The Bitcoin futures funding rate has declined across major cryptocurrency exchanges in the past 48 hours. This shows that the derivatives market is getting less overheated and the rally can become more sustainable.

What is the futures funding rate and why does it affect the Bitcoin price so much?

The Bitcoin futures market employs a mechanism called “funding.” In essence, funding achieves balance in the market by compensating the minority position holder.

For instance, if there are more buyers or long contract holders in the market, then buyers have to pay short-sellers a portion of their position.

Let’s say that a trader has a $100,000 long position open on Bitcoin and the funding rate is 0.01%. That means 0.01% of the notional position size, in this case, $100,000, would be paid to short-sellers every eight hours.

When the funding rate is extremely high, it means that the market is primarily driven by buyers. Thus, the probability of a long squeeze increases, wherein buyers might be forced to market sell their positions if the price of BTC drops.

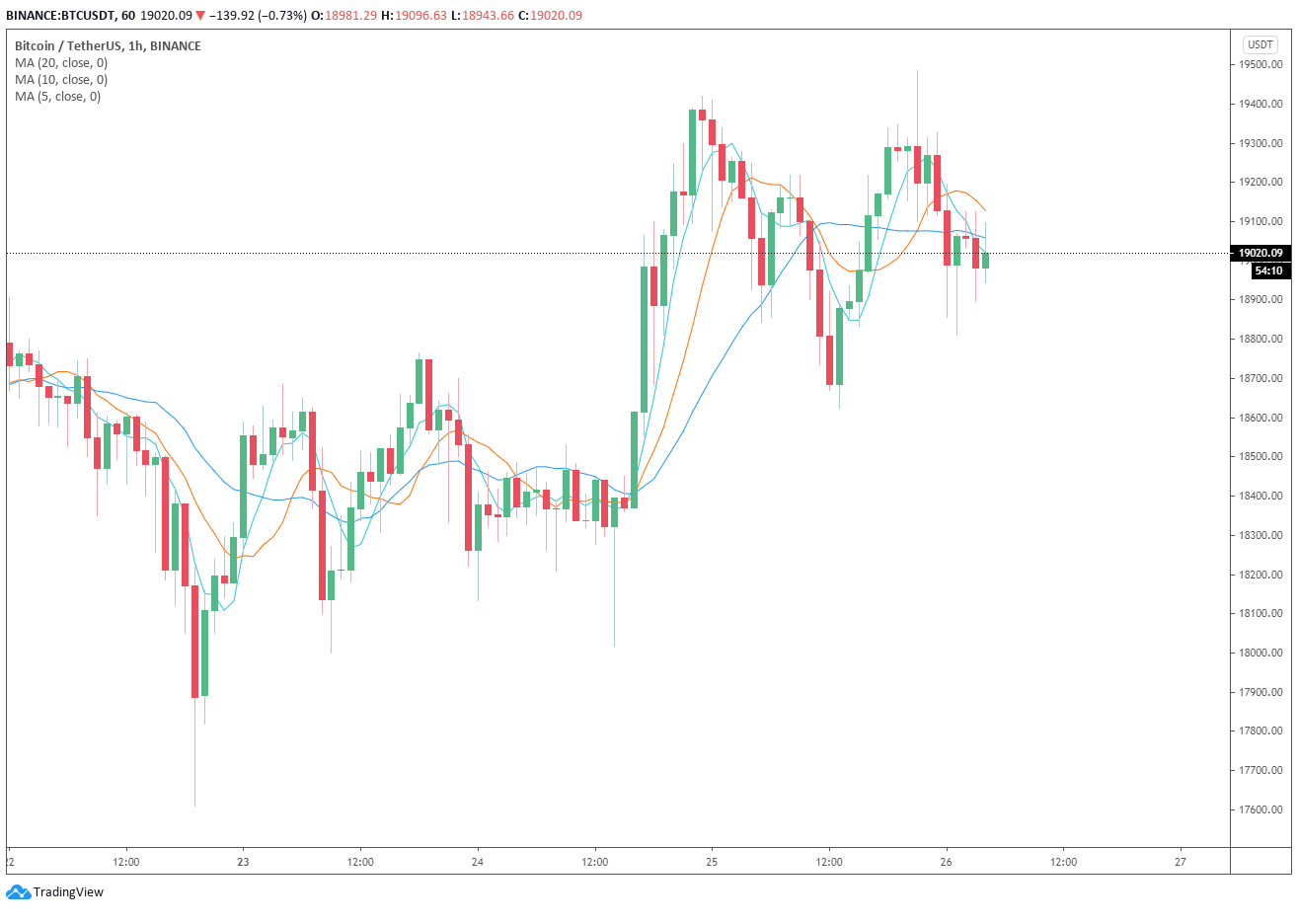

When Bitcoin was hovering at around $18,800, the funding rate of BTC was at 0.1% to 0.2% across major exchanges. Considering that the average funding rate of BTC revolves around 0.01%, this is 10 to 20-fold higher than usual.

Since then, the funding rate of Bitcoin has subsided. Some analysts attribute it to the use of the Time-weighted Average Price (TWAP) algorithm by institutions. Others believe the sharp short-term pullbacks BTC saw allowed the futures market to reset.

Either way, the funding rate is starting to decline. ByBit and Binance Futures both have funding rates under 0.05% as of November 25, 2020. This rate is still relatively high given the historical BTC futures funding rates, but it is substantially lower than last week.

Traders anticipate a bumpy and volatile road ahead

Sam Trabucco, a quantitative crypto trader at Alameda Research, warned that the Bitcoin price trend would likely be highly volatile in the near term. He said:

“Whatever this ride ends up looking like, I think we can count on one thing: it will be bumpy. (OK, maybe we can count on a second thing: liquidations will be involved.)”

The funding rate of BTC is higher than the norm, there is significant interest in Bitcoin, and the open interest of futures exchanges is near its record high.

Bitcoin is also approaching its all-time high at around $20,000, which makes it a critical resistance level

There might be interest for sellers to aggressively defend $20,000 from getting breached, which might lead to extreme volatility.

As an example, on November 25, Bitcoin surpassed $18,500 on Binance and quickly dropped afterward. The highly volatile price action comes from highly levered trades, Trabucco explained:

“See, the fast buying was REALLY levered up, as you might expect for something so aggressive and fast. Mostly happened on Binance BTC perps (surprise, surprise) — once a small drawdown happened, the SUPER levered ‘apes’ got pretty swiftly punished.”