The case for Bitcoin as a proven hedge for the global equity market may have failed temporarily, at least per recent data.

Bitcoin, gold correlation reaches record high

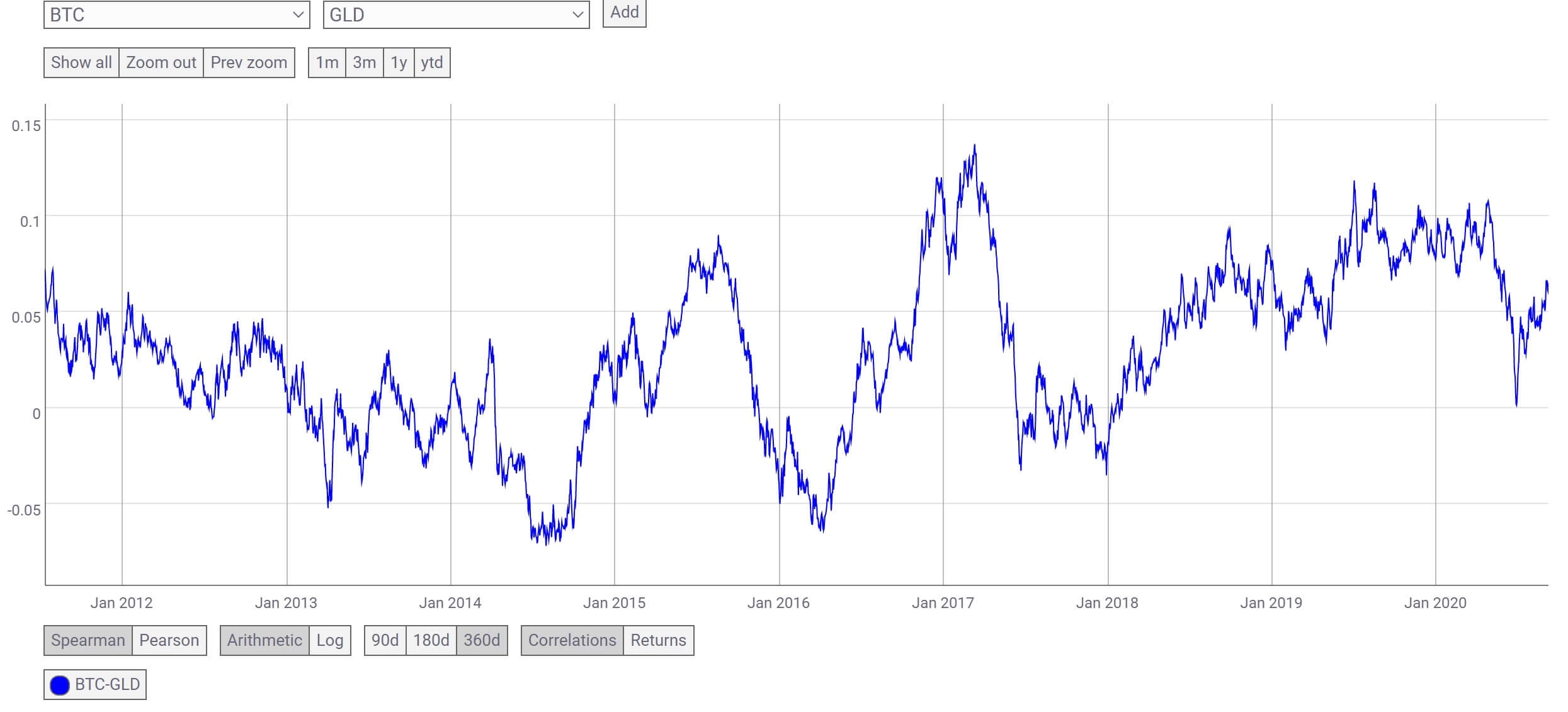

Data analytics and media firm Bloomberg said in its latest crypto newsletter that as per recent findings, the correlation between Bitcoin (BTC) and gold is at its highest level since 2010.

The findings come as Bitcoin, gold, and the broader financial markets have been one trade since March this year — everything dumped by over 40% that month over fears of the coronavirus, only to regain that value and surge higher in the coming months.

