The Bitcoin price has failed to push above a relatively low resistance level at $8,374, making a bigger pullback into the mid-$7,000 region more likely.

According to Arca’s chief investment officer Jeff Dorman, the current state of the cryptocurrency market, given the low volume of bitcoin, incentivizes traders to short bitcoin until bottom levels are hit.

Traders in the cryptocurrency market often utilize BitMEX to place long or short BTC contracts and the low volume of the exchange could make it easier for bears to maintain control.

Since the July peak earlier this year during which the bitcoin price spiked to as high as $13,920, the weekly volume of BTC on BitMEX has dropped from $55 billion to around $15 billion, by more than 72 percent.

The volume of BitMEX, in particular, is important for traders as it is the largest margin trading platform in the global cryptocurrency market, and it is speculated to have the biggest impact on the short term price trend of bitcoin.

Traders are not discarding potential drop of bitcoin to $6k

Some traders who are considered to trade with large size on cryptocurrency margin trading platforms are not dismissing the possibility of bitcoin dropping to the low $6,000 region in the short term.

Patiently waiting for $6k $BTC levels where I will add to long-term holdings.

Good luck homies.

— Angelo฿TC (@AngeloBTC) October 15, 2019

Since early 2019, bitcoin traders who have been gearing towards a bearish medium-term trend have consistently emphasized $6,300 to $6,500 as an area of significant historical activity that could serve as a bottom for BTC heading into 2020.

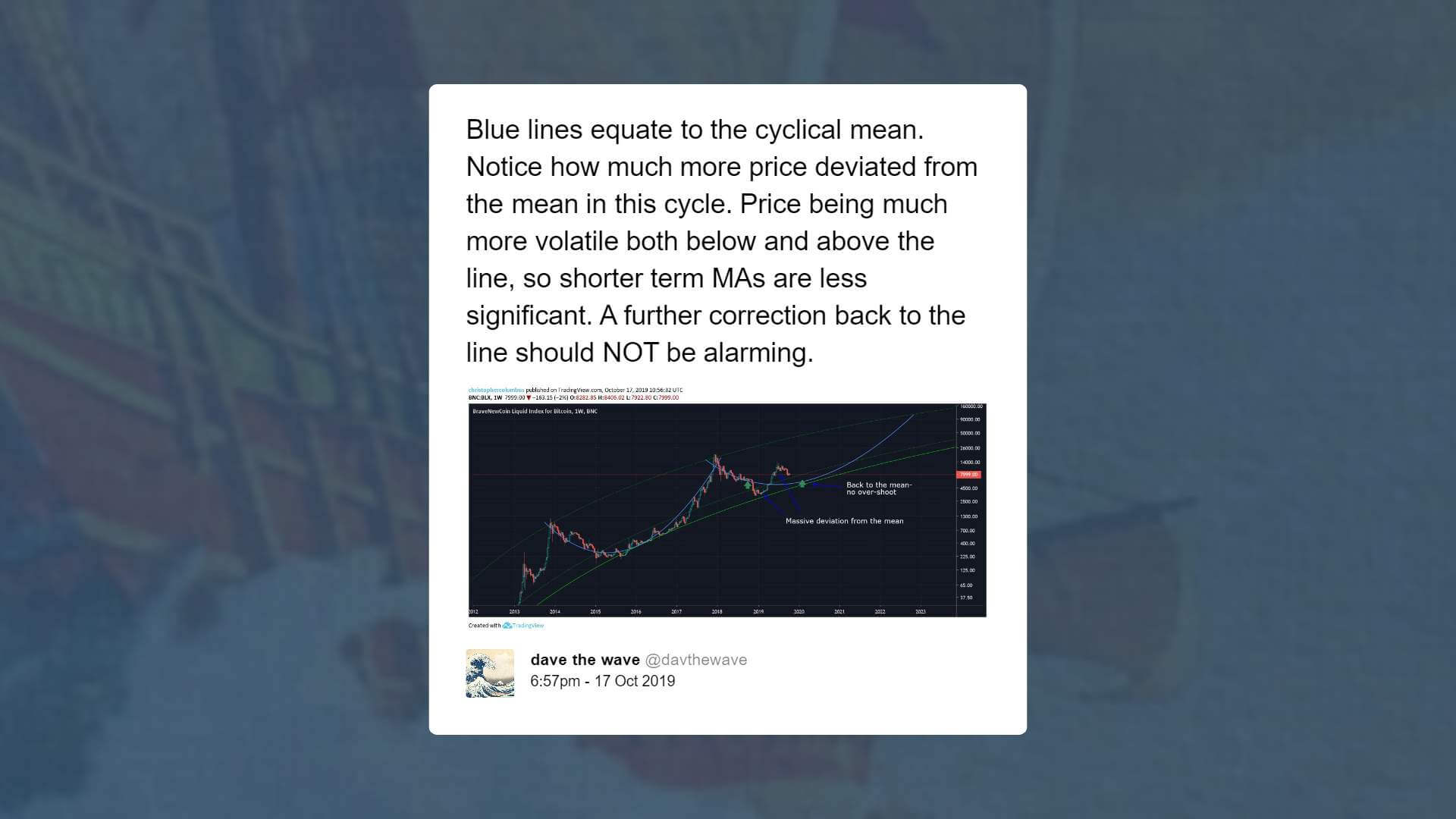

A technical analyst who operates with the alias “Dave the Wave” noted that short term momentum indicators have become increasingly irrelevant due to high volatility.

As such, with the declining volume of BTC on BitMEX and other spot exchanges causing a build-up of sell-pressure, technical analysts foresee a further 30 percent to 40 percent pullback from current levels.

Altcoin market isn’t doing any better

Major cryptocurrencies in the likes of Ethereum and XRP have been underperforming against both bitcoin and the U.S. dollar since the beginning of the year.

From their record highs, the price of Ethereum and XRP have fallen by 88 percent and 92 percent respectively, while BTC has dropped by less than 60 percent in around the same period.

The lagging growth of the altcoin market, following predictions of an altcoin season in July, has led the valuation of the cryptocurrency market to slip by 42 percent within less than four months from $385 billion to $220 billion.

For bitcoin and the cryptocurrency market to recover to key resistance levels, it would need to be supplemented with a noticeable spike in daily and weekly volume.

For now, there are little signs of a potential trading volume upsurge in the cryptocurrency market.

Bitcoin Market Data

At the time of press 4:10 pm UTC on Dec. 7, 2019, Bitcoin is ranked #1 by market cap and the price is up 0.93% over the past 24 hours. Bitcoin has a market capitalization of $145.71 billion with a 24-hour trading volume of $14.34 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 4:10 pm UTC on Dec. 7, 2019, the total crypto market is valued at at $220.37 billion with a 24-hour volume of $52.24 billion. Bitcoin dominance is currently at 66.12%. Learn more about the crypto market ›