The price of Bitcoin (BTC) dropped to as low as $9,110 across major exchanges on July 10. Despite the pullback, key fundamental data points show that market bias remains optimistic.

Three fundamental factors pointing toward positive market sentiment are record high hash rate, neutral futures funding rate, and address activity.

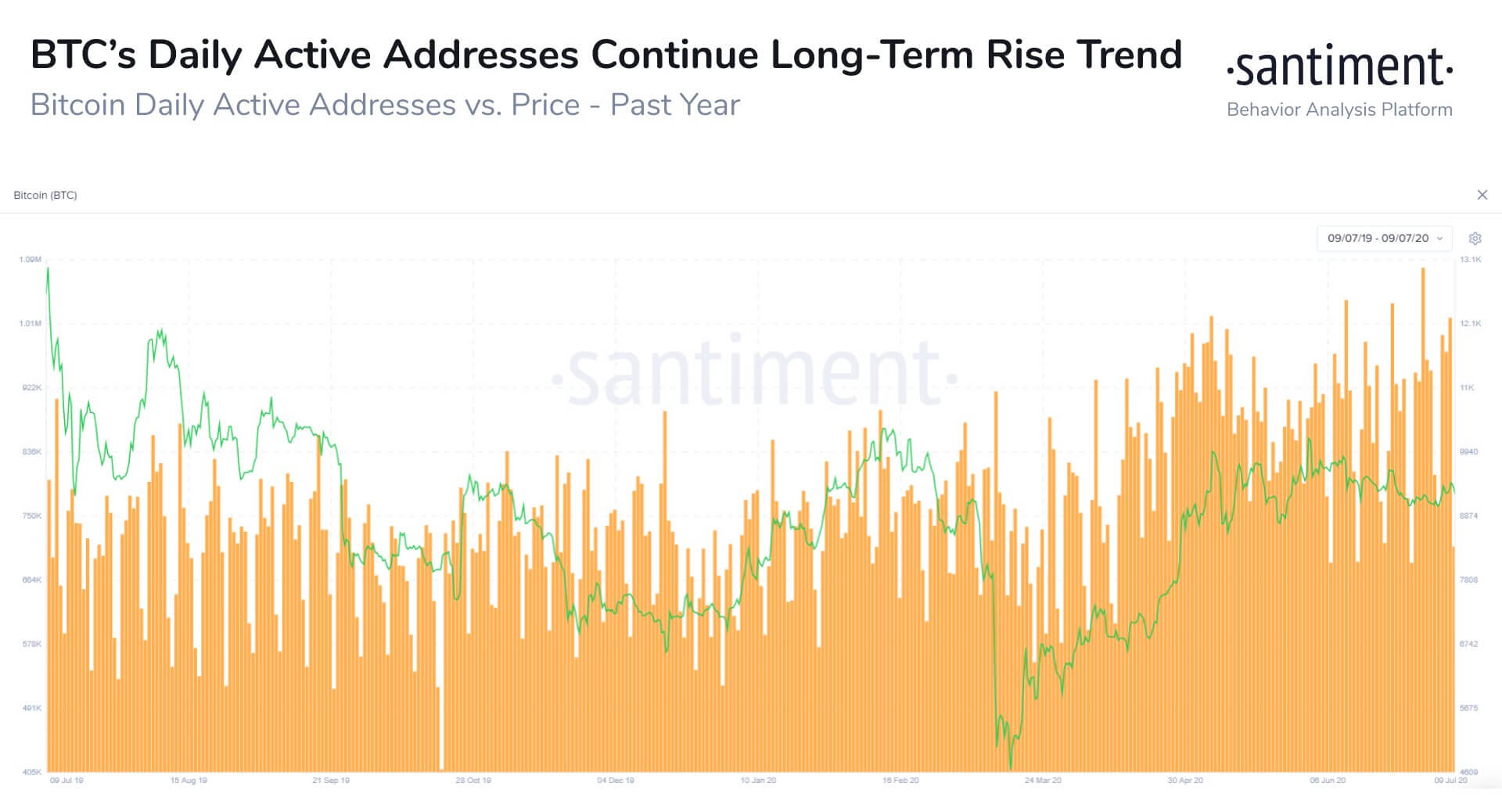

Bitcoin address activity indicates a bullish trend

According to data from market research firm Santiment, the number of daily active addresses on the Bitcoin blockchain is rising.

An increase in active addresses typically suggests strengthening network activity. It could indicate that more users are beginning to use Bitcoin, which is a positive network metric.

Santiment researchers wrote:

“BTC’s daily active addresses continue their long-term uptrend in spite of this morning’s minor retracement down to ~$9,180. After a 2-year high of 1.08M DAA on July 1, yesterday’s DAA at market close nearly matched it at 1.02M DAA.”

Blockchain network metrics, such as developer and address activity, can provide insights into the medium-term trend of BTC.

