Bitcoin currently appears to be in a somewhat precarious position as it struggles to break above its $12,000 resistance, causing the entire crypto market to see some turbulence.

Today, this resistance led the crypto to see a sharp selloff that sent its price reeling down towards $11,300, where bulls eventually stepped up and slowed its descent.

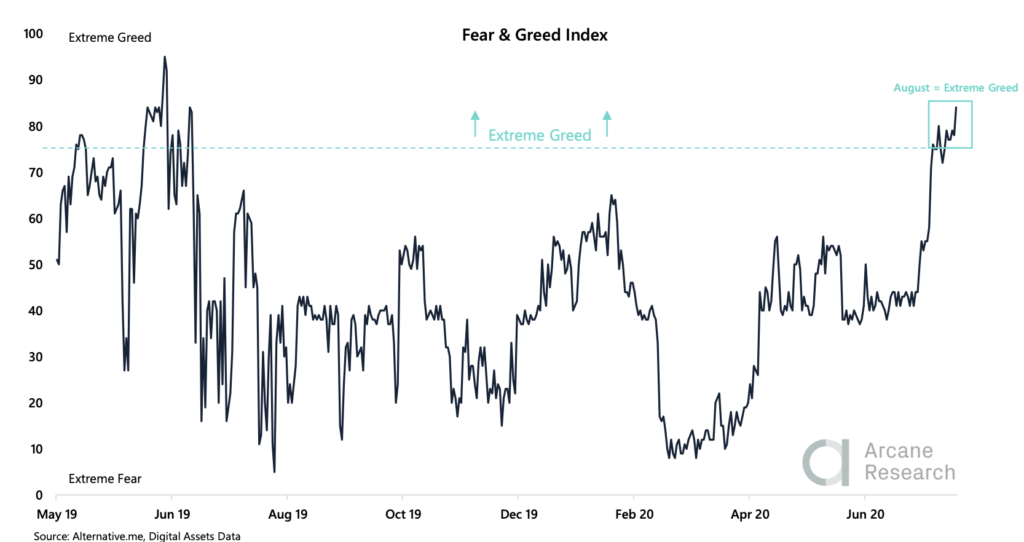

Despite BTC seeing stalling momentum, the strong uptrends seen by many smaller digital assets has caused investors to grow greedy, with the crypto market’s “fear and greed index” hitting levels not seen since the market-wide rally in summer of 2019.

Some investors view this as a counter-indicator that suggests a strong “shakeout” is imminent.

Bitcoin shows signs of weakness as resistance grows

Last Saturday, Bitcoin’s price rallied up to highs of $12,000 before it lost its momentum and saw a sharp decline that sent it down to $11,000.

This ultimately resulted in a multi-week consolidation phase within the upper-$11,000 region, which is where Bitcoin traded at until this weekend when another rejection at $12,000 sparked a selloff.

The crypto is now trading around $11,500, with bulls ardently trying to defend against further downside.

This has sent shockwaves throughout the market, with many major altcoins posting notable losses.

The crucial level to watch in the near-term sits around $11,000, as this is a support region that has been defended on multiple occasions in recent times.

Crypto investors are getting greedy, and it’s a bad thing for BTC

The crypto market’s “fear and greed index” is now reaching levels not seen since late-June of 2019.

This was right when the markets peaked last year, with many analysts now looking towards this index as a counter indicator.

If history repeats itself, then the crypto could be poised to see notable downside in the near-term due to bulls possibly being overleveraged at the current moment.

Arcane Research spoke about this in the latest issue of their weekly report, saying:

“August has been influenced by ‘Extreme Greed’. The Fear and Greed Index is now at 84, after pushing above 80 for the first time in over a year. With most coins doing well lately, it is easy to get carried away. As highlighted last week, these ‘Extreme Greed’ periods have been short-lived historically. Trade carefully.”

It is important to note that the “fear and greed index” was not tracking investor sentiment during the 2017 parabolic rally, but if it were, it would likely show greed at far higher levels than that seen currently.

As such, this shouldn’t be considered the be all end all indicator for determining whether or not a rally can extend further.

Bitcoin Market Data

At the time of press 10:14 am UTC on Aug. 12, 2020, Bitcoin is ranked #1 by market cap and the price is down 2.37% over the past 24 hours. Bitcoin has a market capitalization of $211.87 billion with a 24-hour trading volume of $29.02 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 10:14 am UTC on Aug. 12, 2020, the total crypto market is valued at at $350.65 billion with a 24-hour volume of $112.83 billion. Bitcoin dominance is currently at 60.42%. Learn more about the crypto market ›