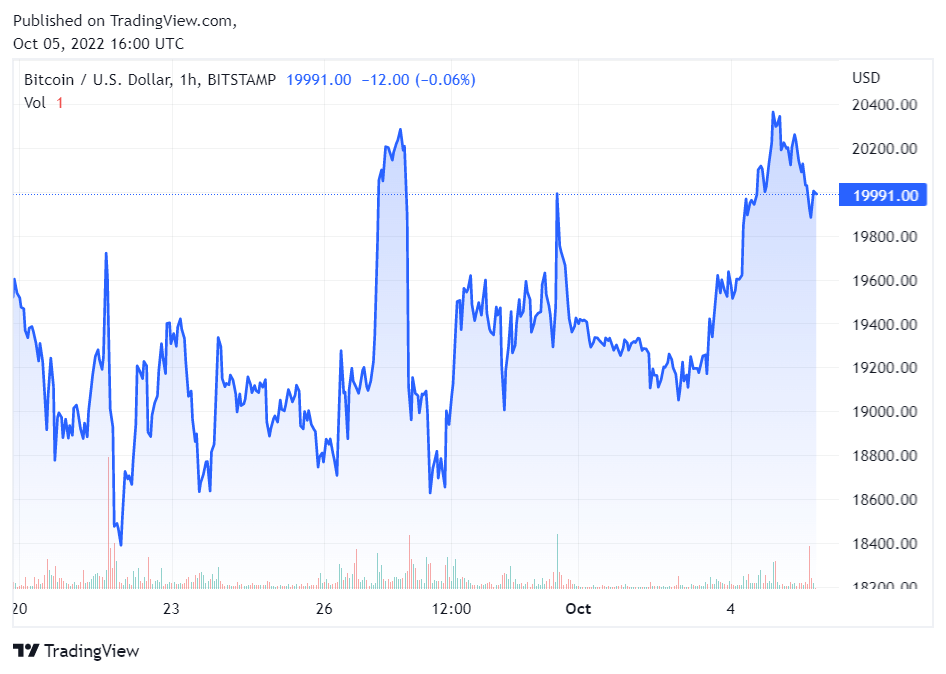

Bitcoin (BTC) briefly bounced above the $20,000 mark earlier today for the first time since Sept. 28 after gaining 4.6% in the past week. However, the euphoria was shortlived as it was rejected around the $20,400 level, dropping to $19,991 as of press time.

The price-performance is coming at a time when the US dollar index reached a 20-year high of 114.78 before declining to 111 today. The Fed’s hawkish policy has negatively affected Bitcoin and stocks but has helped strengthen the dollar.

The recent drop has helped the crypto and stocks market briefly rebound. Nasdaq, S&P 500, and Dow gained a few points to trade up for the first time in a while.

Macroeconomic concerns like Credit Suisse’s possible insolvency and the further escalation of the crisis in Ukraine also appear not to be affecting Bitcoin’s performance presently.

