Bitcoin’s price is showing some signs of weakness as it hovers above its crucial support at $11,300.

This level has been tapped and defended on multiple occasions throughout the past day, with each dip below this level being met with aggressive buying pressure.

Despite the support that exists here, the cryptocurrency is still in a precarious position due to the multiple harsh rejections it has faced around $12,000. Until this resistance is firmly surmounted, bears have a slight edge over bulls.

There is one set of on-chain data that seems to spell trouble for the benchmark digital asset’s near-term outlook.

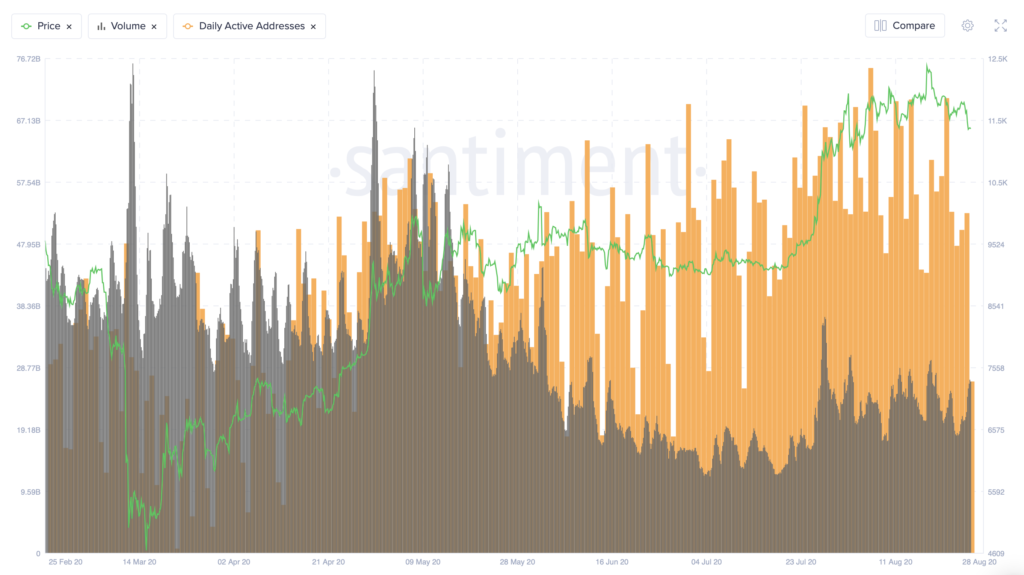

Analytics platform Santiment spoke about the cryptocurrency’s address activity, explaining that its active address count has seen a noteworthy decline over the past few days, which indicates that downside could be imminent.

Bitcoin struggles to hold above key support level as selling pressure mounts

At the time of writing, Bitcoin is trading up marginally at its current price of $11,450. This marks a notable decline from its multi-day highs of $11,800 that were set just a few days ago.

It also marks a climb from daily lows of $11,100 that it briefly tapped yesterday when the entire market saw massive inflows of selling pressure.

Bitcoin appears to be respecting the trading range between $11,000 and $12,000 that has been formed over the past month, but its price action this morning does indicate that it has some support at $11,300.

If this support is broken below in the near-term, it could put the cryptocurrency at risk of seeing significant near-term downside.

BTC’s network activity spells trouble for its near-term outlook

Bitcoin’s active address count is flashing some warning signs for the cryptocurrency’s near-term outlook.

Analytics platform Santiment spoke about this in a recent tweet, explaining that its recent price decline led its active address count to plummet.

This metric is currently down 19.3% from its peak of 1.13 million that was hit on August 6th.

“BTC continues its caution flags with its low level of address activity on its network. The -3.7% price was surely related to this metric’s -19.3% decline since its peak of 1.13M active addresses back on August 6th.”

This trend can be seen while looking towards the below chart from Santiment’s Sanbase Pro platform:

Unless this network metric begins reversing its ongoing downtrend, Bitcoin may see continued pressure on its price action.

Bitcoin Market Data

At the time of press 3:49 am UTC on Aug. 27, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.36% over the past 24 hours. Bitcoin has a market capitalization of $210.76 billion with a 24-hour trading volume of $22.24 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 3:49 am UTC on Aug. 27, 2020, the total crypto market is valued at at $356.95 billion with a 24-hour volume of $93.07 billion. Bitcoin dominance is currently at 59.02%. Learn more about the crypto market ›