Investors and analysts who had believed that the mining rewards halving would reduce the selling pressure placed on Bitcoin appear to have been proven right, as selling activity from miners has plummeted in recent weeks.

Although this has alleviated the stream of selling pressure placed on Bitcoin from miners, it may not be quite as bullish as it seems.

Research firm Glassnode explained in a recently released report that the reason why miners are holding their BTC could be because they are waiting for higher price levels before they offload their holdings.

That being said, miners may simply be accumulating BTC that they will sell as soon as its price climbs higher.

This trend appears to have been confirmed by recent selling activity seen amongst the largest unknown Bitcoin mining pool.

Miners aren’t selling their Bitcoin, but this isn’t bullish

One of the primary narratives regarding why the mining rewards halving would be bullish for Bitcoin in the short term is because the reduced profitability would stop miners from offloading their freshly minted BTC.

Although it is true that this event alleviated the selling pressure placed on BTC by miners, it may not help provide the crypto with any near-term upwards momentum.

Glassnode spoke about this in a research report, explaining that it now appears that miners are simply waiting for higher prices before they sell their crypto.

“This apparent hodling behaviour began immediately after the recent halving… The implication of this is that miners are delaying selling their BTC, and are instead waiting for the price to rise before realizing their profits.”

As such, each time Bitcoin begins pushing higher, it could be subjected to a sharp influx of unexpected selling pressure.

“It is therefore more likely that the next meaningful price spike will trigger a sell-off by miners, and that this ‘hodling’ behavior is not long-term.”

This mining pool’s selling activity confirms this notion

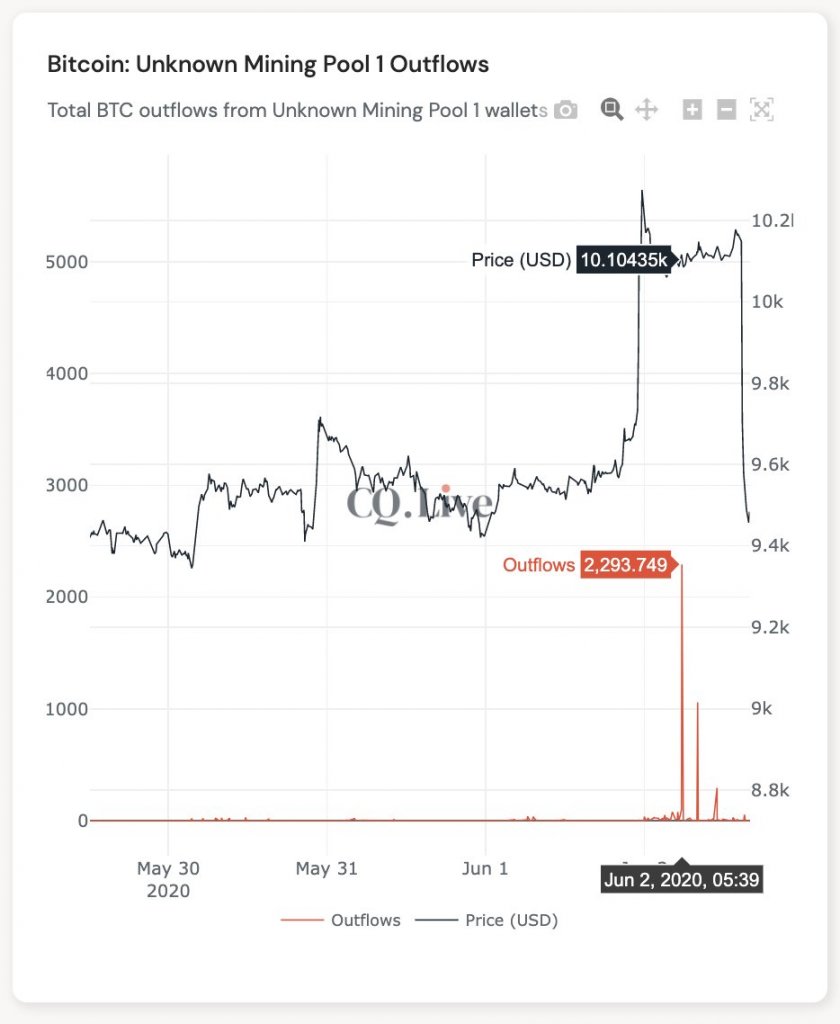

Earlier this week, CryptoSlate reported that the largest unknown mining pool has been selling their Bitcoin holdings each time the digital asset’s price spikes into the five-figure price region.

When BTC rallied to highs of $10,400 earlier this week, they almost instantly transferred a significant amount of crypto to an exchange wallet.

This data seems to vindicate the notion put forth by Glassnode, as it confirms that many miners are selling each pump.

That being said, this trend could stop the benchmark cryptocurrency from incurring any major near-term momentum.