Bitcoin saw some explosive momentum overnight that allowed it to briefly tap highs of $10,000 before settling back into the mid-$9,000 region.

This movement came about after an extended period of sideways trading within the upper-$8,000 region, and the bullish resolution to this consolidation has led many analysts to target a move back up to BTC’s yearly highs around $10,500.

In spite of this, it doesn’t appear that Bitcoin is in the clear yet.

One fundamental indicator is now signaling that it may be too soon to accurately forecast that BTC will see significant further upside in the near-term, as some large hurdles still remain.

On-chain data signals that the Bitcoin rally may not last for too much longer

According to a recent report from blockchain analytics firm Glassnode, Bitcoin has yet to enter full bull territory due to a recent decline in investor sentiment.

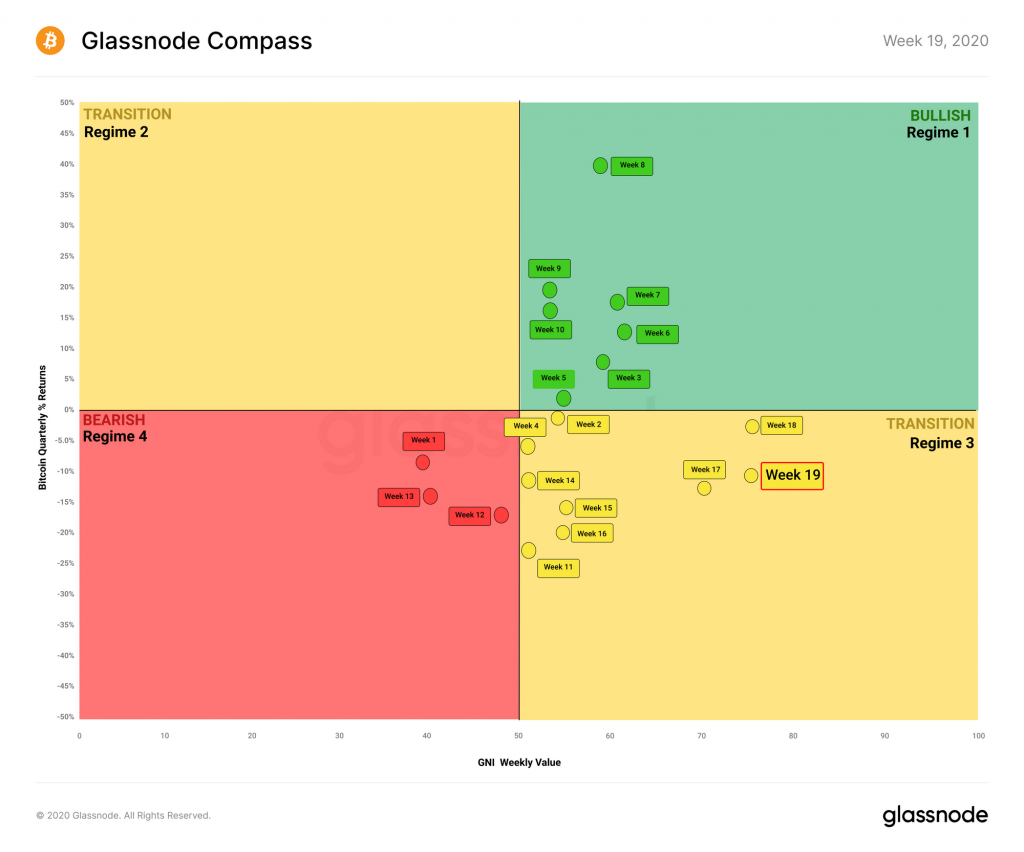

While looking towards the Glassnode Compass – an indicator that uses a combination of BTC’s network health, liquidity, and investor sentiment – it does appear that Bitcoin is still in a transition phase, not entering a full-blown bullish phase due to a recent decline in investor sentiment.

Glassnode spoke about this within the report while referencing the compass, saying:

“This week, the compass is still well away from the bearish Regime 4, characterised by a declining Bitcoin price and weakening on-chain fundamentals. Rather, it sits firmly in transition Regime 3 which is characterised by a diverging Bitcoin price and on-chain fundamentals.”

From a fundamental perspective, sentiment is the only thing that has declined throughout the past week – according to their indicators – and it is likely that this will shift in the week ahead as BTC makes a bid it $10,000.

The data firm is still expressing caution when it comes to getting too bullish on BTC.

“While the on-chain fundamentals are still strong in the long term, the halving is likely priced in, and it might be too soon to expect bullish price action in the summer.”

BTC approaches major technical resistance

This latest upswing also led Bitcoin to approach a key resistance level that could provide a “prime spot” for a pullback.

One popular pseudonymous trader named Ledger spoke about this level in a recent post, explaining that this is a major level that must be surmounted or else BTC could be poised for a pullback.

“Prime spot for a BTC pullback. I don’t have to draw the horizontal, [because] you can see the price line going back the last year. Big level to conquer or TP.”

The confluence of this technical resistance and subtle signs of fundamental weakness could hamper the strength of Bitcoin’s ongoing uptrend.