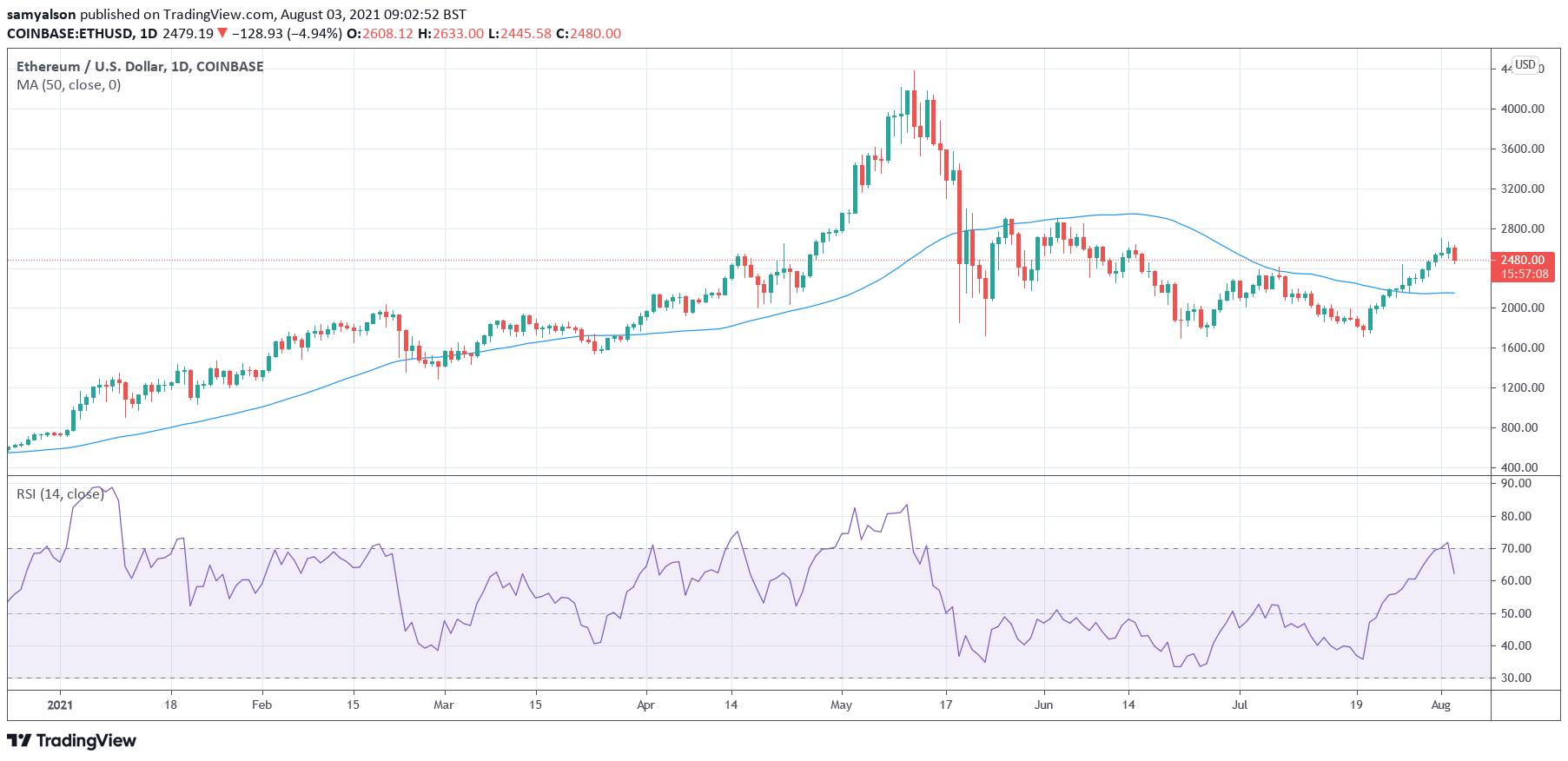

Ethereum closes 13 successive daily green candles, making this the best run of form in its six-year history.

As with all things good, the upward price movement came to an end today as ETH dumped 5% within the early hours of Tuesday morning (GMT).

Nonetheless, a remarkable turnaround today still could extend this record to 14 days. Then again, a look at the RSI shows a sharp dive suggesting that forward market momentum has dissipated.

Ethereum outshines Bitcoin

Crypto sentiment has seen a significant reversal recently. Just two weeks ago, the Fear & Greed Index was reading extreme fear. Today, sentiment is neutral and has been for the past two days.

The road to recovery began as Bitcoin managing to regain $30,000. It since went on to post 10 consecutive daily green closes, culminating with a peak of $42,000 on Jul 30.

As the most paired cryptocurrency and the most well-known, Bitcoin is considered the “God market,” in that alts tend to follow its direction.

Ethereum also took its cues from Bitcoin during this period. But rather than peter out on the 10th day, it managed to stretch its run by an additional three days, making a 46% gain in the process.

Analysts attribute this performance to the up-and-coming London hard fork scheduled for rollout on Aug 4 between 13:00 and 17:00 UTC.

London hard fork going live tomorrow

The London hard fork will implement several improvements to the Ethereum network. But the main proposal is EIP 1559: Fee Market Change.

Under EIP 1559, the protocol will move from an auction-style fee system to a more predictable floating bid system that aligns with network traffic. This will also include a burn mechanism that takes the base fee out of circulation.

The devs intend to address spiraling fees during times of high traffic and enable quick turnaround times as miners are less incentivized to cherry-pick high-paying transactions.

“There is a base fee per gas in protocol, which can move up or down each block according to a formula which is a function of gas used in parent block and gas target (block gas limit divided by elasticity multiplier) of parent block. The algorithm results in the base fee per gas increasing when blocks are above the gas target, and decreasing when blocks are below the gas target. The base fee per gas is burned.”

Another significant component is the deflationary aspect that comes with burning the base fee burning, leading to increased ETH scarcity.

While the run-up to the London hard fork has seen the price increase, the founder of controversial token Hex, Richard Heart, warned that the days following the rollout would see a hard dump.

“I think the price of Ethereum will dump hard in 2 days when the EIP-1559 actually goes live.”

However, Heart thinks Ethereum will still flip Bitcoin in the long run.