Bitcoin’s macro uptrend seen throughout the past two months has now led it to enter a consolidation phase as it struggles to surmount $10,000.

Analysts are widely watching to see how it ultimately responds to the coveted five-figure price region, as another firm rejection here could prove to be enough to spark a short-term downtrend.

It is important to note that although the cryptocurrency’s market structure still remains strong as it hovers in the mid-$9,000 region, a few key on-chain data metrics are pointing towards declining short-term network health.

Bitcoin sees slight degradation in network health following last week’s halving

Last week’s mining rewards halving event went off without a hitch, with Bitcoin’s block rewards being successfully reduced by 50 percent.

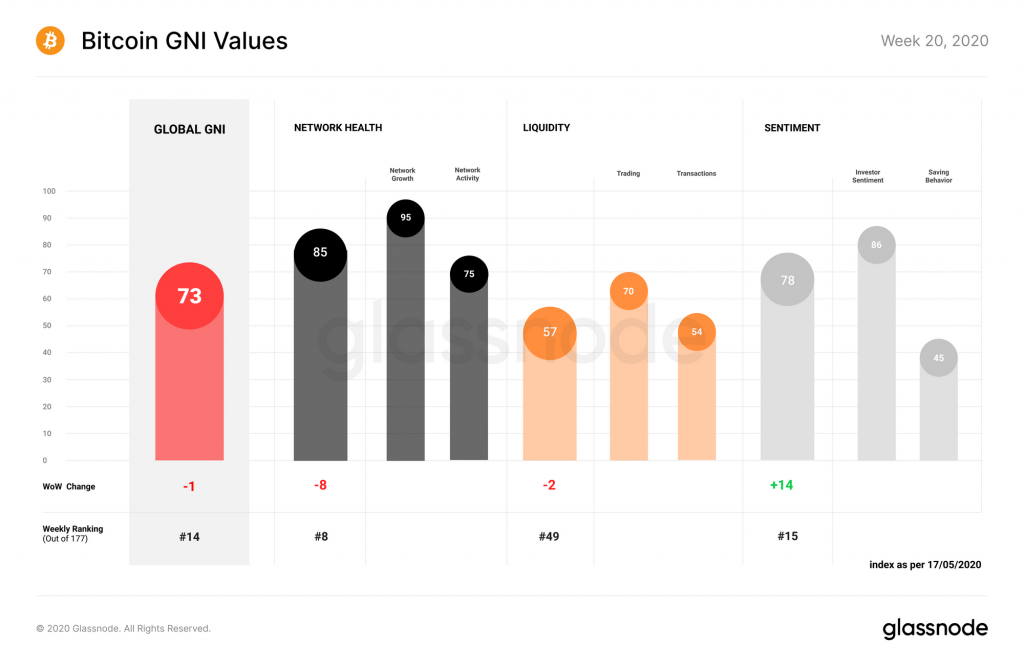

In the time following this event, the cryptocurrency has seen a slight decline in its network health – as measured by data platform Glassnode’s GNI indicator.

As discussed in the firm’s “The Week On-Chain” report, Bitcoin’s fundamental strength has declined throughout the past week as a result of a slight decrease in network activity and liquidity.

They explain that although the network health subindex did deteriorate this week, it does not signify that the network itself is unhealthy, but rather that its growth trajectory has slowed marginally.

“This week’s 8 point decrease should not be taken to signify an unhealthy network, but rather a return to the network’s previous growth trajectory.”

Glassnode further adds that this particular subindex is still up “70% from last month” and “240% for the year.”

Investors continue fleeing crypto exchanges

CryptoSlate has previously reported that investors have been moving their Bitcoin away from exchanges at an unprecedented rate.

This trend has shown no signs of slowing down or reversing throughout the past several days, as the balance of BTC on exchanges has now reached levels not seen since late-May of 2019.

Glassnode also spoke about this within their report, explaining that this decline marks that “most prolonged BTC exchange balance downtrend in Bitcoin’s history.”

This trend seems to be emblematic of a shifting investment approach amongst investors, who are likely moving this crypto towards cold storage wallet systems.

Because the use of a cold storage wallet decreases how quickly digital assets can be sold, it is a strong probability that investors are planning on holding their BTC until it sees significantly higher price levels.

This trend could also have implications on the cryptocurrency’s volatility, as it means that traders will be less prone to trade their spot positions.

Bitcoin Market Data

At the time of press 9:10 pm UTC on May. 18, 2020, Bitcoin is ranked #1 by market cap and the price is down 0.54% over the past 24 hours. Bitcoin has a market capitalization of $178.24 billion with a 24-hour trading volume of $42.36 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:10 pm UTC on May. 18, 2020, the total crypto market is valued at at $265.91 billion with a 24-hour volume of $141.3 billion. Bitcoin dominance is currently at 67.03%. Learn more about the crypto market ›