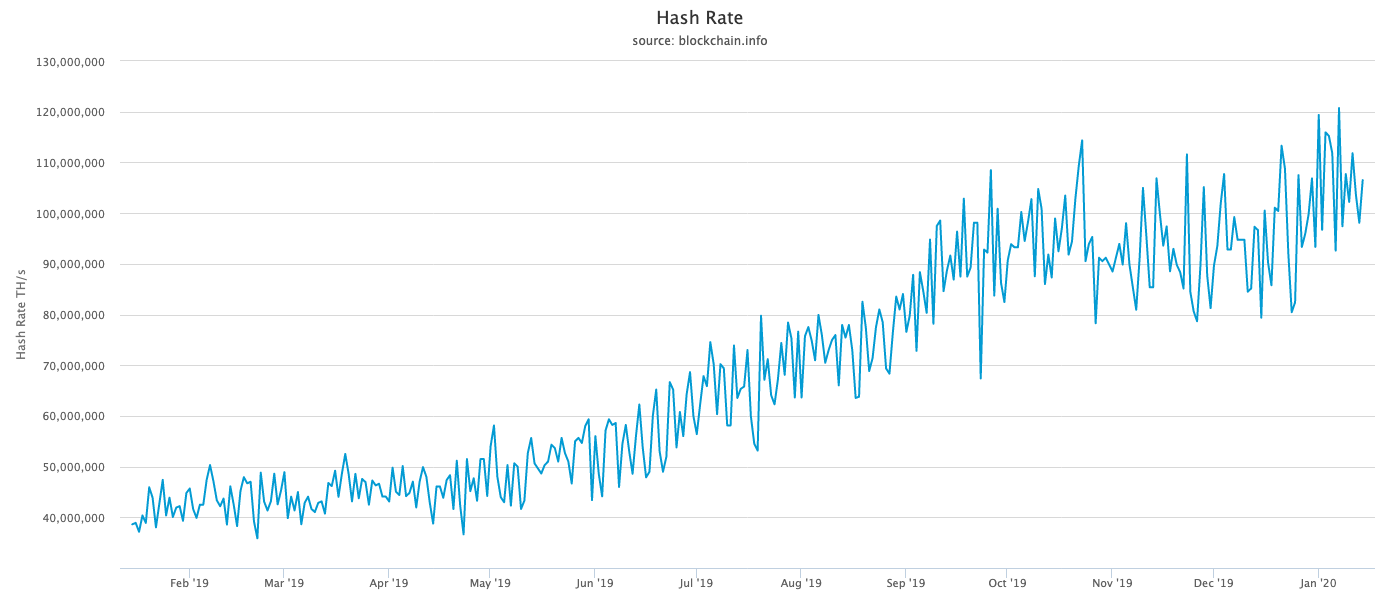

While many analysts predicted Bitcoin’s mining difficulty will rise around 8 percent, few believed it would continue to increase at the same pace in the days following the adjustment. According to data from CoinMetrics, the difficulty increased 7 percent after the adjustment, with the hash rate reaching an all-time high of 14.8T.

Even before the latest Bitcoin mining difficulty adjustment occurred, the crypto industry was knee-deep in discussing the effects it could have on the market. The term “difficulty” gets thrown around a lot, but few understand just how significant it is for Bitcoin. It represents the number of hashes, or solutions, necessary to find a solution to a complex mathematical problem that is required to create a new block.

The more computing power the network has, the quicker new blocks get discovered, which is why the difficulty adjusts every 2,016 blocks or approximately two weeks. As the mining difficulty rises, the competition increases and it gets increasingly hard to earn rewards from mining. And usually, the harder it is to earn rewards, the more expensive Bitcoin gets.

Following the latest adjustment, Bitcoin mining difficulty reached an all-time high and is now more than three times higher than it was on Jan. 15, 2019.

Bitcoin’s mining difficulty continues “staggering” increase

According to data from CoinMetrics, it’s not just Bitcoin’s hashrate that has gone parabolic. In a Jan. 15 tweet, the company shared a graph showing that Bitcoin’s mining difficulty has continued to rise, calling its increase “staggering.”

The growing hashrate and the increasing difficulty mean that Bitcoin miners are still standing strong. Many analysts predicted that the impending halving would push out much of the network’s miners and decrease its hash rate, as most small and mid-tier players in the space will be looking to cut their losses before the rewards are reduced in half.

However, the numbers speak for themselves and there is still no sign of miners capitulating. One of the few factors that could have affected Bitcoin’s hash rate rise is a slight decrease in mining coming from China.

According to a report from Asia Times, local authorities at Sichuan, a province in the southwest of China and a top destination for miners, urged miners to reduce their electricity consumption during the dry season.