However, these assets are now enjoying a renaissance after Binance listed Ordinals’ ORDI tokens on its platform. Following the news, the crypto token’s value surged by more than 290% over the last seven days, according to CoinMarketCap data.

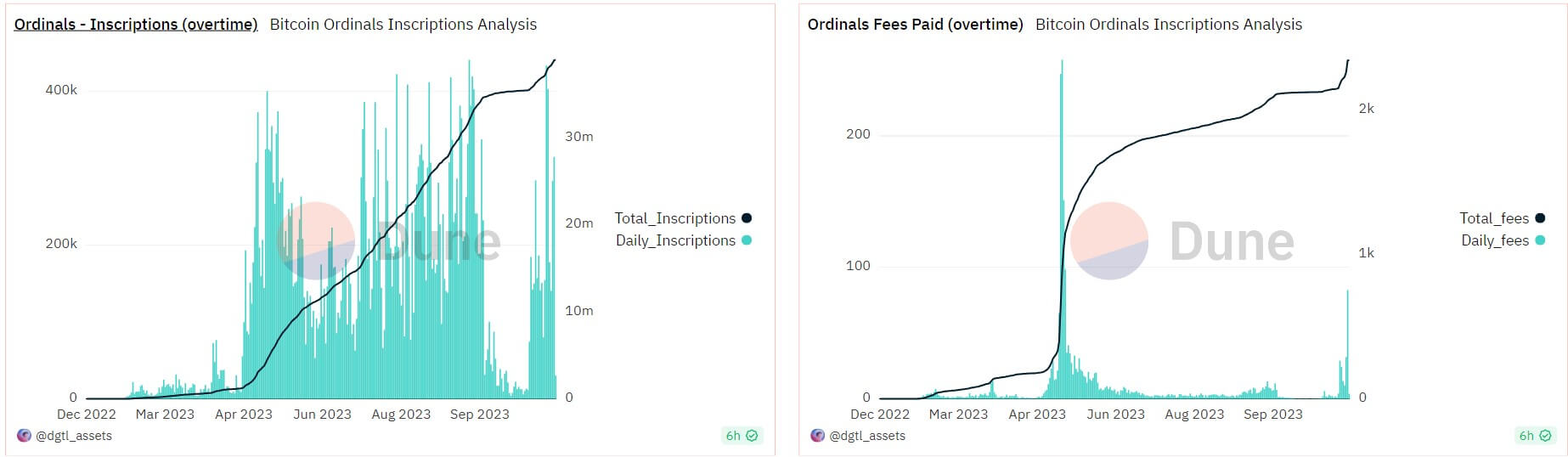

Dune Analytics data, curated by dgtl_assets, further shows that the daily inscriptions on Bitcoin averaged more than 150,000 again after a brief lull between September and October. Per the dashboard, approximately 39 million inscriptions have been minted, generating 2,346 BTC, roughly $85.45 million, in transaction fees.

This surge has also propelled Bitcoin into the second-largest blockchain by NFT sales volume, surpassed only by Ethereum, CryptoSlam data showed.

However, the increase has also led to a substantial rise in unconfirmed transactions on the network, with over 150,000 transactions currently in the backlog.

While the elevated transaction fees may pose challenges for Bitcoin traders, they substantially benefit miners. Increased transaction fees translate to higher rewards for miners, especially as they brace for the upcoming reward cut associated with Bitcoin’s next halving.

Bitcoin miner Marathon Digital pointed this out on social media platform X, saying it recently earned 3.25 BTC in fees from mining a block.