Bitcoin took a significant nosedive sending investors into fear, according to the Crypto Fear and Greed Index. Despite the commotion in the market, on-chain metrics reveal that BTC’s network is stronger than ever.

Bitcoin could drop even further

Over the past two weeks, Bitcoin entered a bearish trend that has seen its price depreciate over 18 percent. The flagship cryptocurrency went from trading at a high of $10,500 to recently hit a low of $8,555. Although the correction has been quite significant, the carnage may not be over yet.

As a matter of fact, the support given by the 200-day moving average appears to be weakening. Breaking below this support barrier could trigger a spike in the selling pressure behind Bitcoin. Such a bearish impulse could push its price down to the 100-day moving average.

This hurdle currently sits around $8,300, which could hold the pioneer cryptocurrency from a further retracement.

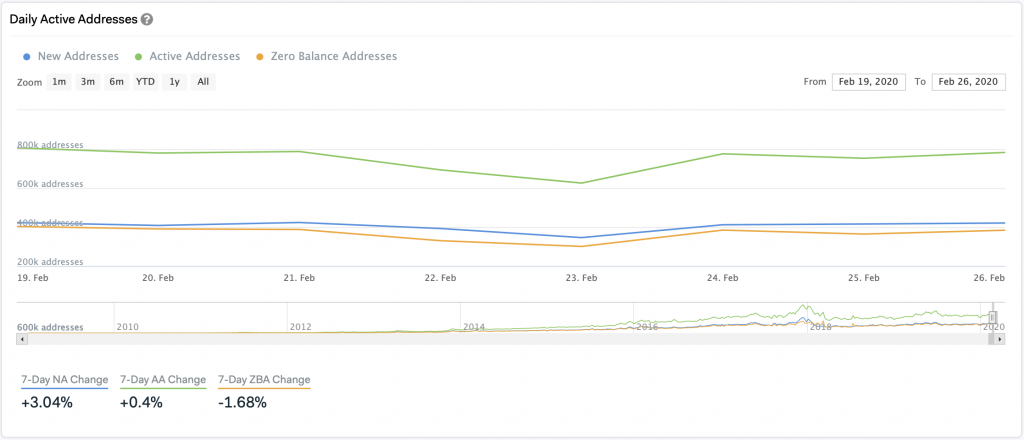

Despite the high probability of a steeper decline, the Bitcoin network continues growing at an exponential rate. Every day, more addresses are created and the number of holders continues rising, according to data from IntoTheBlock.

The network grows at a “hyperbolic” rate

The machine learning and statistical modeling firm estimate that there was a total average of 405,440 new addresses created per day over the past week. This outweighs the number of addresses that went zero, which only represents 368,250 addresses per day.

Bitcoin’s network grew by a whopping 231,000 addresses in the past seven days at a positive ratio with an average of 37,190 daily addresses.

The exponential growth rate that the flagship cryptocurrency is going through cannot be easily understood due to human nature’s instinct to look at “things in a linear stance,” according to on-chain analyst Willy Woo.

Woo affirmed:

“If you were to look at where we are on the adoption curve, we are at 1% of the world population holding this asset class. And, if you look at the rate in which that is growing, which is 2x every year… and 4x on a bull market. If you run those numbers, we are going to have half of the world using [cryptocurrencies] within the next seven years.”

When will #Bitcoin reach mass adoption? @woonomic pic.twitter.com/CwSS5PVvZF

— Dennis Parker⚡️ (@Xentagz) February 24, 2020

Although it is unknown what the future holds for cryptocurrencies, the fact is there have been over 3.1 billion blockchain transactions in the last ten years, based on a recent report from BlockNative. More than 37 percent of these transactions took place in 2019.

This growth trend leads Woo to believe that mass adoption of cryptocurrencies is happening now.

Time will tell whether Bitcoin will indeed triumph to become part of the global financial system. In the meantime, a wave of traditional investors like Shark Tank’s Robert Herjavec appear to be bullish about the future of the pioneer cryptocurrency.

In a recent interview, Herjavec suggested that precious metals like gold are not going to be an “economic indicator” in the future. However, Bitcoin could have a better chance to succeed as an electronic payment method.

Herjavec said:

“I think the price of Bitcoin, on a long-term basis, will quintuple. Consumers over the long-run always go to convenience and Bitcoin is just convenient.”

Bitcoin Market Data

At the time of press 1:14 pm UTC on Feb. 27, 2020, Bitcoin is ranked #1 by market cap and the price is down 4.07% over the past 24 hours. Bitcoin has a market capitalization of $160.65 billion with a 24-hour trading volume of $52.55 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:14 pm UTC on Feb. 27, 2020, the total crypto market is valued at at $250.64 billion with a 24-hour volume of $198.45 billion. Bitcoin dominance is currently at 64.03%. Learn more about the crypto market ›