The world’s two largest cryptocurrency protocols are showing great promise in terms of network activity and inclusivity.

While Bitcoin’s transaction fees fell to pre-halving levels, Ethereum GAS usage surged as DeFi activity increased in the past month, reaching an all-time high level.

Bitcoin transactions made cheaper

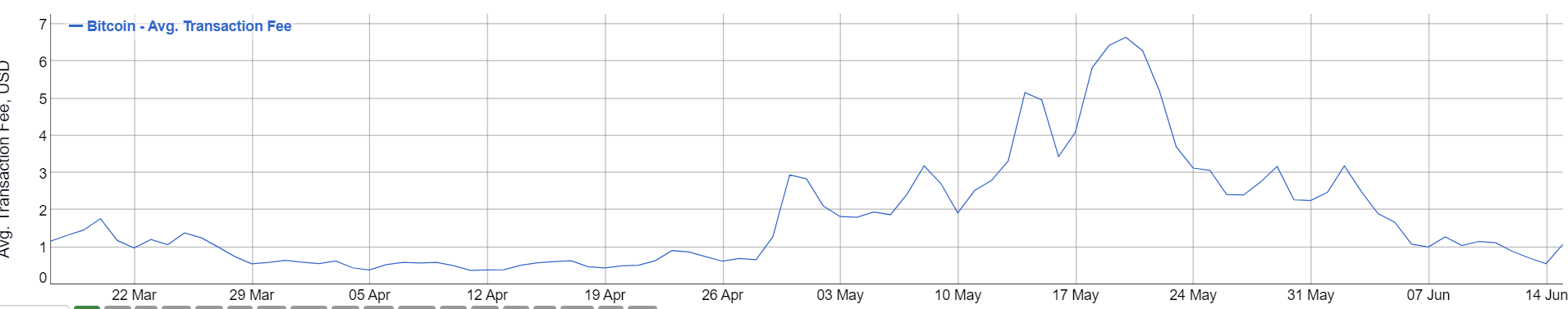

Transaction fees are below $1 on the Bitcoin network, hovering between $0.70 – $0.75 at the time of writing. These levels were last seen in late-April 2020, weeks before the halving event shot fees to over $6 in the following days.

Fees have steadily fallen since. The network has experienced a loss of old miners who have, presumably, sold their remaining Bitcoin and mining equipment.

BTC prices continue to bounce between $9,200 and $9,800. Reports suggest negative difficult adjustments in the past few weeks have caused miners to return, especially the smaller players.

The below chart shows transaction fees have decreased over 90 percent after May 19-20, falling to as much as $0.60 on June 15.

Lesser fees mean faster network transactions and more miners exchanging their computing resources to keep Bitcoin secure and protected. Centralization fears were amplified last month after the halving event, as critics said a few players were dominating Bitcoin activity.

Despite the local peak of $6 in May, Bitcoin’s highest recorded fees remain those of December 2017, a period of frenzy and massive retail interest in cryptocurrencies which caused BTC transactions to cost over $55 at one point.

Ethereum buoyed by stablecoins, DeFi

Meanwhile, GAS usage has increased multifold. Data from on-chain analytics firm Glassnode shows Ethereum network activity, in terms of GAS, is at ATH levels.

Daily #Ethereum gas usage is currently sitting at all-time highs.

It has seen an increase of 58% since the beginning of the year and is hovering above the 60 billion mark.

Chart: https://t.co/hrcDwp9Klq pic.twitter.com/PVZjfq7KAd

— glassnode (@glassnode) June 14, 2020

Glassnode said GAS has seen an increase of 58 percent since the beginning of the year and is hovering above the 60 billion mark.

Every Ethereum transaction requires a certain GAS value to ensure a successful transaction or for executing a smart contract on the network. Network activity at any given time determines exact GAS prices, although they don’t vary significantly.

As previously reported by CryptoSlate, increasing stablecoin and DeFi activity may attribute rising GAS usage. Last week, we noted Tether transfers on the Ethereum blockchain (USDT is issued on five other protocols) were increasing significantly.

Ryan Watkins, a research analyst at crypto data firm Messari, noted in relevant research:

“In short, Ethereum is being used more than ever, and in just two years, Ethereum has evolved from a blank canvas to an agglomeration of novel forms of value and use cases.”

While DeFi applications follow stablecoin activity, crypto scams and a China-linked Ponzi scheme account for their share of network usage.