The current economic superpowers would have been a surefire bet some years ago to lead blockchain and cryptocurrency adoption in the world. However, the data shows this is not the case.

LatAm leads in Bitcoin adoption

In its latest report on global crypto adoption, on-chain analytics firm and security provider Chainalysis said that of the top ten nations where the usage of Bitcoin is the highest, only two feature in the list: China and the US.

Our Global Crypto Adoption Index is here! We used on-chain and P2P transaction volume weighted by population, GDP, and other factors to rank 154 countries by grassroots-level cryptocurrency adoption. Read our blog for a sneak peek at the top 10 countries! https://t.co/R4zpSE3Bxc

— Chainalysis (@chainalysis) September 8, 2020

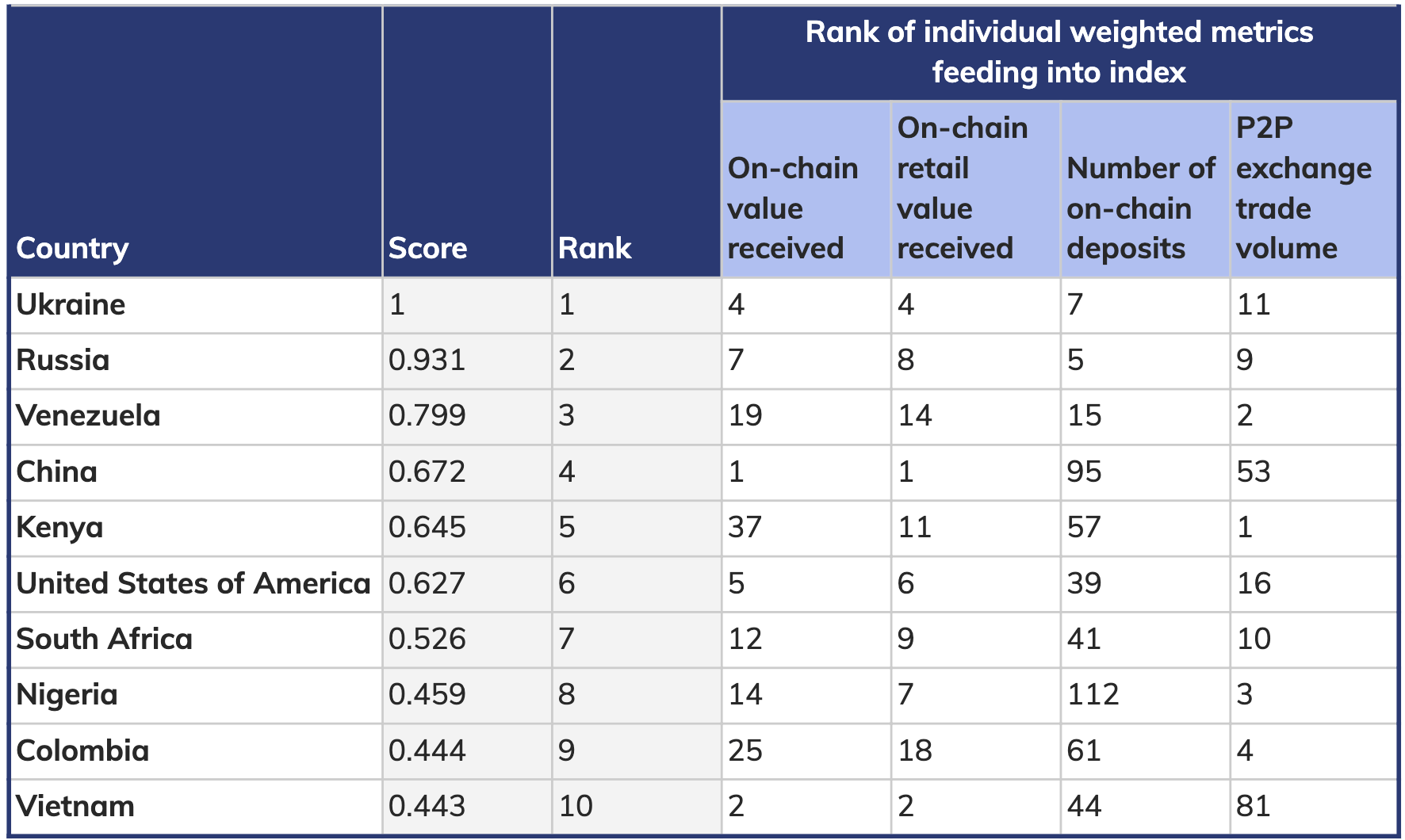

The firm used its proprietary tracking tool, the so-termed Global Crypto Adoption Index, to chalk out the listings. The latter measures each country’s population and the total size of its economy when assessing four factors, namely: on-chain cryptocurrency valued received, on-chain retail value transferred, number of on-chain crypto deposits, and exchange trade volume.

As per Chainalysis, such a method helps find the “intention to highlight the countries where most residents have moved the biggest share of their financial activity to cryptocurrency.”

The firm added that while trading and speculation are important to the cryptocurrency economy, “we wanted our index to emphasize grassroots adoption by everyday users.”

On the Global Crypto Adoption Index accounts for the 154 countries that Chainalysis tracked, it found that Russia, Venezuela, and Ukraine lead in terms of crypto adoption. Others on the list are China, Kenya, the US, South Africa, Nigeria, Colombia, and Vietnam.

What’s up with Venezuela and Columbia?

In South America, Venezuela and Colombia — two countries marred with a corrupt government and rising inflation — have led the way in Bitcoin trading volume. Of those, Venezuela has been a “case study” for Chainalysis:

“Venezuela represents an excellent example of what drives cryptocurrency adoption in developing countries and how citizens use it to mitigate economic instability.”

The firm said Venezuelans have started to use more cryptocurrency more as its “native fiat currency is losing value to inflation,” which in turn suggests that using the new asset class is a way to “preserve savings they may otherwise lose.”

Meanwhile, Columbia, ninth on the Chainalysis list, apparently leads crypto adoption despite the strict regulations governing the industry in the country.

However, the firm noted that lawmakers in Colombia are actively working to make the country more “Bitcoin friendly” by instilling new regulations for crypto trading and related activities.

One added fundamental point is the rising number of Bitcoin ATMs and payment fintech in Colombia, that show a potential boom in the country’s local crypto industry, said Chainalysis.