Bitcoin markets fell over -7% in the past day amidst a broader fallout in crypto markets and a surge in the Dollar Index (DXY), data from multiple sources shows.

However, on-chain data from analytics tool Glassnode showed buyers were stacking sats and sending newly-bought Bitcoin to long-term wallet holdings instead of selling the asset outright (this could, however, be exchanges sending their holdings to cold wallets instead of active traders/investors).

“215,331 Bitcoin moved to strong HODLers wallets yesterday. This is the 3-year ATH. Interesting,” noted Leo Moskovski, CIO at crypto fund Moskovski Capital.

215,331 #Bitcoin moved to strong HODLers wallets yesterday.

This is the 3-year ATH.

Interesting. pic.twitter.com/IxbSQziT2z

— Lex Moskovski (@mskvsk) March 25, 2021

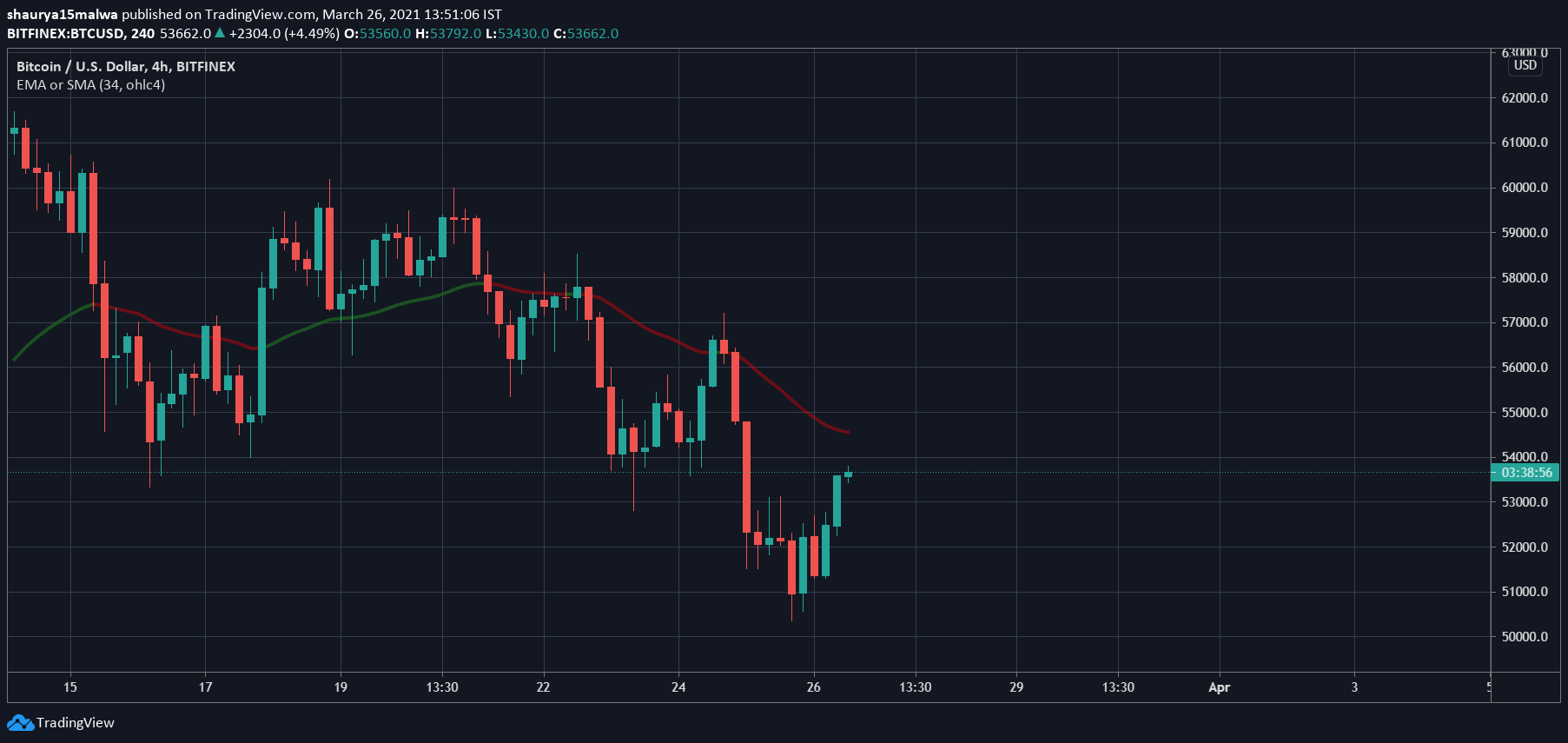

As the below image shows, Bitcoin dropped to as low as $50,393 yesterday before finding a support level at the $51,400 price range and recovering to over $53,000 by press time. The asset still trades below its 34-period moving average—a popular tool used by traders to determine market strength and trend.

The Bitcoin expiry

Some in crypto circles attributed the drop to the Bitcoin options ‘expiry’ scheduled for today. Over $6 billion worth of bets on the asset’s prices would go void today, leading to a more volatile trading session in the past few days.

“This Friday $6 billion in options contracts are set to expire,” noted Glassnode co-founders Yann Allemann and Jan Happel on Twitter. However, they added that traders were betting on higher Bitcoin prices in April—expecting the market to bounce and surge upwards:

“Bitcoin price expectations for April are high with lots of investors placing their new bets on $80k.”

This Friday $6 billion in options contracts are set to expire. #Bitcoin price expectations for April are high with lots of investors placing their new bets on $80k. pic.twitter.com/xRipoAaD1F

— Jan & Yann (@Negentropic_) March 24, 2021

Meanwhile, Glassnode’s Reserve Risk indicator—a tool that calculates the number of long-term holders at various price levels—suggested that despite the price drop, the overall market had not ‘peaked.’

The current level is slightly over 0.008 while the previous market ‘tops’ recorded a level of over 0.02 and above, meaning the current risk/reward ratio to ‘invest and hodl’ was more favorable compared to previous cycles.

Reserve Risk indicates a strong conviction of long-term holders at these price levels.

The current risk/reward ratio to invest and hodl is still attractive compared to previous $BTC cycle tops.

Current level: 0.008

Precious tops: > 0.02#BitcoinChart: https://t.co/Pr4VA4QrXX pic.twitter.com/sPKtTp3FnH

— glassnode (@glassnode) March 23, 2021

And with Bitcoin surging to $53,000 since Thursday’s drop, some are likely investing and ‘hodling.’