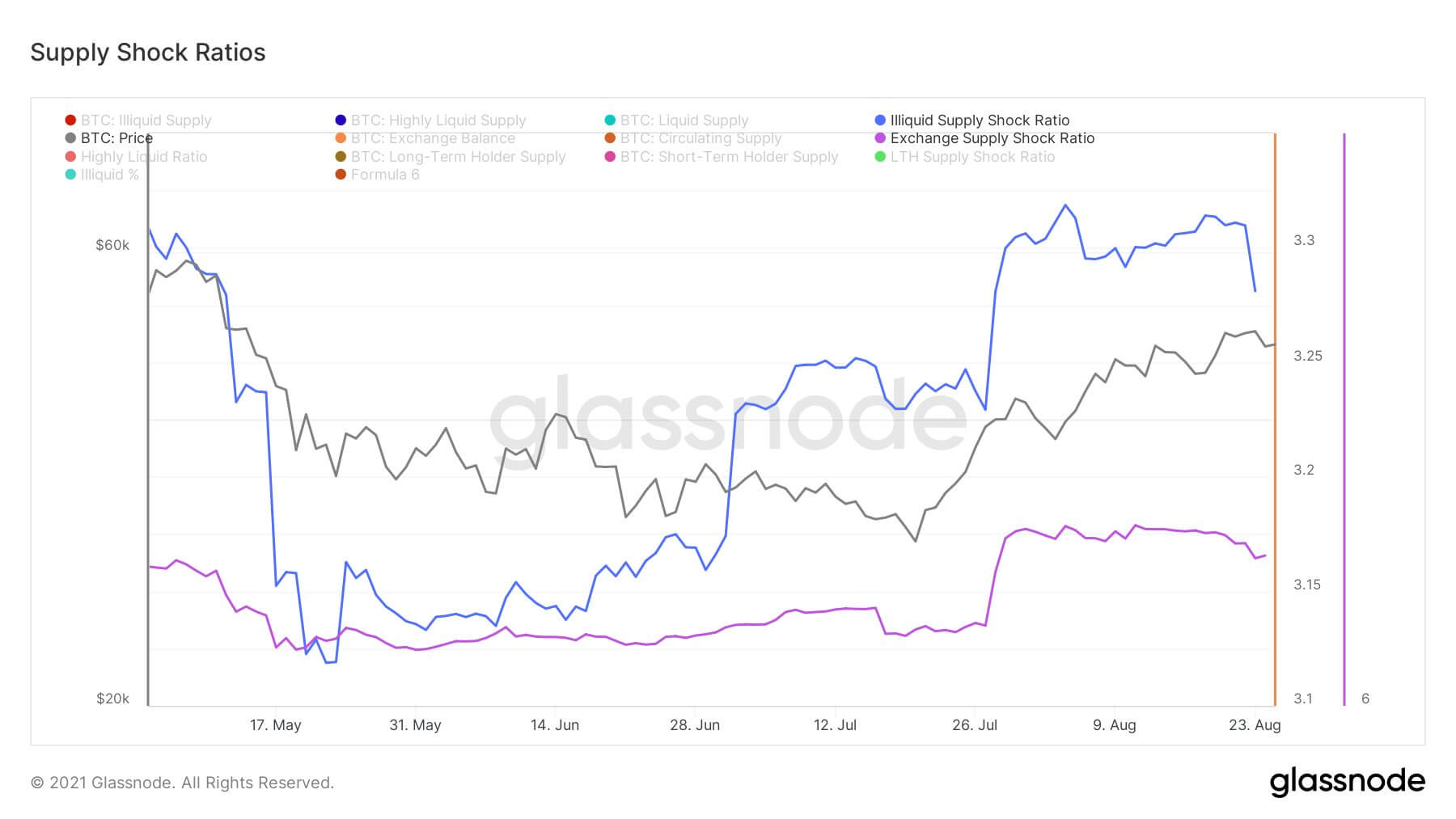

As Bitcoin dips back below $50,000, data is emerging of a possible short-term bearish outlook.

Bitcoin supply shock dynamics

Will Clemente, self-described as a “Lead Insights Analyst,” anticipates short-term bearish action for the Bitcoin price. This, he explains, is due to three factors – a drop in illiquid supply ratio, BTC inflows into exchanges, plus profit taking by whales following the break of $50,000 on Monday – a 14 week high.

I am short term bearish.

Drop in Illiquid Supply Ratio and coins moving onto exchanges. Also seeing some selling from whales. pic.twitter.com/nRhdB2GuSp

— Will Clemente (@WClementeIII) August 25, 2021

The analyst referred to the ratio of illiquid supply, which is a metric that falls under the remit of supply shock analysis. In turn, analysis of supply shock can be used to gauge investor intent, and therefore offers price predictive properties.

On-chain analyst Willy Woo documented the nuances involved in understanding supply shock. This includes quantifying it in its various forms, such as exchange supply shock, liquid supply shock, and long-term holder supply shock.

But, in terms of a modeling supply shock, Woo said he prefers liquid supply shock due to its ability to capture investor intent.

“Glassnode’s Liquid Supply metric forensically clusters wallet addresses into distinct investors and then classifies their coins as illiquid, liquid or highly liquid based on the historic behaviour of the investor.”

Based on the data above, it’s possible to calculate the supply shock ratio by dividing illiquid coins by liquid and highly liquid coins.

Liquid Supply Shock = Illiquid Coins / (Liquid + Highly Liquid Coins)

Woo’s work in this area leads him to conclude that supply shock leads to price. He said this makes sense as the above tracks investor intent before their action to buy or sell.

“For example if a long term investor that historically accumulates moves enough coins to another entity (usually it’s to an exchange) all coins held by that investor become re-classified as liquid or highly liquid as the intent of the investor is now considered to have changed.”

It follows that a fall in illiquid coins, per Clemente’s analysis, suggests long-term investors are moving coins into more liquid forms. The effect of supply shock is lessened as there is more “willingness” to sell on the supply side.

Hold your horses

The feedback to Clemente’s initial tweet has drawn “salty comments” from some quarters. Presumably from perma-bulls who refuse to accept the possibility of short-term bearishness.

However, as Clemente points out, the on-chain data is the on-chain data, and in any case, he still remains bullish.

As assets don’t go up forever in a straight line, a pullback at this point is good, even necessary, to consolidate and regroup for a further leg higher.

“The amount of salty comments is unbelievable. I’m literally just reading you the data I think is important. Ive been long since low 30Ks, that’s not changing.

Nothing wrong with a pullback before continuation…“