The bitcoin price (BTC) has slipped to $9,900 following the highly anticipated launch of Bakkt, a bitcoin futures market operated by ICE, the parent company of the New York Stock Exchange (NYSE).

Traders expected the dominant cryptocurrency to demonstrate large volatility as the opening of Bakkt coincided with a weekly close for BTC.

However, the selling pressure on BTC continued to build up past the weekly close, bringing the bitcoin price below $9,900 briefly on the day.

Why Bakkt isn’t causing any immediate effect on the bitcoin price

Su Zhu, CEO at Three Arrows Capital, said that Bakkt is not likely to see a sudden spike in volume in the short term.

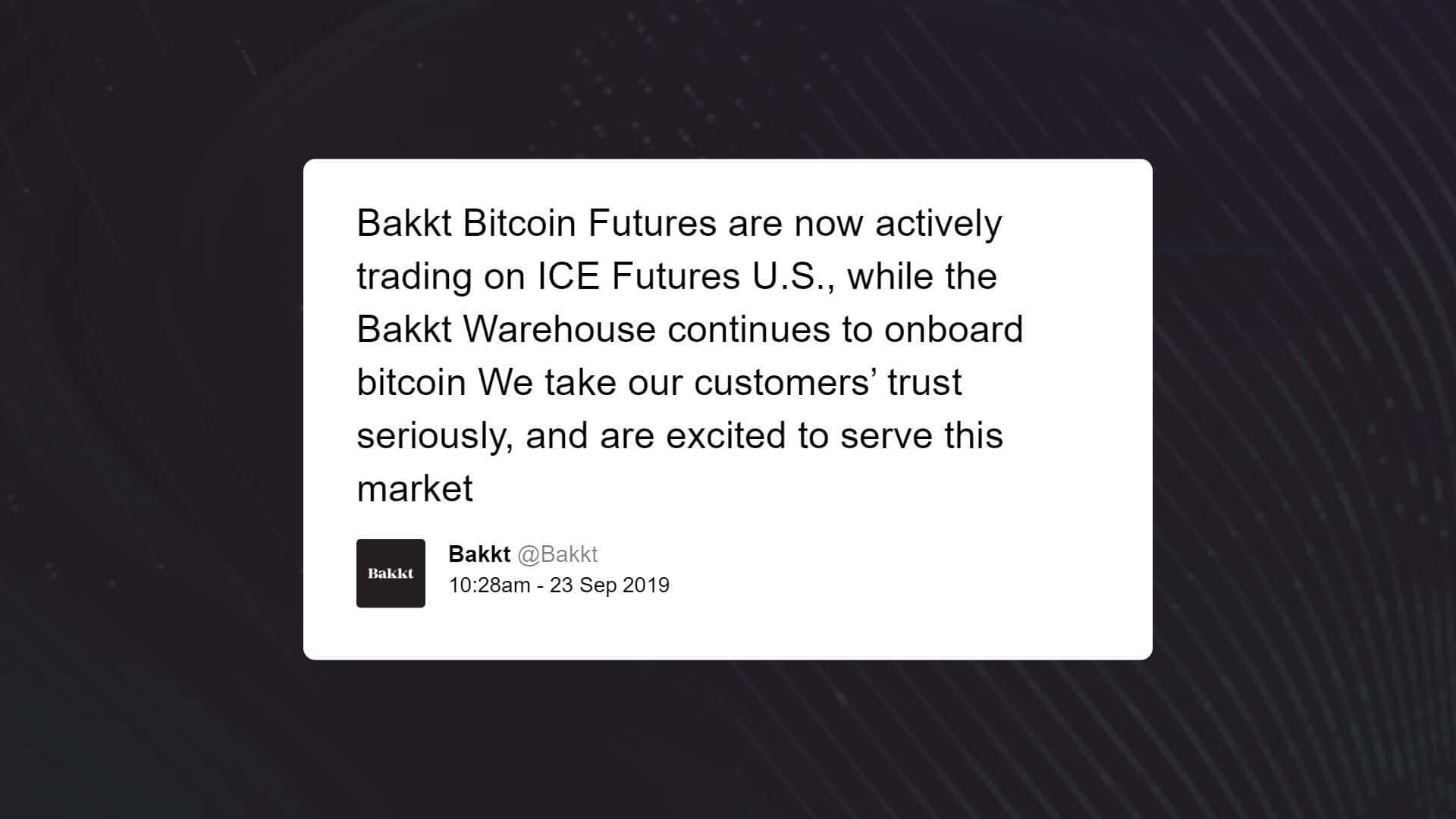

Bakkt, as a strictly regulated futures market that primarily targets accredited and institutional investors, will have to go through a period in which brokers and third-party facilitators prepare to process trades through Bakkt.

Until brokers establish a system to push trades onto Bakkt, the bitcoin futures market is not likely to see large volumes near the volumes of CME Group and other major exchanges.

“Bakkt will be likely first a trickle and then a flood. The reality is that most regulated futures contracts get low adoption on day1 simply b/c not all futures brokers are ready to clear it, many ppl want to wait and see, the tickers are not even populated on risk systems, etc,” Zhu said.

The potential effect of Bakkt on the bitcoin price has remained an uncertainty in the previous several months.

While the qualities of Bakkt as the first platform to offer physically-settled bitcoin futures contracts increases the chances of the exchange affecting the short to medium term trend of the bitcoin price, the demand from investors would have to rise to a certain threshold to begin to fuel the momentum of the cryptocurrency.

It could take days or weeks before Bakkt begins to see any meaningful volume from BTC investors, lessening the potential impact of Bakkt on the bitcoin price.

Still, Matt Odell, a bitcoin analyst and the co-host of Tales from the Crypt: A Bitcoin Podcast, said that the launch signifies a major credibility boost for BTC regardless of the interest surrounding its debut.

“Honestly didn’t think bakkt would launch. Pleasantly surprised. Bitcoin just got a big credibility boost. Kind of unreal to be honest,” he said.

In August 2018, when ICE first announced its plans to launch a BTC futures market, ICE chairman Jeff Sprecher said that BTC and cryptocurrencies as an asset class are “here to stay,” emphasizing that it is critical to build strong infrastructure around it for the long-term growth of the asset class.

“The unequivocal answer is yes [crypto assets will survive]. As an exchange operator it’s not our objective to opine on prices,” said Sprecher.

Is a further pullback possible?

If Bakkt fails to act as a short term catalyst for the bitcoin price, as reported by CryptoSlate on September 22, some technical analysts anticipate BTC to test the bottom of the range it has been in since early August at $9,600.

A drop below a strong support level in $9,600 could see BTC test lower supports in the $8,000 region.

Bitcoin Market Data

At the time of press 2:45 am UTC on Mar. 20, 2020, Bitcoin is ranked #1 by market cap and the price is up 3.58% over the past 24 hours. Bitcoin has a market capitalization of $172.17 billion with a 24-hour trading volume of $32.52 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 2:45 am UTC on Mar. 20, 2020, the total crypto market is valued at at $252.18 billion with a 24-hour volume of $109.58 billion. Bitcoin dominance is currently at 68.30%. Learn more about the crypto market ›