Last week saw global markets react to news of potential tax law amendments in the United States. As CryptoSlate reported, sources close to the current Biden administration said policymakers were planning to increase taxes for wealthy investors to as much as 43.50% for gains above $1 million.

The news resulted in a sell-off that saw the flagship cryptocurrency’s market value drop by 15.40%, shedding 8,570 points. Bitcoin went from trading at a high of $55,500 on April 22 to hit a low of $46,940 three days later.

The sudden downswing generated nearly $1.30 billion in liquidations worth of long BTC positions across the board.

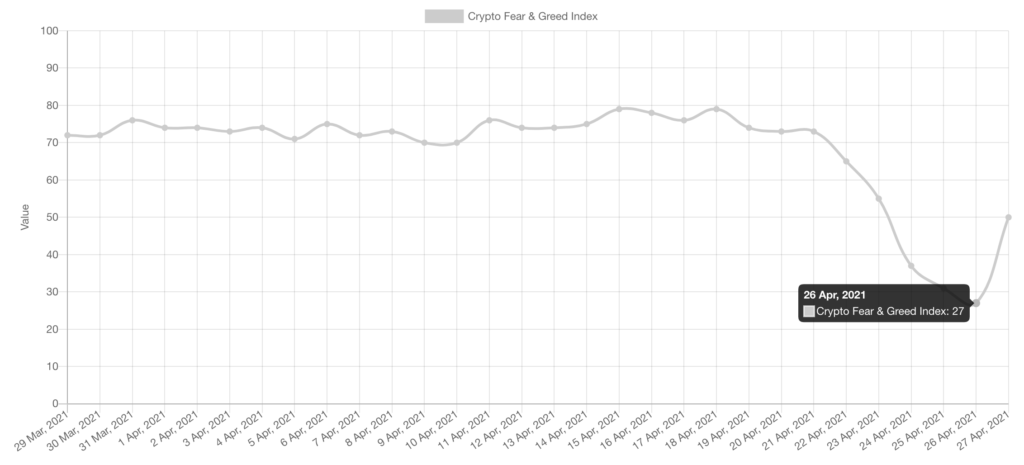

Given the magnitude of the losses, the “Crypto Fear and Greed Index,” a collective metric that measures current sentiments on the cryptocurrency market, swiftly swung from “Extreme Greed” (79 points) to “Fear” (27).

According to on-chain analytics firm Glassnode, new Bitcoin holders have been the most fearful while older holders remain calm.

The number of BTC with less than a week old was quickly spent over the past few days, suggesting “newer market entrants were shaken out during this correction.” Meanwhile, the number of coins older than six months did not see a significant increase in spending.

The on-chain data provider maintains that such behavior by market participants was seen in previous consolidation periods, which essentially led to higher highs.

“Previous instances of similar spending behavior was observed during the December 2020 consolidation, just before breaking to new ATHs, and during the first bull market correction in January,” said Glassnode.

Bitcoin hits a brick wall

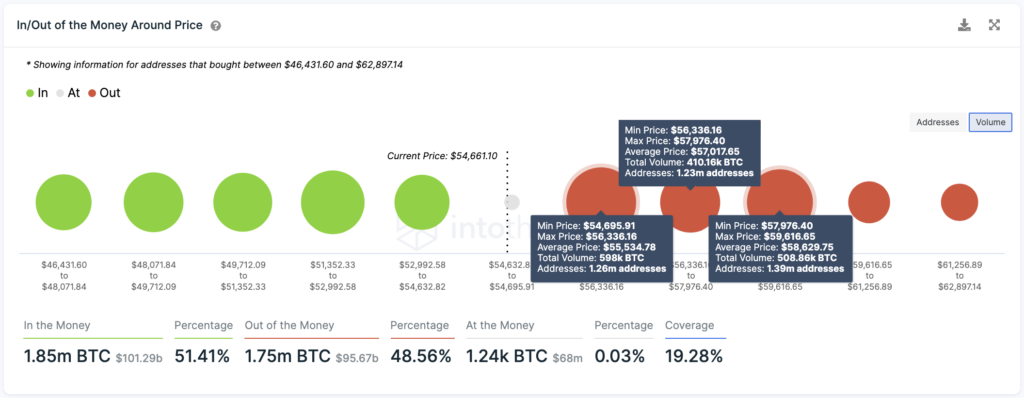

Data from on-chain analytics firm IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that Bitcoin sits underneath a massive supply barrier. Roughly 3.90 million addresses had previously purchased more than 1.50 million BTC between $54,700 and $58,700.

As such, further price appreciation may prove challenging.

Only a decisive daily candlestick close above the $54,700-$58,700 resistance wall could allow Bitcoin to resume its uptrend and reach new all-time highs. But failing to break this hurdle might lead to a rejection back to $50,000.

Bitcoin Market Data

At the time of press 12:45 pm UTC on Apr. 27, 2021, Bitcoin is ranked #1 by market cap and the price is up 3% over the past 24 hours. Bitcoin has a market capitalization of $1.03 trillion with a 24-hour trading volume of $51.54 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 12:45 pm UTC on Apr. 27, 2021, the total crypto market is valued at at $2.07 trillion with a 24-hour volume of $147.88 billion. Bitcoin dominance is currently at 49.46%. Learn more about the crypto market ›