Bitcoin bulls have long been looking towards its stock-to-flow model as an accurate pricing model that forecasts that the crypto will see a tremendous near-term upside, with the model suggesting that a movement towards $100,000 could be looming on the horizon.

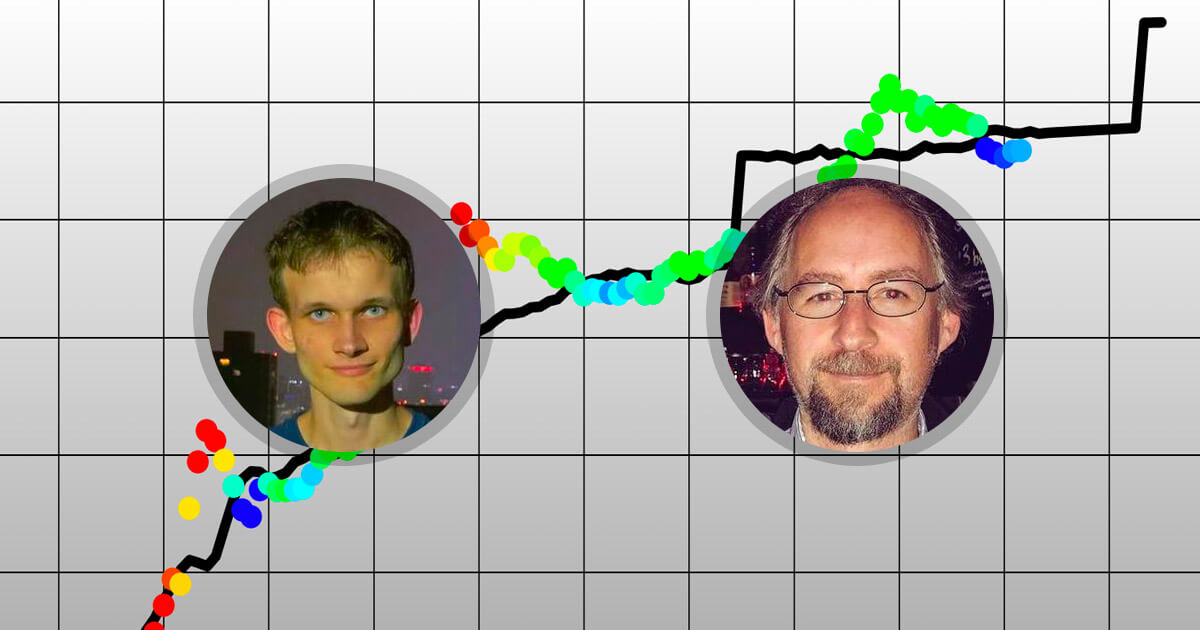

This simple model, however, has drawn the ire of Ethereum co-founder Vitalik Buterin, who recently called bullish BTC forecasts “post-hoc rationalized bullshit,” going on to slam BTC’s S2F model.

These comments, however, drew a scathing critique from Blockstream CEO and co-founder Adam Back, who rebutted Buterin’s claims by insinuating that Ethereum is highly centralized.

Ethereum co-founder slams bullish Bitcoin price predictions and economic models

In a recent tweet, Buterin called the majority of Bitcoin price predictions “bullshit” while referencing screenshots of multiple speculative news reports regarding BTC’s future price prospects.

“Your daily reminder that 95%+ of articles of the form ‘event X will make crypto go (up | down)’ are post-hoc rationalized bullshit.”

In a response to a question from Pierre Rochard regarding articles surrounding BTC’s S2F model, Buterin explained that all “that stuff” is part of the 95% of “ad hoc bullshit” he referenced in his original tweet.

“Nah that stuff is part of the 95%.”

It remains unclear what articles about Bitcoin are exempted from this categorization.

Adam Back rebuts Buterin, insinuates Ethereum is centralized

In response to an article detailing Buterin’s comments, Adam Back – a prominent Bitcoiner and the CEO/co-founder of Blockstream – explained in a response that Buterin’s altcoin (Ethereum) can’t have a S2F model because its stock is undefined and its flow is adjusted ad hoc on the “whims of a few programmers.”

“Who’d have thought. ofc you can’t have a stock2flow when your altcoins stock is undefined and it’s flow is adjusted ad hoc on the whims of a few programmers.”

Back further went on to say “what’s not to believe” about the bullish S2F model, noting that it seems to be logical.

“It’s just a back tested curve fit to historic data, affirmed by co-integration stats test. What’s not to believe? More interesting is interpreting why, given good fit. It does seem logical that rate of supply halving, other things being equal, would tend to drive up price.”

If the forecast offered by this model does come to fruition, it is possible that Bitcoin will rally up towards $100,000 in the coming several years.