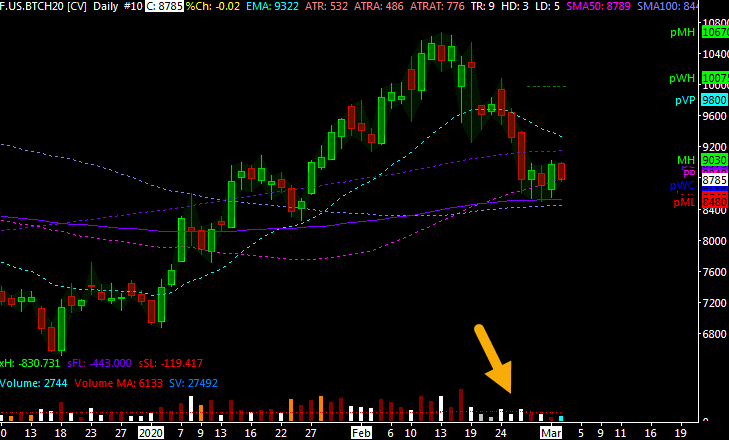

Since late February, the volume of CME Bitcoin futures market has declined substantially as the global financial market started to see extreme volatility due to rising fear towards the coronavirus outbreak.

At its peak in February, the CME Bitcoin futures market recorded a staggering $1 billion in daily volume, as reported by researchers at Skew Markets.

$1.1bln bitcoin futures traded yesterday at CME after the long weekend – only third time we record > $1bln pic.twitter.com/dxoblqOvUb

— skew (@skewdotcom) February 19, 2020

The declining volume of Bitcoin and the rest of the crypto market have started to worry traders that a consolidation phase has started after weeks of strong momentum.

Bitcoin isn’t able to escape the stock market trend

In the last three days, both risk-on and risk-off assets have seen large spikes in volatility after central banks released various stimulus packages as an urgent response to the global economic slowdown.

Similar to how the Dow Jones and the Asian equities market demonstrated unprecedented levels of volatility, the Bitcoin price has also seen major price swings as a result.

When the volume in the Bitcoin market is low, it becomes easier to sway the price of BTC, as order books become relatively thin and traders wait for BTC to reach for outmost lows or highs to confirm support or resistance.

According to global markets analyst Alex Krüger, the decline in the volume of the CME Bitcoin futures market is not related to manipulation nor margin calls. Rather, he explained that traders are increasingly seeking certainty in times of unpredictability.

He said:

“This has nothing to do with manipulation. Not about margin calls either, would have seen volumes spike if so (think liquidations). Traders likely relocated capital to other asset classes or moved to cash and reduced risk during times of extraordinary uncertainty.”

Bitcoin has not done well during times of heightened geopolitical risks and economic slowdown over the past three years.

When investors foresee the global economy to stagnate and the stock market to consolidate, they tend to liquidate high-risk assets first before anything else.

Despite the widespread narrative that Bitcoin is a safe haven asset, its low market cap of $160 billion suggests that it will not adequately be able to perform as a safe haven in the near-term.

As such, as the sell-off of high-risk assets continues, the demand for Bitcoin is likely to decline. If it does not trigger a correction, at the very least, it will cause the volume to drop and create a difficult environment to rally.

Is crypto vulnerable to deep correction?

Technical analysts who successfully predicted multiple market cycles in crypto in the likes of Pentarhudi are anticipating the Bitcoin price to pullback to the lowest of supports, retesting recent lows.

Whales and investors trading with large capital often wait for market sentiment to switch to the extreme, either to the upside or downside, before making larger time frame calls.

Due to the presence of a large number of buy orders in the $6,500 to $7,700 range for Bitcoin, traders are generally readying up for a sizable correction in the foreseeable future.

Bitcoin Market Data

At the time of press 6:33 pm UTC on Mar. 4, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.11% over the past 24 hours. Bitcoin has a market capitalization of $159.49 billion with a 24-hour trading volume of $35.69 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 6:33 pm UTC on Mar. 4, 2020, the total crypto market is valued at at $249.77 billion with a 24-hour volume of $138.79 billion. Bitcoin dominance is currently at 63.87%. Learn more about the crypto market ›