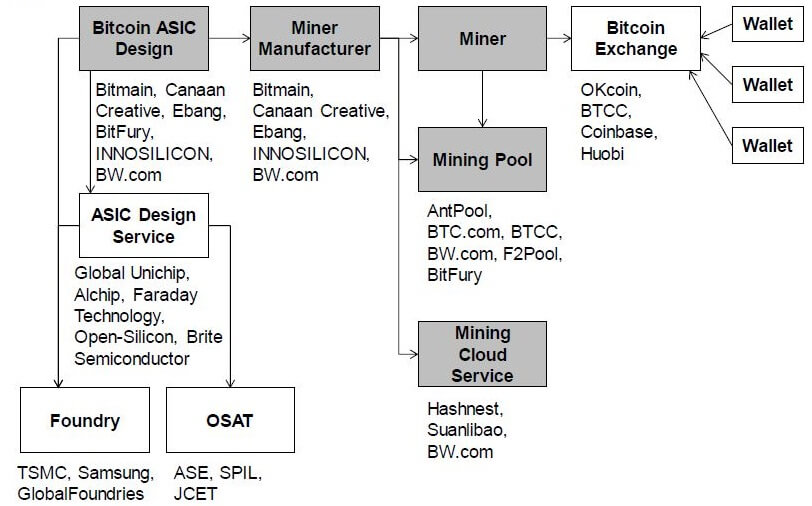

Jihan Wu continues to expand his crypto imperium and apparently there is nothing in the way to stop him. His company Bitmain seems to be present in most of the core businesses in the field of blockchain industries: The company designs the silicon chips that power the ASICs they have patented, then they assemble the machines being practically the only serious supplier of mining equipment in the market.

Equipment that they also use in their mining farms and rent to other people through cloud mining contracts on their hash power.

They also control the world’s two biggest Bitcoin mining pools, and if that is not enough, Jihan Wu is also in charge of researching and innovating blockchain technology getting deep into Artificial Intelligence and funding of several startups such as the recent initiatives to create Blockchain Central Banks. So Mr. Wu has built a profit chain that has almost become cyclical, and that is something remarkable for any entrepreneur.

Bitmain Profits from several parts (highlighted in gray) of the bitcoin mining supply chain.

That kind of achievement is not something that can be done in a weekend, such a vast fortune and power to influence an entire technology is something that even his biggest detractors (Bitcoin.org’s “Cobra” for example) recognize.

In fact, last year his name appeared in the top 10 of the most influential people in Blockchain ( as “The Villain,” of course).

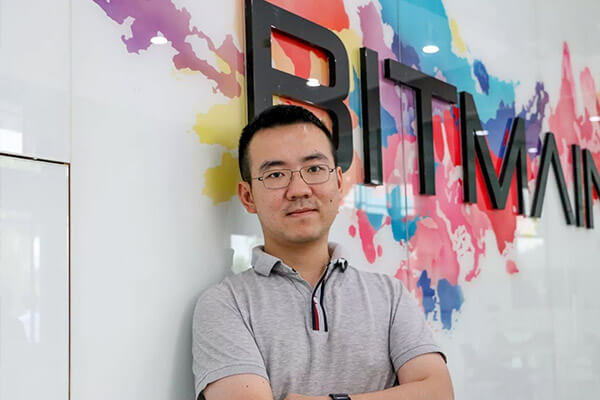

Jihan Wu is the man behind the company that changed the conception of individual and competitive mining Satoshi himself had. He is the man who transformed the ideas behind mining hardware as they were imagined and is the man behind the most important fork Bitcoin has ever had in its history.

And just as many blame Nobuaki Kobayashi for causing a bitcoin drop as a result of a $400 Million sale, many blamed Jihan Wu for a less-than-1-hour 10% drop in Bitcoin Price when BCH was announced. But, of course, if you think that’s wrong and don’t agree with his point of view, Jihan Wu will always have a few words to show you how much he cares about what you think of him:

fuck your mother if you want fuck.

— Jihan Wu (@JihanWu) May 15, 2016

This man just sees the future, understand it and tries to shape it to what he considers to be the best option.

Wu, who sees himself as a “bitcoin evangelist in China,” was born in 1986. Before diving into bitcoin, he worked as a financial analyst and private equity fund manager.

In May 2011, Wu had his first contact with Bitcoin, and instead of seeing it as a geeky virtual coin to play with, he visualized a business opportunity worth to invest in. “When I entered this industry, I bought bitcoins on Taobao and Mt.Gox,” Wu said in an interview in 2014.

He then started a business that destroyed competition. He popularized the union of Bitcoin miners in pools instead of making them “compete” (He now has control of almost one third of the Bitcoin mining power worldwide), he then put in the market the best equipment specialized on bitcoin hash decryption (ASIC’s) and he did it in a better way than any of the few competitors out there (a vast number of the miners from other pools use his ASICs). As said, he crashed the competition and then ventured into another level.

After controlling all those strategic processes (or at least after gaining so much influence) he was also behind the Tokyo and New-York Agreements, being a strong proponent of Bitcoin Unlimited and Segwit2x: Consensus algorithms that modified the original one, making the blocks larger.

That would increase the computing power needed to mine a block which would give him even more control by reducing the possibilities of small miners to decrypt one (or “mining”).

No consensus, no change

Given that the algorithm could not be changed due to the lack of consensus, his last step was simply to promote Bitcoin Cash, his version of what Bitcoin should be. Thus BCH was born as a coin with a much smaller market cap, but with quite a controversial reputation for its advertising methods, among them the fact of being pumped by sites such as bitcoin.com, calling BTC as bitcoin-core and promoting BCH as the “real bitcoin” or even forcing buyers to use Bitcoin Cash as the only cryptocurrency available to pay for their Bitcoin Miners.

-

![]()

First clause: No BTC allowed. Only USD and BCH

Those who have seen Jihan Wu at a first glance might think such a pacific and conservative man as Jihan Wu is not the kind of person with an aggressive business vision, but in real life nothing seems to stop this highly influential businessman, and while he announced investments in such critical business, politics have been a little nuisance that the company located in China has need to deal with. However, it seems now they may have decided to fight once and for all.

According to research published in the Union Bulletin, Jihan Wu seems to be making arrangements to build Bitmain facilities in a more crypto-friendly United States:

(Walla Walla) Port Executive Director Patrick Reay said his agency has been working with Antcreek LLC for about six months on the development of a blockchain facility

This would not be interesting if it weren’t for the fact that upon investigating the records of Antcreek LLC, the only Governing Person of the company is none other than Jihan Wu.

It’s not the first time Wu has built facilities abroad. He has been doing so for years taking advantage of low electricity costs or cold climates that improve his ASICs life among other things. But something curious on this occasion is the reason for this strategic move: The investments are being made after the announcement of possible restrictions to crypto mining and trading by the Chinese government.

The purchase option is quite large, exceeding 40 acres of land and with a possibility of investment that could reach 10M USD.

However, it remains to be seen whether the headquarters of the famous mining equipment assembler will be actually to consolidate Bitmain on this place, or whether it will merely be a branch office.

Jihan Wu, as usual, has not made any comments on this matter.