The Bitcoin price just dropped by more than four percent within one hour—from $9,224 to $8,851—after 52 hours of ranging with low volatility and volume.

The sudden drop led to the liquidation of $19.25 million on BitMEX and $1.5 million on Bitfinex based on statistics from Datamish.com, causing a sizable long squeeze in a short period of time.

What triggered the abrupt Bitcoin price pullback?

Typically, after several days of low volatility in a tight range, the Bitcoin price tends to see a large movement.

While extended periods of ranging do not necessarily point towards a bearish action, in the case of Bitcoin as of recent, it saw a steady climb in its price with low volume.

An upward trend with declining volume usually suggests that the probability of it being a fakeout before a large downside movement is high.

The significant amount of long contracts placed across major margin trading platforms including BitMEX, Binance, and Bitfinex, and the low volume across the crypto market likely left Bitcoin vulnerable to a pullback.

Market data shows that several whales or individuals holding large amounts of Bitcoin market sold tens of millions of dollars at $9,200, causing a strong reaction from long contract holders and buyers.

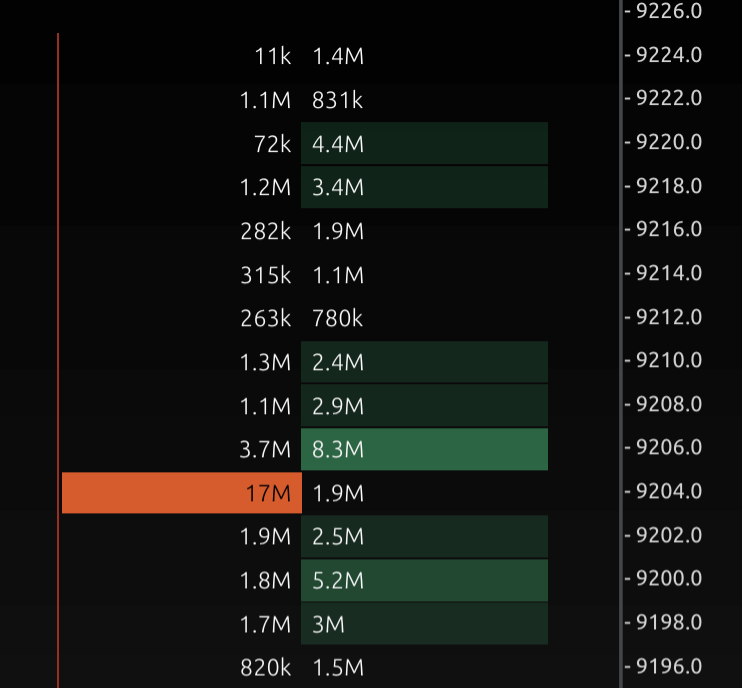

One trader shared an exchange order book that showed a $17 million market sell at $9,204, which was filed just before the correction to the $8,000s.

In highly-leveraged markets like Bitcoin, a relatively small market sell, in comparison to the daily volume of the asset, can cause a large response from both buyers and sellers.

The Bitcoin market shows tens of billions of dollars in daily volume on paper, but since most of it is leveraged volume on BitMEX, Binance Futures, and OKEx, the actual volume is substantially lower.

Low volumes before a highly anticipated event like the block reward halving that is scheduled to occur in April of this year creates an ideal environment for extreme volatility.

Extreme volatility can be expected before halving

As said by crypto trader Jacob Canfield, historical data shows the block reward halving does not coincide with an extended rally.

In the previous two halvings, the Bitcoin price dropped immediately after the halving, with no signs of a strong upsurge until months after the occurrence of the halving.

Canfield noted:

“If you’re thinking that Bitcoin will just go up non-stop because of the halving, let history be your guide. This chart from Nunya Bizniz shows you how volatile BTC can be 60 days out from the halving event. Be prepared for anything.”

Previously, on March 7, CryptoSlate also reported that a well-known multi-billion scam has started to move their funds again equivalent to $117 million in Bitcoin.

Analysts remain uncertain whether the distribution of funds would lead to an immediate sell-off, but favor the theory that a sell-off would be quickly followed by distribution. If that is the case, it could add more selling pressure to the market.