The Bitcoin price declined by seven percent in the last 24 hours, liquidating more than $185 million worth of longs. The drop comes hours before the highly anticipated weekly close of BTC.

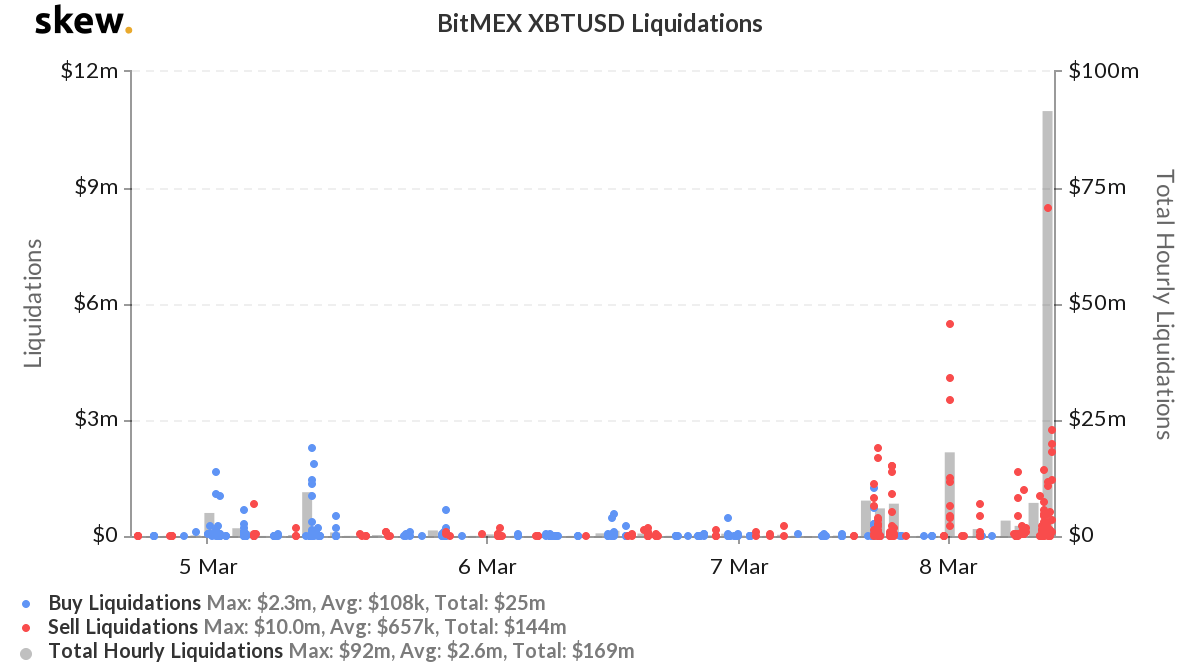

$91 million worth of longs liquidated in a single hour

With many hours left on the day towards the weekly close, Datamish.com shows that $185 million worth of long contracts were liquidated, from 267 positions.

According to data from researchers at Skew, BitMEX alone saw liquidations of around $91 million within a single hour.

As the Bitcoin price fell from $8,633 to $8,160 in less than 45 minutes, it led to a cascade of buy liquidations, causing the cryptocurrency market to pull back significantly within a short period of time.

Other cryptocurrencies like Ethereum saw a steeper sell-off in the same period. ETH dropped by 12 percent on the day, from $237.9 to $211.25.

Why is the Bitcoin price pulling back so intensely?

