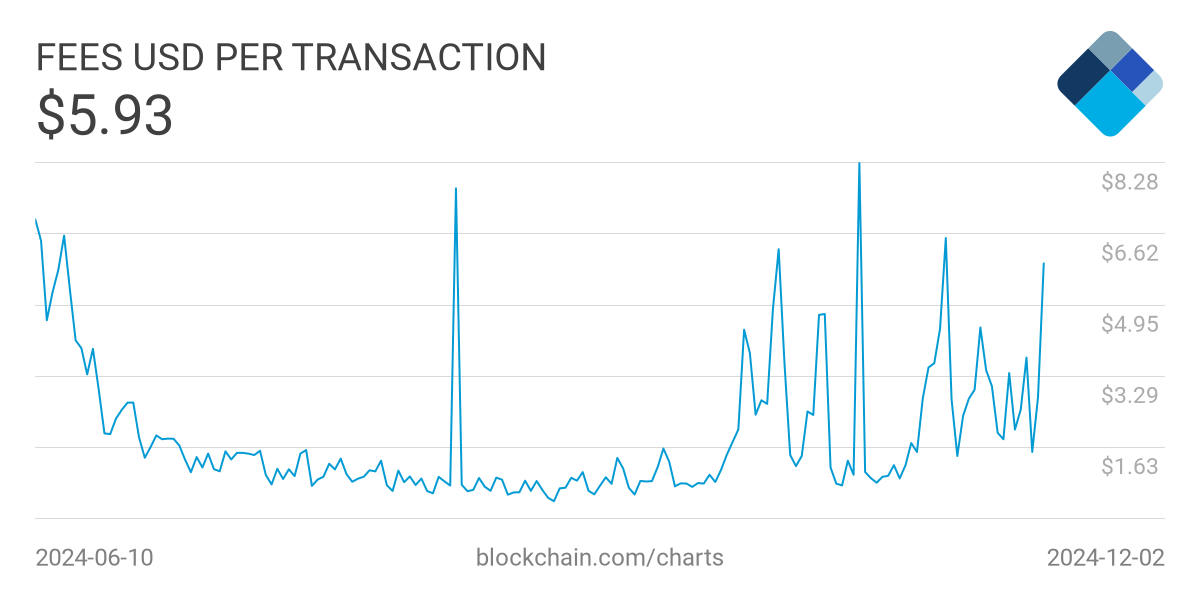

It’s been an expensive past three weeks for Bitcoin users.

The average cost to send a BTC transaction, according to data from Blockchain.com, surged from approximately $0.50 at the start of the month to a high of $6.63 on May 21 — a growth of more than 1,000 percent in just weeks’ time.

This means that at the transaction fee highs, a user wanting to quickly spend $10 worth of BTC had to spend over half of their transaction value on fees.

This comes in spite of the fact that Bitcoin is not in a bull market, with 2017’s bull market driving the average Bitcoin transaction fee past $50 for a short period of time.

The 3 factors behind the parabolic Bitcoin transaction fee increase

Chief executive of Bitcoin startup Bitrefill, Sergej Kotliar, postulated that there are three “main” causes behind this parabolic increase in transaction fees.

Firstly, he identified is the Bitcoin halving, which took place around two weeks ago.

The block reward halving, while deemed astronomically bullish by investors, resulted in a ~50 percent reduction in the revenues of miners, which in turn forced some to turn off their ASIC miners. This, in turn, has resulted in the mining of fewer blocks. Kotliar wrote:

“The halving, which many of you celebrated, caused a decline in hashrate by some 20-30% or so. This has caused fewer blocks, and will continue until the next retargeting ca 14 days from now.”

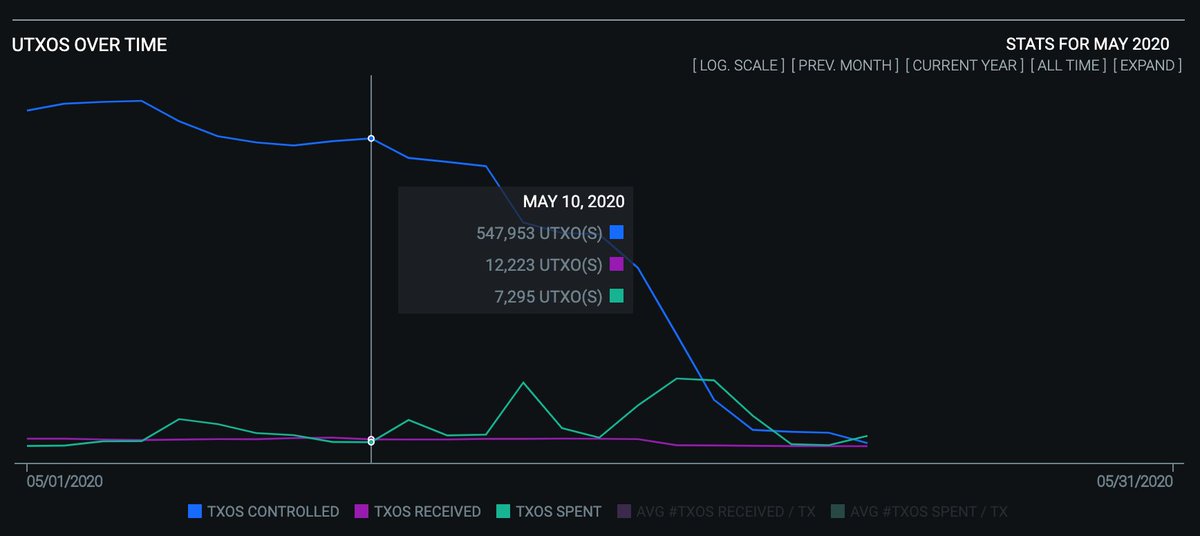

Secondly, the industry executive suggested that there is a “mysterious entity” — meaning a series of Bitcoin addresses seemingly owned by the same private key — that has been consolidating coins “at the highest fee rates, driving up fees for everyone.”

Analysis by Kotliar and a Bitcoin data scientist suggested the entity has spent ~72 BTC, worth approximately $650,000, on consolidating more than 720,000 transactions into a specific set of wallets.

Lastly, Kotliar postulated that the recent volatility in the Bitcoin market is causing an increase in transactions between exchanges, making this “quite the perfect storm.”

The importance of scaling solutions

Although a $6 fee is far from ludicrous — traditional payment rails charge a handful of percentage points, after all — this scenario highlights the need for the implementation of scaling solutions if Bitcoin is to ever become a medium of exchange for one’s day-to-day life.

The leading scaling solution in place is the Lightning Network, which is being pioneered by Lightning Labs and Square. The network basically migrates most transactions to a secure second layer, where Bitcoin can be transacted between parties at extremely low cost, rapidly, and in a more private manner than the base blockchain.

Lightning has only seen tepid adoption thus far, though, with infrastructure still in its earliest stages.