Digital asset investment products experienced outflows of $54 million during the week ending May 13, CoinShares said in its weekly report.

That trend of outflows has been ongoing for four consecutive weeks, bringing the period’s overall outflow to around $200 million and representing 0.6% of total assets under management.

Bitcoin (BTC) specifically saw outflows that amounted to nearly $38 million, accounting for 80% of all outflows. Eight altcoins saw inflows, CoinShares said.

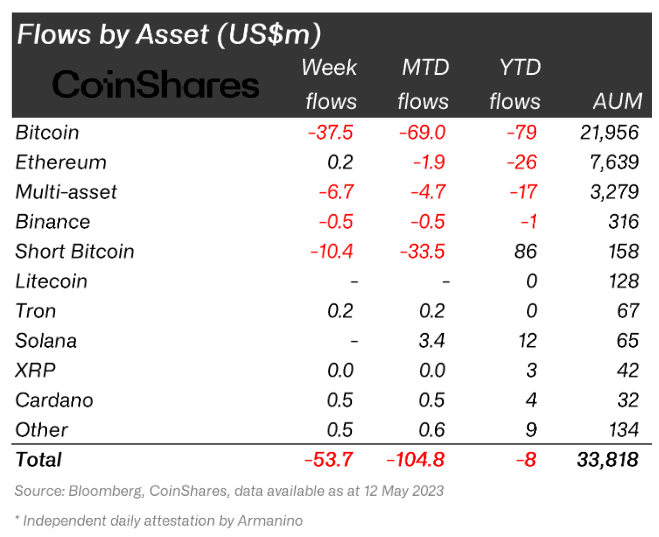

Flows by asset

Bitcoin (BTC) saw outflows of $37.5 million over the past week, while short-Bitcoin products saw outflows of $10.4 million over that timeframe. These statistics indicate that investors have been “almost solely focused on the asset,” CoinShares said.

Certain assets saw much smaller outflows. Multi-asset investments saw $6.7 million in outflows, while Binance’s BNB token (BNB) saw outflows of $500,000.

Some assets saw positive inflows. Ethereum (ETH) and TRON (TRX) each saw inflows of $200,000, while Cardano (ADA) saw inflows of $500,000. Ripple’s XRP token (XRP) saw zero outflows and inflows. Other assets collectively saw inflows of $500,000.

All categories combined amounted to $53.7 million of outflows.

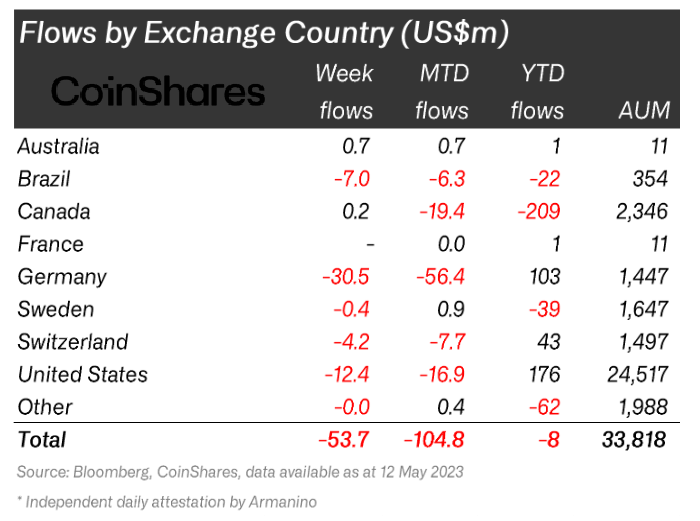

Flows by country

CoinShares also noted that outflows occurred across several regions, suggesting that the sentiment that caused the trend is not limited to a small number of investors.

Germany was responsible for most outflows, with $30.5 million this week. The U.S. ranked second, with $12.4 billion in outflows.

Brazil was responsible for $7 million in outflows, while Switzerland was responsible for $4.2 million. Sweden saw $400,000 in outflows.

Only Australia and Canada reported positive inflows, with $700,000 and $200,000, respectively. France’s inflows and outflows were not reported, and other countries had zero inflows or outflows.