On Nov. 28, 2012, Bitcoin went through its first halving, at a block height of 210,000. During that time, the block rewards provided to miners dropped from 50 BTC per block to 25 BTC. Such a significant supply reduction had a great impact on the price of the pioneer cryptocurrency, which was perceived in anticipation of the event and after it occurred.

After reaching a market bottom of $2 on Nov. 19, 2011, Bitcoin entered a year-long bull rally. This cryptocurrency saw its price appreciate by nearly 500% in anticipation of the first halving. By the time the event concluded on Nov. 28, 2012, BTC was trading around $12. From that point, Bitcoin skyrocketed over 97x peaking at an all-time high of $1,177 on Nov. 30, 2013.

The 2016 Halving

The second block rewards reduction event took place on July 9, 2016, at a block height of 420,000. At the time, the 25 BTC mining reward halved to 12.5 BTC per block. Like the first halving, this one also had serious implications on the price of Bitcoin.

On Jan. 14, 2015, Bitcoin hit a market bottom at a price of $164 following the 2014 bear market. Since then, BTC surged by nearly 300 percent to a high of $650 on the day the halving was set to occur. After the pioneer cryptocurrency went through its second halving on July 9, 2016, it entered a parabolic advance that saw its price increase by 29x. Bitcoin hit an all-time high of $19,765 on Dec. 17, 2017.

History Repeats Itself

The previous halvings have demonstrated to be a significant pivotal point in Bitcoin’s trend. They tend to propel the price of the flagship cryptocurrency into new all-time highs. Therefore, the upcoming block rewards reduction event could have similar implications.

Thus far, it seems like Bitcoin reached a market bottom on Dec. 15, 2018, at a price of $3,150. Since then, this cryptocurrency is up over 180 percent and is currently trading around $8,700. Now, investors appear to anticipate higher prices as the date approaches.

The Wisdom of the Crowd

Alex Kruger recently ran a poll on Twitter that involved over 4,000 participants. Kruger asked his followers what they thought will be the high of the year for Bitcoin.

The results show that 47 percent of the respondents believe that BTC would trade above $20,000 sometime this year. Around 28 percent are convinced that this crypto would peak between $14,000 and $19,999. Meanwhile, the remaining 25 percent stated that it will trade at $13,999 or lower.

The survey reveals that nearly 75 percent of the participants think that Bitcoin will double in price this year.

What will be the high of the year for $BTC?

— Alex Krüger (@krugermacro) January 14, 2020

Along the same lines, some of the most prominent technical analysts in the crypto community affirm that Bitcoin entered a new bull market last week. The break of the $8,500 resistance level, was seen as a make-or-break point that could have set out the stage for a bull run. According to Mohit Sorout, a partner at Bitazu Capital, a new uptrend is emerging.

However, there are other analysts who disagree with the bullish outlook. Chris Slaughter, the founder and CEO of LVL, for instance, has been studying a fractal since Dec. 27, 2019, that has proven to be correct. This pattern anticipated the recent rally that took Bitcoin above $8,500. Now, Slaughter estimates a downturn in the market that could push BTC to “new lows.”

The wisdom of the crowd is rarely correct, especially in the cryptocurrency market. Under this premise, since 75 percent of the market is bullish, the probabilities for the bearish outlook increase.

The different perspectives about Bitcoin’s future have the overall market sentiment in a “neutral” stage, according to the Crypto Fear and Greed Index. It remains to be seen whether history will repeat itself and the upcoming halving will trigger an inflow of capital in the market that allows BTC to reach new all-time highs.

Bitcoin Market Data

At the time of press 9:27 am UTC on Apr. 25, 2020, Bitcoin is ranked #1 by market cap and the price is up 2.42% over the past 24 hours. Bitcoin has a market capitalization of $161.51 billion with a 24-hour trading volume of $35.32 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:27 am UTC on Apr. 25, 2020, the total crypto market is valued at at $245.48 billion with a 24-hour volume of $133.01 billion. Bitcoin dominance is currently at 65.76%. Learn more about the crypto market ›