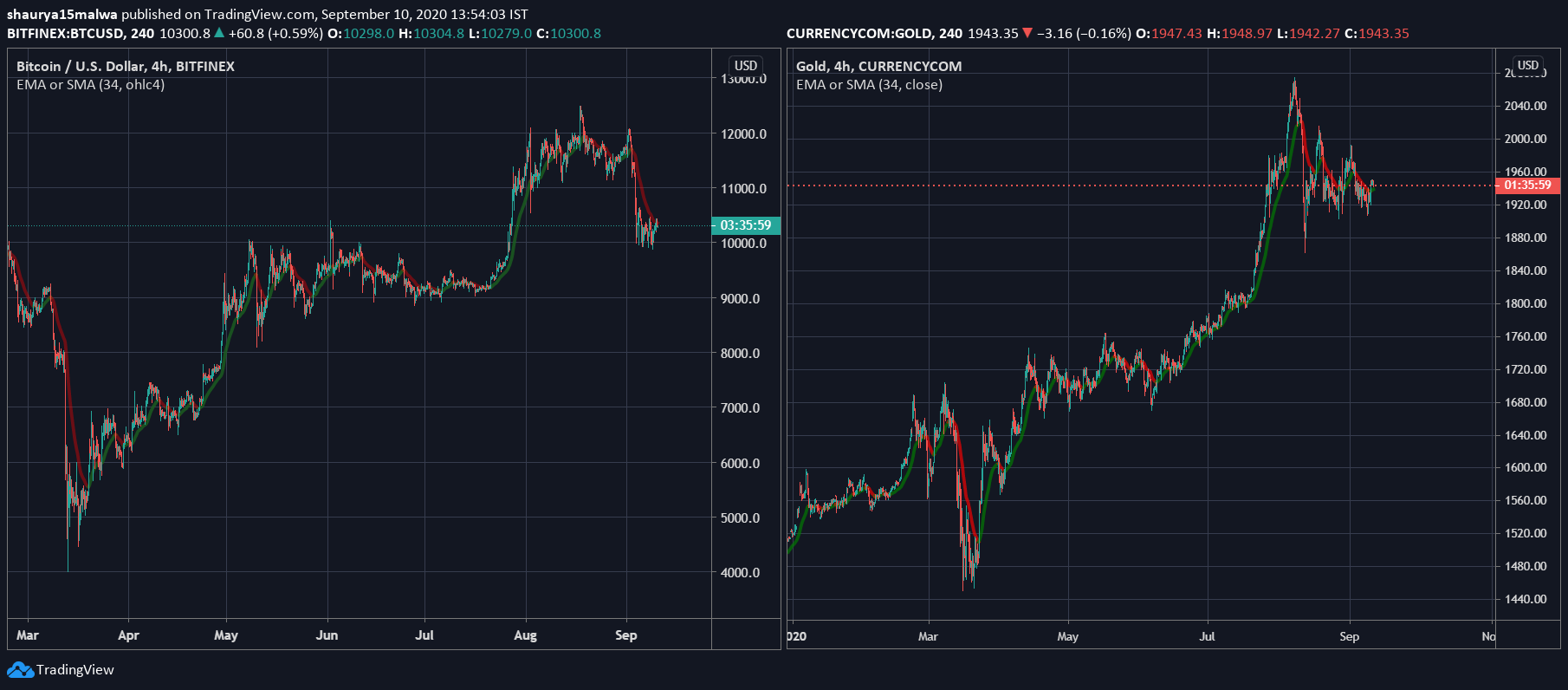

As the above chart shows, regardless of the tracking service you use, the correlation of prices between Bitcoin and gold are similar. They start rising around the same date, show pullbacks and spikes on the same date, and start moving around the same dates as well.

However, despite their visual similarity, Bloomberg argued the correlation ratio isn’t exactly one.

#Gold at $1,900, #Bitcoin $10,000 Return to Decisive Support Zone – Some overdue mean reversion in the stock market is pressuring most assets, but we expect gold and Bitcoin to come out ahead in most scenarios. Declining equity prices encourage more monetary and fiscal stimulus.. pic.twitter.com/8dkJ2vdkdg

— Mike McGlone (@mikemcglone11) September 9, 2020

“On a 12-month basis, the quasi-currencies are about 0.80 correlated, the highest in our database since 2010, explained Mike McGlone, the firm’s senior commodity analyst and author of the newsletter. He added:

“Bloomberg default and simple percentage change function. The percentage monthly changes on a rolling 12-month basis, past 12-months, the highest in our database.”

Meaning that instead of determining the correlation daily, Bloomberg calculates the interrelation of this data on a monthly basis, hence the difference.

Tech stocks behind the plunge?

Meanwhile, McGlone said that the recent plunge in Bitcoin and cryptocurrency prices last week were a result of a dip in the NASDAQ tech index, a collection of US-listed technology are infamous for their volatility and quick price movements.

However, he had good news for Bitcoin bulls. McGlone added that if gold were to maintain its price above the $1,900 level, Bitcoin was to similarly stay above $10,000.

While the development is odd considering Bitcoin’s ethos of being uncorrelated to fiat currencies or equities, the resemblance could be the result of trading firms operating similar strategies across asset classes, as quant trader Qiao Wang noted in a tweet:

Why not retail or crypto-natives, you ask? Well the correlation is evident during the overnight hours between BTC and stonk futures. I highly doubt enough retail or crypto-natives know how these futures work to be able to move the market like that.

— Qiao Wang (@QwQiao) September 9, 2020

Wang added it was likely high-frequency teams trading at short time intervals that were making the two asset classes correlate instead of a discretionary fund. “Well look at the high-frequency data. The correlation is strong at a very high frequency / short time frame. It’s more likely algo than discretionary trading,” said Wang.