Last week, Ethereum investment products finally broke a nine-week long streak of outflows, while Bitcoin saw a fourth consecutive week of inflows, according to the latest report by institutional crypto fund manager CoinShares.

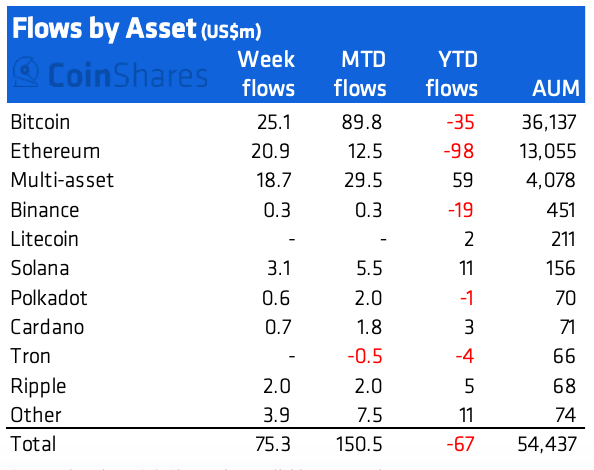

The report, which analyzes weekly flows into digital asset funds, uncovered the persisting popularity of multi-asset (coin) investment products, which saw a fifth consecutive week of inflows–totaling $19 million last week.

European investment products dominating

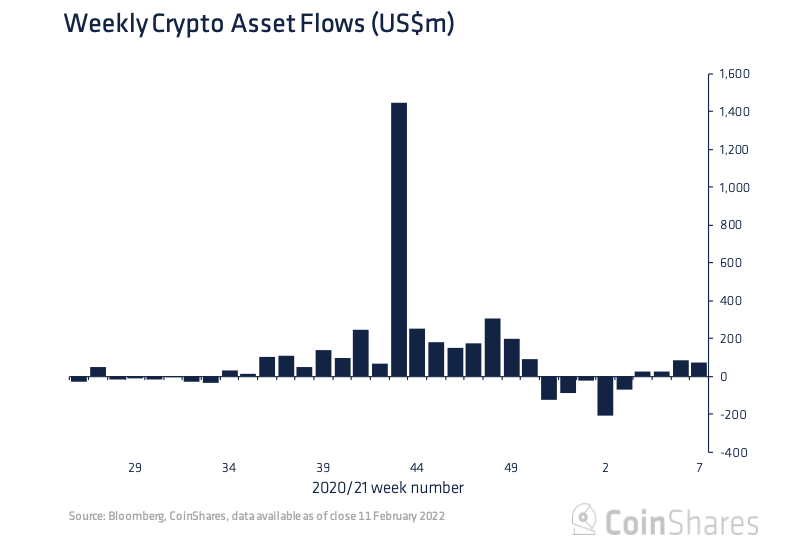

Digital asset investment products recorded another week of inflows–totaling $75 million.

This brings the last four-week streak of inflows to $209 million–representing 0.4% of total assets under management (AuM).

However, despite the positive inflows that the overall digital asset investment product market has witnessed last week, CoinShares reported that these volumes “remain relatively minor” in comparison to the figures observed in Q4 2021.

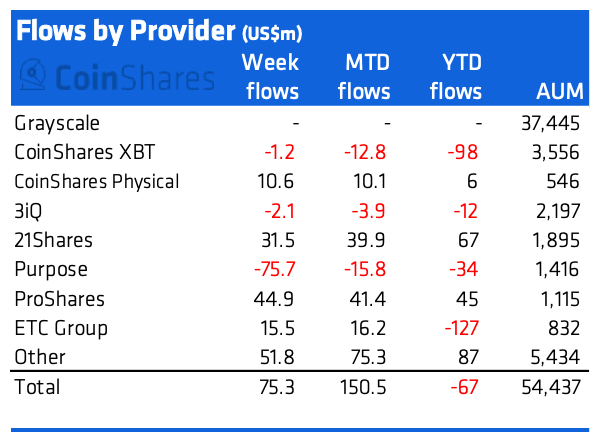

The institutional crypto fund manager also noted observing some regional variances–with $5.5 million of outflows in the Americas vs $80.7 million of inflows into European investment products.

The biggest inflows in the week ending February 11

Zooming into digital asset investment products, Bitcoin recorded a fourth consecutive week of inflows. Accounting for one-third of last week’s volume, Bitcoin inflows totaled $25 million, while Ethereum followed, with inflows totaling $21 million.

With inflows totaling $19 million, last week’s third-best performers were multi-asset (coin) investment products that continue affirming their popularity among institutional investors.

In the meantime, Solana and Ripple investment products saw inflows totaling $3.1 million and$ 2 million respectively.

The report also noted that recently created altcoin investment products, Terra, Tezos and Cosmos all saw inflows last week.

While Terra saw $2.2 million of inflows, Tezos and Cosmos investment products followed, recording $0.9 million and $0.6 million of inflows respectively.

Zooming into funds revealed that ProShares saw the largest inflow last week–totaling $45 million.

Meanwhile, Purpose recorded the largest outflow of $75 million.

Finally, with inflows totaling $69 million last week–blockchain equity investment products saw the largest volumes since mid-December.

Equity investment products are surely one of the industry’s answers to regulatory roadblocks–offering exposure to companies involved in the development and utilization of blockchain technology.