The recent BTC run has borne good news for two important parts of the Bitcoin ecosystem — investors and miners.

Data from on-chain tracking firm Glassnode shows miner revenues are back at pre-halving levels, i.e. before May 12 of this year. These are the same as when block rewards were double those of today.

#Bitcoin miner revenue is back at pre-halving levels.

Chart: https://t.co/Ao9DodRwqi pic.twitter.com/PwUHPaKz8L

— glassnode (@glassnode) November 18, 2020

Bitcoin mining is an important, but intensive, part of the asset’s ecosystem. Miners armed with multimillion rigs build out complex infrastructure to maintain the Bitcoin network and receive BTC rewards for each block they mine (requiring millions of mathematical calculations each second).

The upkeep of this requires big money, as not only does the setup itself cost thousands of dollars for a single miner, but maintenance, labor and electricity costs, and cooling the mining rigs brings up a huge bill for miners each month. Add to this repair costs and other unforeseen difficulties.

Such reasons are why Bitcoin rewards, and the asset’s price, are important for miners. Low revenues mean shutting down a mining plant, which in turn means better, more well-funded players start to corner Bitcoin’s hashpower.

Effects on Bitcoin’s price

Meanwhile, recent data shows miners are not facing such problems thus far (even if regulatory issues remain a problem). As seen in the chart below, revenues are equal to pre-halving earnings from earlier this year:

The levels are also at a yearly-high, with yesterday’s daily revenue figure — inclusive of block rewards and transaction fees — alone being over $21.2 million. The previous peak was on May 6 at $20.6 million. This figure was still much higher than the revenues immediately after halving, with miners making just $7 million a day compared to the then previous week.

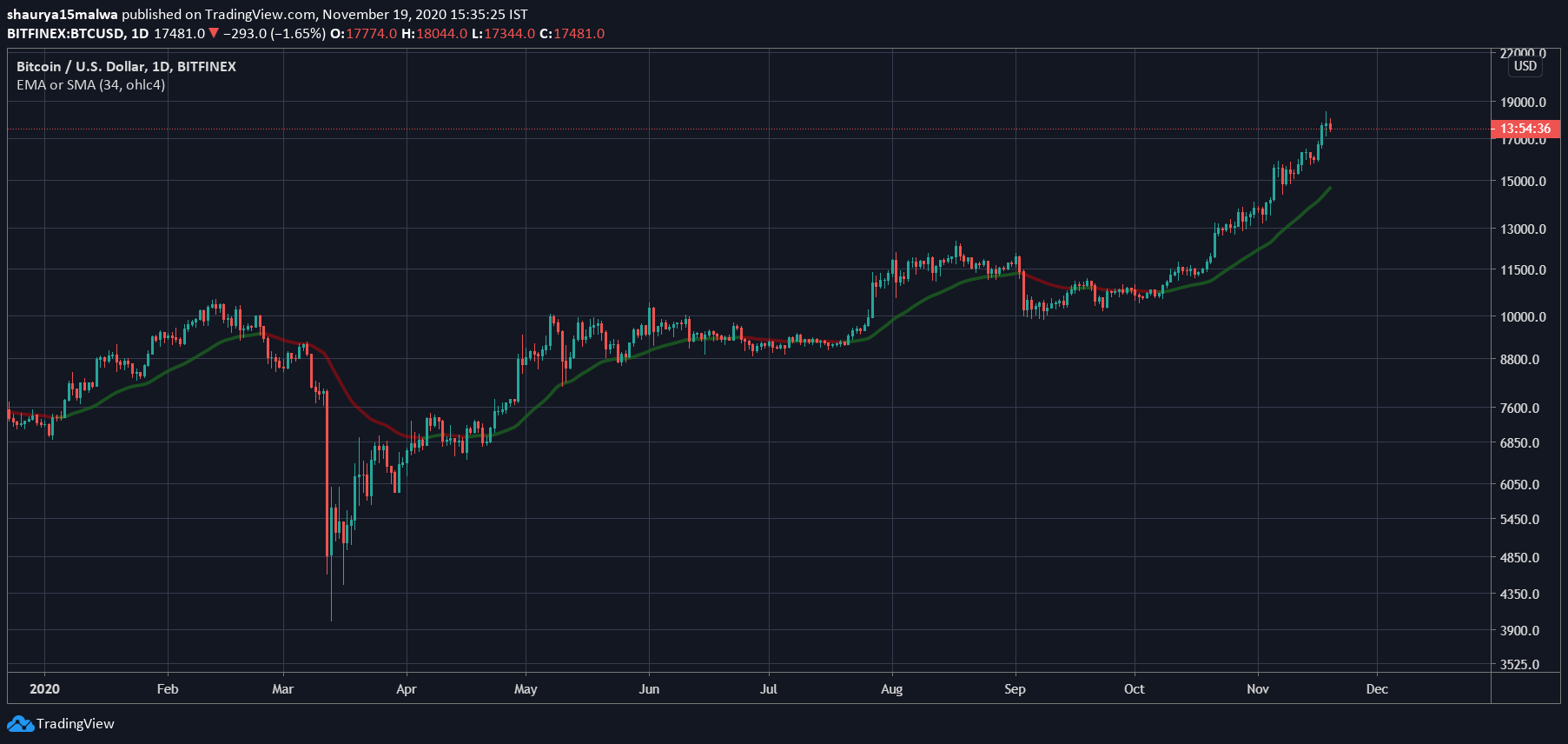

Interestingly, Bitcoin’s price charts show a correlation between miner revenues and sudden drops in the asset’s price. Revenues reaching their peaks in March and May were met with a price drop in Bitcoin shortly afterward, as the below graph shows:

This could suggest that when miners start selling en masse to lock in higher profits, the market starts to sell off similarly, resulting in a temporary price drop. However, the first of the sell-offs could be an anomaly, as March’s plunge came at a time when the announcement of lockdowns led to a global sell-off around equities, bonds, metals, and cryptocurrencies.

Bitcoin Market Data

At the time of press 12:29 pm UTC on Nov. 19, 2020, Bitcoin is ranked #1 by market cap and the price is down 2.11% over the past 24 hours. Bitcoin has a market capitalization of $328.5 billion with a 24-hour trading volume of $42.35 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 12:29 pm UTC on Nov. 19, 2020, the total crypto market is valued at at $496.33 billion with a 24-hour volume of $149.49 billion. Bitcoin dominance is currently at 66.11%. Learn more about the crypto market ›