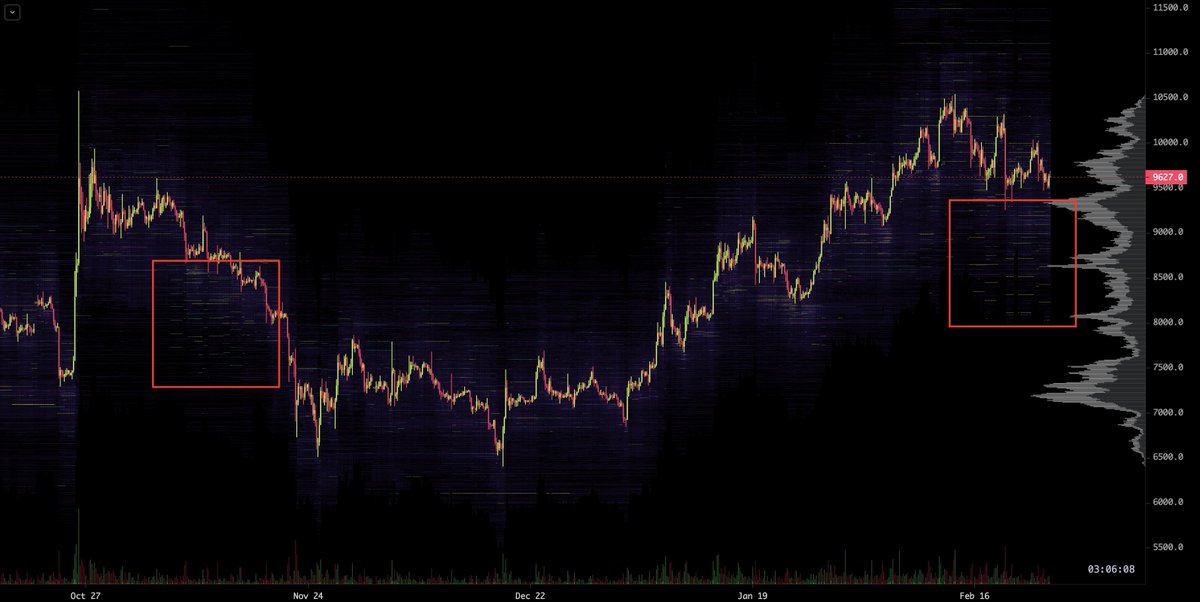

The weekly close of Bitcoin on March 8 has been highly anticipated by traders. Since Bitcoin’s rejection of the $9,200 resistance level, technical analysts have been considering the possibility of a bearish continuation.

Since March 1, the Bitcoin price has shown declining volume and a noticeable drop in open interest, which typically signal the likelihood of a short-term price drop when met with a temporary price upsurge.

Highly-regarded cryptocurrency trader known as “DonAlt” said that a weekly close below $8,750 for Bitcoin would indicate a bearish retest on all large time frames for BTC, including monthly, weekly, 3-day, and daily.

He said:

“So far so good. Tightened risk a little bit, if the much sought out $9500 level hits I think we go higher, not lower. Today’s weekly close will be interesting if we close below $8750 BTC will have had bearish retests on the monthly, weekly, 3d and daily time frame.”

The sudden spike in volatility before a weekly close is not a coincidence, as the Bitcoin price often tends to print a clear short-term direction before a major larger time frame candle closes.

What traders see in the near-term

Prior to the large daily drop, technical analysts like Adaptive Fund’s Nik Yaremchuk said that the presence of deep liquidity in the mid-$7,000 region makes an extended consolidation to that area likely.

As early as February 26, Yaremchuk warned that a drop to $7,500 in the medium-term is a possibility, with sufficient TA arguments.

He said:

“TBH, I’m waiting $8-$8.5k. $7.5k is too perfect. Enough TA arguments for this. Despite some external factors, for example, high expectations from halving. Of course, there will be growth, Bitcoin is doomed to move up, but this is not utopia, this is the market.”

With relatively low volumes across the board and a severe correction in the altcoin market, it will require a big reaction from buyers at lower supports to recover market sentiment.

Bitcoin Market Data

At the time of press 10:15 pm UTC on Mar. 8, 2020, Bitcoin is ranked #1 by market cap and the price is down 6.86% over the past 24 hours. Bitcoin has a market capitalization of $151.55 billion with a 24-hour trading volume of $39.05 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 10:15 pm UTC on Mar. 8, 2020, the total crypto market is valued at at $236.53 billion with a 24-hour volume of $146.2 billion. Bitcoin dominance is currently at 64.10%. Learn more about the crypto market ›