Traders flock futures

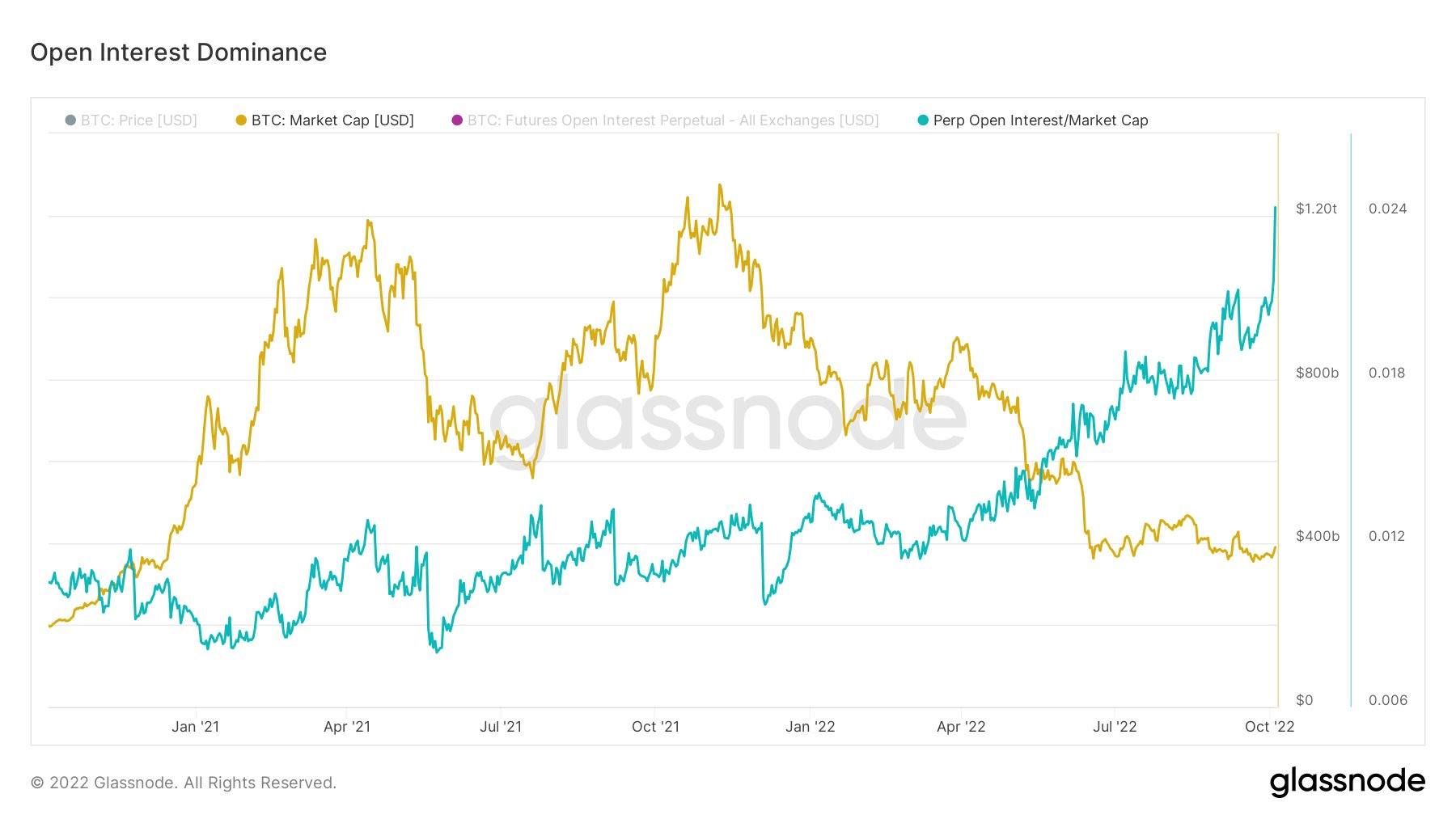

Glassnode data, as analyzed by CryptoSlate, showed that most traders were apeing into BTC futures trading, which is currently at an all-time high.

Traders are taking on leverage using USD/stablecoins in futures open contracts and non-expiring futures contracts with very little spot activity trading occurring.

Traders are using stablecoins as leverage to pump BTC price, which is not sustainable considering there is little spot BTC trading. It also means that there is the possibility of BTC price falling once investors begin to take profits.

Meanwhile, with traders using stablecoins as the underlying asset, BTC will likely see less volatility. It should be added that there is a potential for a liquidation cascade on either short or long positions as open interest keeps building.

Should traders be bullish?

Popular crypto trader il Capo Of Crypto told his followers not to be “too bullish” if the price of Bitcoin get to the $20,500-$21,000 level because it is a sell zone.

20500-21000 is a sell zone. If price gets there, which should, don’t be too bullish.

— il Capo Of Crypto (@CryptoCapo_) October 4, 2022

Meanwhile, more people are buying the asset despite BTC’s performance and volatility. IntoTheBlock data showed that the BTC holders reached 42 million on Sept. 27, increasing by 4.5 million since last year.

The number of #Bitcoin holders has been growing in the bear market 📈

Over 42M addresses are currently holding $BTC, 4.5M more than a year ago pic.twitter.com/BEx4HjVCeW

— IntoTheBlock (@intotheblock) September 27, 2022