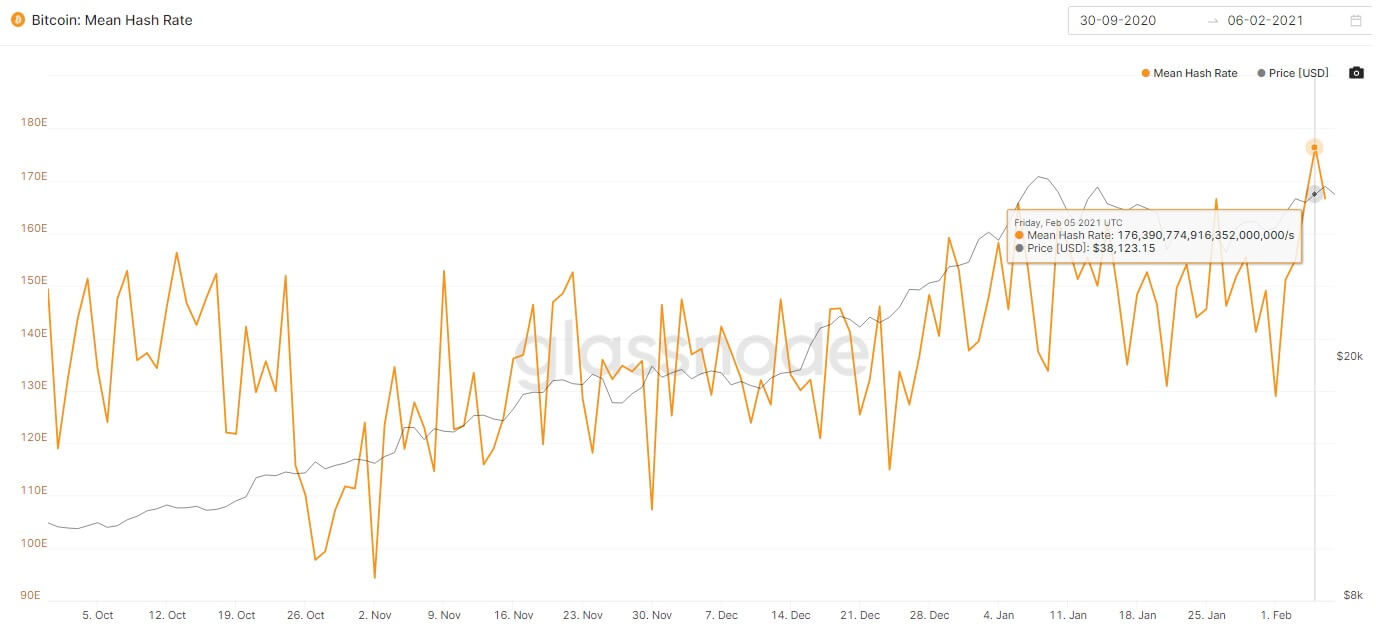

The mean hash rate of the Bitcoin (BTC) blockchain—or the total computational power dedicated to mining—reached a new all-time high of over 176 exahashes per second (EH/s) on Friday, according to crypto metrics platform Glassnode.

Yeah, that’s a lot.

The increase in hash rate can be explained by the growth of Bitcoin’s price itself. Since miners receive BTC as rewards for discovering new blocks, the more the coin costs, the higher is miners’ revenue. Therefore, when the price of Bitcoin goes up, miners are incentivized to contribute more computational power.

Another factor is transaction fees—the second stream of revenue for miners. Essentially, as trading volumes grow—as they tend to amid bull runs—so do transaction fees. Combined with Bitcoin’s price, this additionally makes mining more profitable.

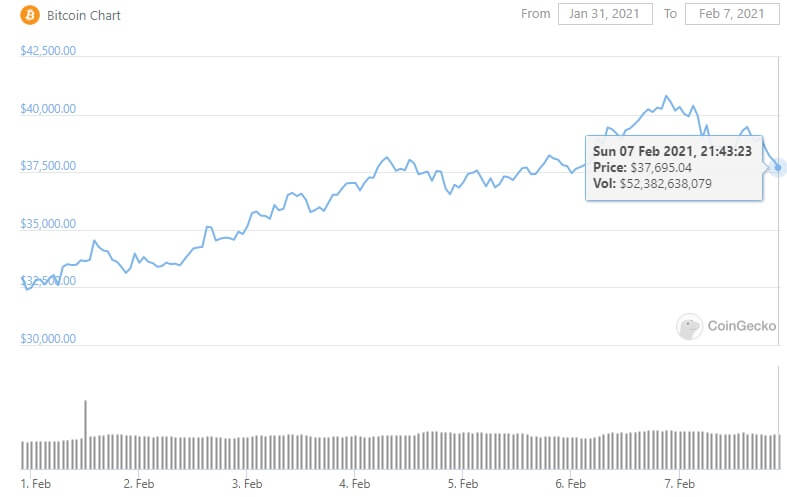

As CoinGecko’s data shows, Bitcoin’s price rally to $38,000 coincided with the spike in hash rate on Friday.

Currently, Bitcoin is trading at around $37,700 while its hash rate dipped below 165 EH/s.

What are exahashes?

In simplest terms, new blocks are discovered by solving mathematical puzzles on countless mining systems. Each individual sum of these calculations is called a hash, and the total hash rate represents how many of these sums are being calculated every second.

Thus, 176 EH/s means that 176 quintillions (that’s 18 zeroes) of hashes are calculated every second across the whole Bitcoin network. For comparison, Bitcoin’s hash rate was around 120 EH/s in early 2020—that’s roughly a 50% increase in just a year.

However, increases in hash rate don’t make discovering new blocks any faster. This is because the rate of one block per 10 minutes is hardcoded into the Bitcoin blockchain, and it stayed largely the same over the last 12 years.

To keep this rate, Bitcoin’s network regularly auto-adjusts its difficulty. This way, even if there is a massive influx of computational power, the process of discovering new blocks will just become proportionally more difficult.