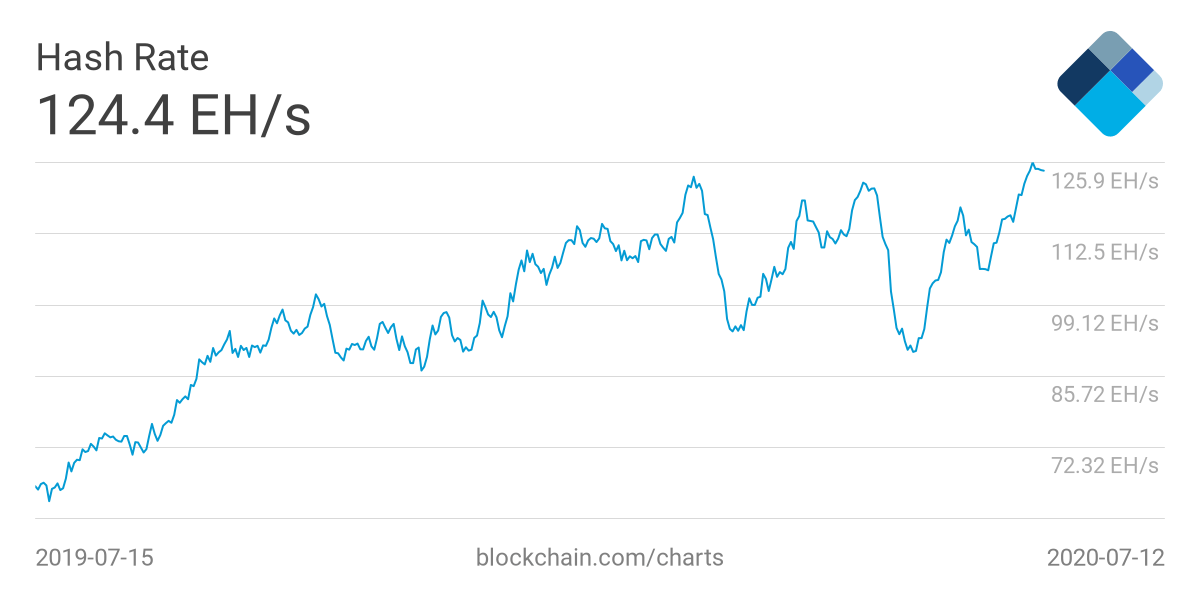

Hash rate continues to climb to new highs

Data from Blockchain.com shows the total hash rate of the Bitcoin blockchain network has achieved a new all-time high.

The total hash rate of Bitcoin now hovers at 124.42 million terahash per second (TH/s). It is up by nearly two-fold within the past 12 months.

The record high hash rate of the Bitcoin blockchain network hints at stability in the mining industry. Due to the relatively cheap electricity cost in some regions, like Sichuan, many large-scale miners remain highly profitable.

The profitability of big mining centers reduces the probability of an intense sell-off in the Bitcoin exchange market.

Miners are regarded as an external source of selling pressure against the cryptocurrency exchange market.

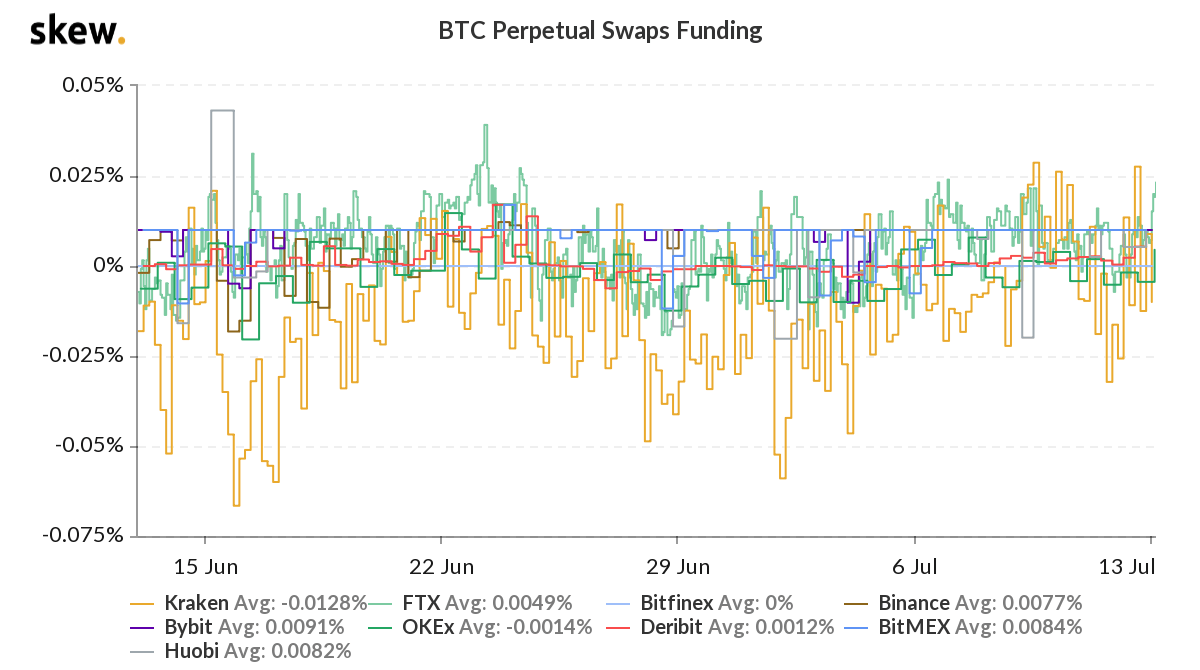

Futures funding rate is neutral

Bitcoin futures exchanges employ a mechanism called “funding” to provide balance in the market.

Perpetual swaps are a type of futures contract with no expiration. That means traders can continue to trade Bitcoin futures without being limited by time.

But, the funding mechanism incentivizes either short or long contract holders if the market sways to the opposite side.

For example, if there are more short contracts in the market, long contract holders are incentivized with a negative funding rate. When the funding rate turns negative, sellers pay long contract holders a fee every eight hours.

Currently, the funding rate on BitMEX and Binance Futures remains at a neutral 0.01%. It shows the market is net neutral following the recovery of BTC from $9,110 to nearly $9,300.

A confluence of a neutral futures market and optimistic fundamental metrics suggest an overall positive sentiment in the Bitcoin market.