Sam Bankman-Fried, the founder and CEO of FTX and Alameda Research, confirmed the acquisition, saying that Binance has become the first and last investor in FTX.

FTX has come to an “agreement on a strategic transaction” with Binance, SBF said but provided no time frame as to when the acquisition will be completed.

SBF reiterated that customer funds will be protected as both Binance and FTX were working on clearing out the withdrawal backlog. As CryptoSlate previously covered, FTX came under fire for failing to process any withdrawals on the Ethereum blockchain for over three hours.

All of the assets on FTX will be covered 1:1 and the liquidity crunch the exchange was experiencing will be cleared out, SBF said in a tweet.

“This is one of the main reasons we’ve asked for Binance to come in. It may take a bit to settle etc. — we apologize for that.”

4) A *huge* thank you to CZ, Binance, and all of our supporters. This is a user-centric development that benefits the entire industry. CZ has done, and will continue to do, an incredible job of building out the global crypto ecosystem, and creating a freer economic world.

— SBF (@SBF_FTX) November 8, 2022

SBF noted that FTX.US and Binance.US are two separate entities from FTX and Binance and have not been impacted by the acquisition. FTX.US, the exchange U.S. arm, has been operating normally and the platform is fully liquid.

Binance’s native token BNB soared on news of the acquisition, spiking over 20% in minutes.

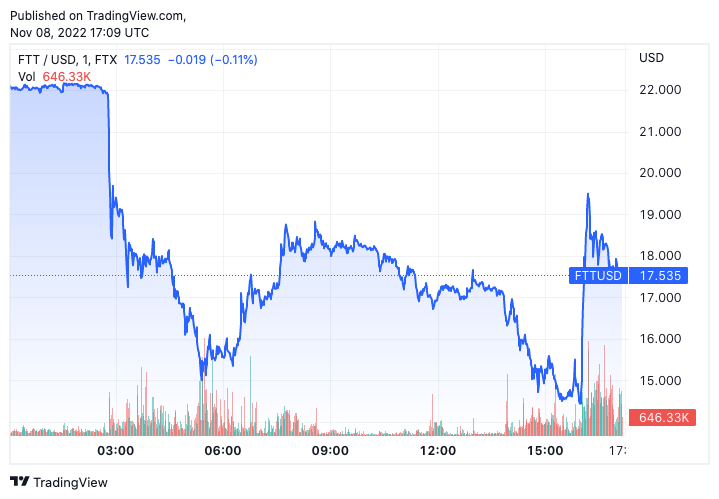

BNB’s spike pulled the rest of the market with it into the green, including FTX’s native token. FTT saw a vertical drop that wiped out over 36% of its price as rumors of the exchange’s insolvency began circulating. However, Binance’s intent to acquire the exchange sent the token’s price skyrocketing — FTT gained over 20% at press time.