Ethereum has been outperforming Bitcoin this year in multiple metrics, as the world’s largest cryptocurrency has been sluggish ahead of the May 2020 halvening. According to data from Skew, Ethereum has shown a 47 percent YTD price growth, outpacing Bitcoin’s 29 percent. Ethereum futures and options have also seen a significant rise in volume.

The world’s second-largest cryptocurrency sees major growth in 2020

If the first month of the year is any indicator of how the rest of 2020 will pan out, then Ethereum is up for quite a year. The world’s second-largest cryptocurrency spent most of 2019 struggling with controversies and poor performance, but the new year seems to have brought a new wave of optimism into space.

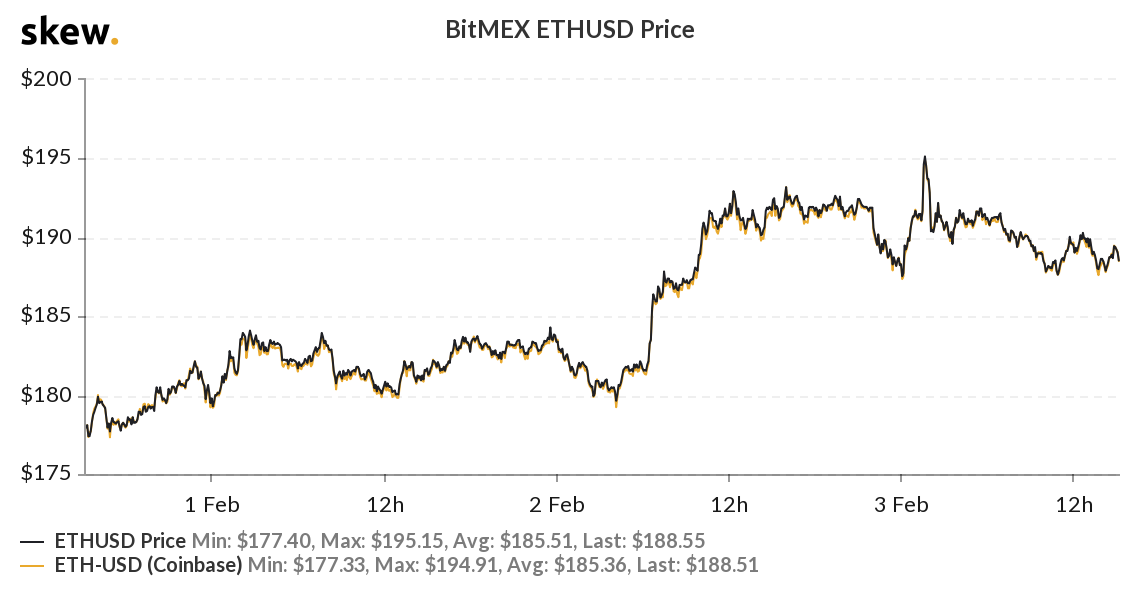

According to data from crypto analytics company Skew, ETH has been trading at $190, which is the highest price it has seen in the past four months. Another interesting thing to note is that almost half of its growth was achieved in 2020 alone—Skew reported that ETH has seen a 47 percent YTD increase. Bitcoin, on the other hand, has seen its price rise 29 percent since Jan. 1, 2020.

Price isn’t the only Ethereum metric that has seen major growth this year. Data from IntoTheBlock has shown that the average transaction size on the Ethereum network increased by more than 122 percent since the beginning of the year.

Bitcoin lagging behind Ethereum

While Bitcoin has also seen its average transaction size grow, the 73 percent YTD increase fades when compared to Ethereum’s 122 percent.

The number of large transactions on the Ethereum network has also grown from 130 on Jan. 1, to 350 on Feb. 2. The 169 percent increase is in line with the rise other metrics have seen so far.

The rise in metrics influenced by ETH spot trading comes as no surprise. Even the slightest rise in the coin’s price is set to push average transaction sizes, transaction numbers, and the number of active addresses up. However, what came as a surprise were the huge developments in Ethereum derivatives trading.

Data from Skew has shown that the aggregated daily volumes of Ethereum futures have seen a significant spike in mid-January.

The aggregated open interest on ETH futures has also seen a slow, but steady rise since the beginning of the year, showing that ETH products shouldn’t be shrugged off.