The crypto markets have seen some insane price action over the past several days and weeks, with Bitcoin racing above $10,000 as a plethora of different altcoins see returns that can only be accurately described as being parabolic.

This volatility, however, may have been easily forecasted simply by looking at data regarding the search trends for keywords and phrases relating to Bitcoin and crypto.

This same data that gave some investors insight into this latest uptrend also is signaling that Bitcoin and the aggregated crypto market could have significantly further room to run.

Google Trends data offered insight into the latest crypto rally

Bitcoin’s unwavering uptrend has allowed the crypto to post steady gains on a weekly basis, with each pullback being met with intense buying pressure that ultimately allows it to continue climbing higher.

Prior to the latest leg up – which allowed the crypto to rally from the $9,000 region into the $10,000 region – analysts had noted that search activity for important Bitcoin-related phrases was spiking.

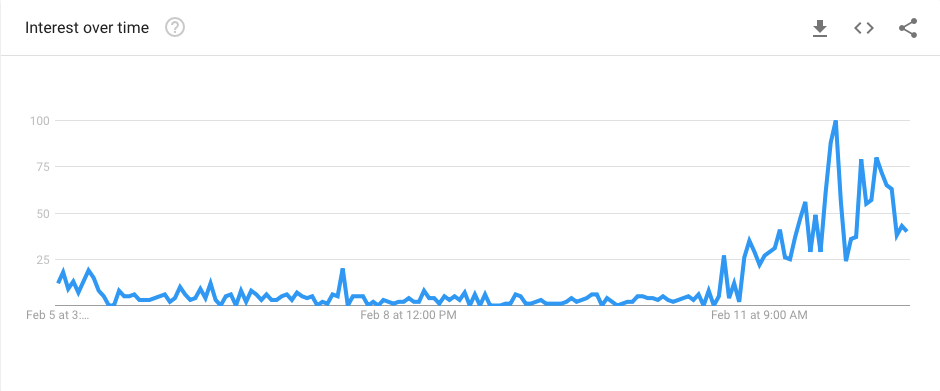

This hasn’t been limited to Bitcoin, however, as altcoins have also witnessed a similar phenomenon, with Hedera Hashgraph – a little known crypto that is currently trading up nearly 100% – seeing a massive spike in Google search volume just prior to its rally.

This volume surged on February 10th, and then the crypto began its meteoric ascent the next day, on February 11th.

Does Google Trends show that Bitcoin is about to see further upside?

The same effect was seen while looking at Hedera Hashgraph also applies to Bitcoin and other cryptos, and analysts have noted that search terms related to BTC have been spiking as of late.

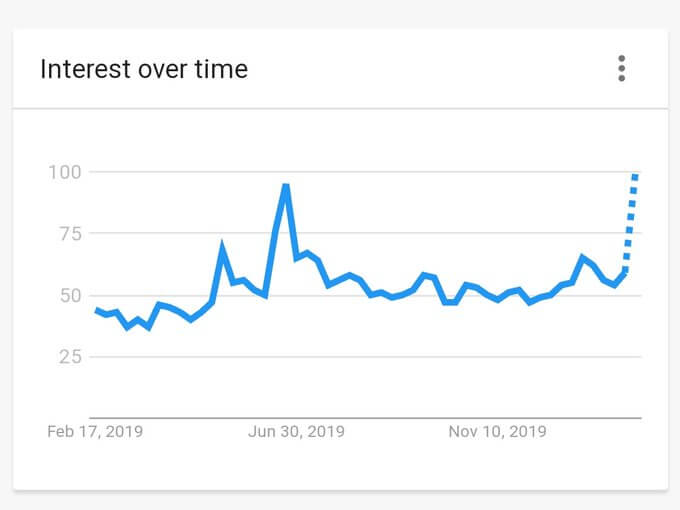

Alistair Milne – the CIO of the Altana Digital Currency Fund and a well-known crypto investor – spoke about search volume for the term “buy Bitcoin” in a recent tweet, pointing to a chart showing that it is about to go parabolic.

“Google trends data for ‘buy Bitcoin’ (12 month range)”

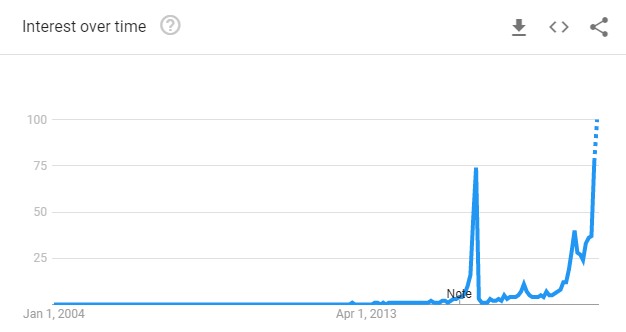

The same type of parabolic rise is seen while looking at the search terms for “bitcoin halving,” which Milne also pointed out in a tweet.

“Google trends data for ‘bitcoin halving’”

It does appear that data from Google Trends is one often overlooked indicator that could provide investors with valuable trend data, especially when it comes to fiat inflows and outflows to and fro the crypto markets from retail investors.