Bitcoin saw a notable overnight upswing that allowed it to climb as highs as $8,400, finding some stability around this price level as bears struggle to defend against the heavy buying pressure that has been driving this movement.

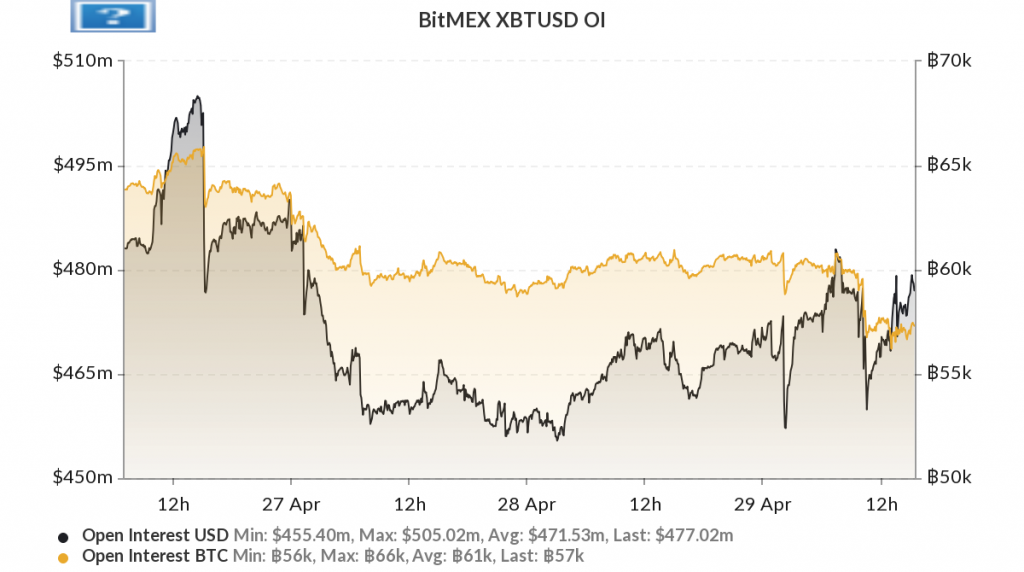

An interesting byproduct of this bull-favoring volatility has been diving open interest (OI) – likely resulting from the massive amount of liquidations seen throughout the past 12-hours.

One popular cryptocurrency analyst on Twitter explained that he believes this declining OI could actually be a bullish sign for BTC – contrary to what many analysts and investors think.

Immense overnight volatility sends bears into retreat

After an extended period of consolidating around $7,700, Bitcoin buyers were able to propel the cryptocurrency past the resistance that previously laced the upper-$7,000 region.

Bulls are now attempting to flip the previous resistance at $8,000 into support, although this level has yet to be retested in the time following its surge.

An interesting consequence of this recent volatility has been the massive liquidation of short positions on the crypto trading platform BitMEX.

So far, over $40 million in short positions have been liquidated on April 29th, and this number will grow larger if bulls are able to further extend BTC’s momentum.

According to data from blockchain research and analytics platform Skew, these liquidations have subsequently led the cryptocurrency’s open interest to dive.

Here’s why BTC’s declining OI could favor buyers

Typically, when Bitcoin makes major price movements in both directions its open interest rockets higher, with OI showing a striking correlation to the cryptocurrency’s volatility.

This time has been different though, and one analyst believes that it could be a positive sign.

Cantering Clark mused this possibility in a recent tweet, explaining that the context of Bitcoin’s recent price action is critical for understanding why this phenomenon is bullish.

“One thing that often gets paraphrased and applied like a standard is the concept of OI rising with a trend. I think that OI not rising here much with BTC is actually more bullish when taken in context with how it has regained these levels,” he noted.

He further elaborated on this theory in a later post, explaining that he believes it signals that there could soon be a huge “herd rush” of momentum when sidelined players attempt to reenter the market.

“Bitcoin is a momentum trade, and this is one of the characteristics of momentum. An initial delayed response of participants, even better in very inefficient markets. OI not rising on futs gives plenty of room for BTC to run if we see some big hitters start piling on there.”

Because BTC futures are currently experiencing backwardation – meaning that they are trading at a discount to spot BTC – this could suggest that the crypto’s current momentum stems from the significant retail buying pressure seen in the time following its decline to lows of $3,800.

Bitcoin Market Data

At the time of press 8:34 am UTC on Apr. 30, 2020, Bitcoin is ranked #1 by market cap and the price is up 16.21% over the past 24 hours. Bitcoin has a market capitalization of $168.85 billion with a 24-hour trading volume of $69.97 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 8:34 am UTC on Apr. 30, 2020, the total crypto market is valued at at $257.55 billion with a 24-hour volume of $237.54 billion. Bitcoin dominance is currently at 65.68%. Learn more about the crypto market ›