Bitcoin’s seeing increased retail interest ahead of its upcoming halving event on May 12, if Google’s search trends are considered.

Developing countries leading search

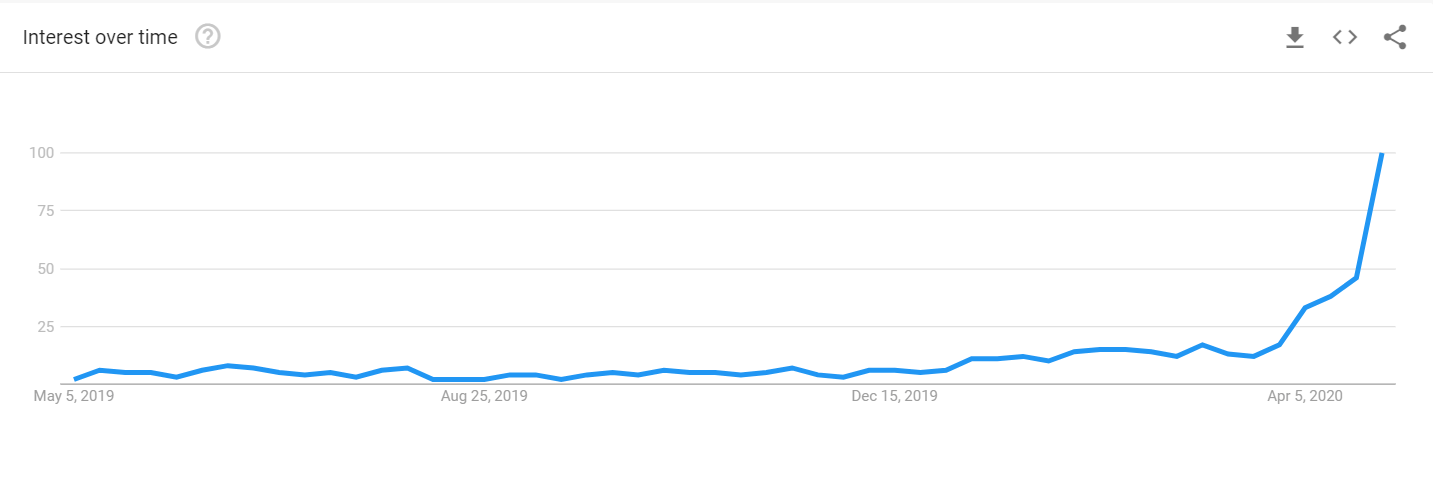

Unique hits for Bitcoin halving are surging, reaching a historically unseen level. The protocol is scheduled for a reduction in block rewards to miners after May 12, cutting incentives down to 6.5 BTC per block instead of the current 12.5 BTC.

Search interest started trending in early-January but seems to have exponentially grown after “Black Thursday” in mid-March, a now-historic event that saw Bitcoin plunge by 45 percent over two trading sessions.

Trends from last month indicate European countries like Latvia, Belarus, and Switzerland account for the greatest interest in Bitcoin halving compared globally. But in May, the term springs also up Nigeria and Venezuela amongst other countries most searching for halving information.

Major economies like the U.S., U.K., India, and South Korea do not feature in the Trends data, despite otherwise having a robust and bustling cryptocurrency ecosystem in terms of workers and entrepreneurs.

As shown below and when grouped by “worldwide,” the “search” sentiment has now peaked at the highest possible “100” points, meaning maximum interest from retail users globally. As per Google, trends are calculated by compiling total searchers in a particular region compared to the relative popularity of the particular search term.

Rising retail interest

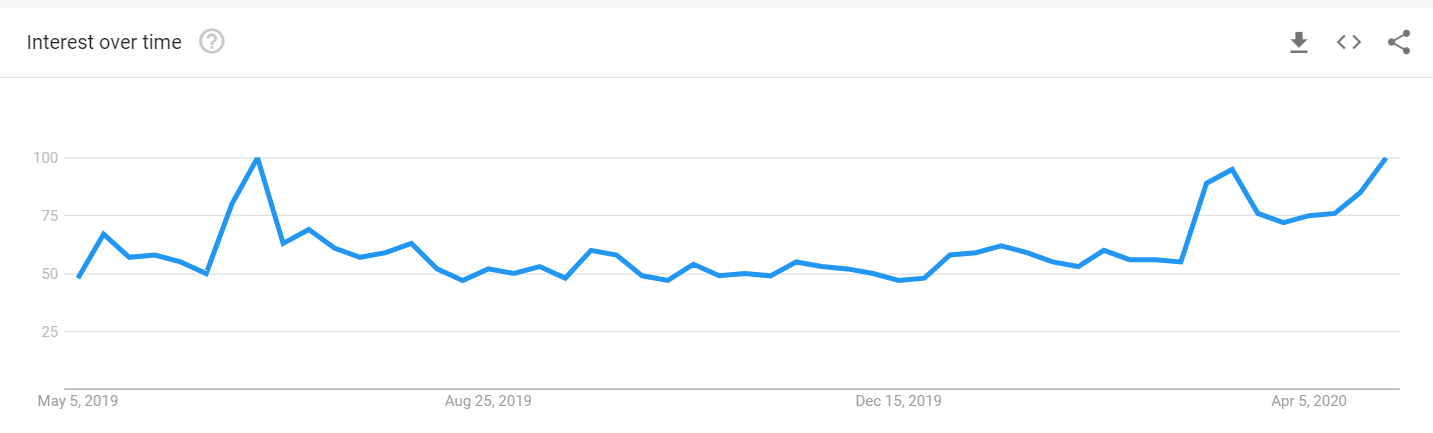

The searches bear an uncanny resemblance to Bitcoin’s price charts, indicating retail and algorithmic traders are looking at Google trend data as a predictive “indicator” for prices.

However, it’s difficult to fully attribute increasing prices to just Google trends. Retail searchers may simply be searching for information on the widely-publicized halving, while traders capitalize on the increased sentiment and a potential sell-off post halving.

Interestingly, search queries for “buy Bitcoin” and “buy crypto” are only slightly over average, although they are steadily rising at the time of writing. The African economies of Nigeria, Ghana, and Cameroon lead in this regard:

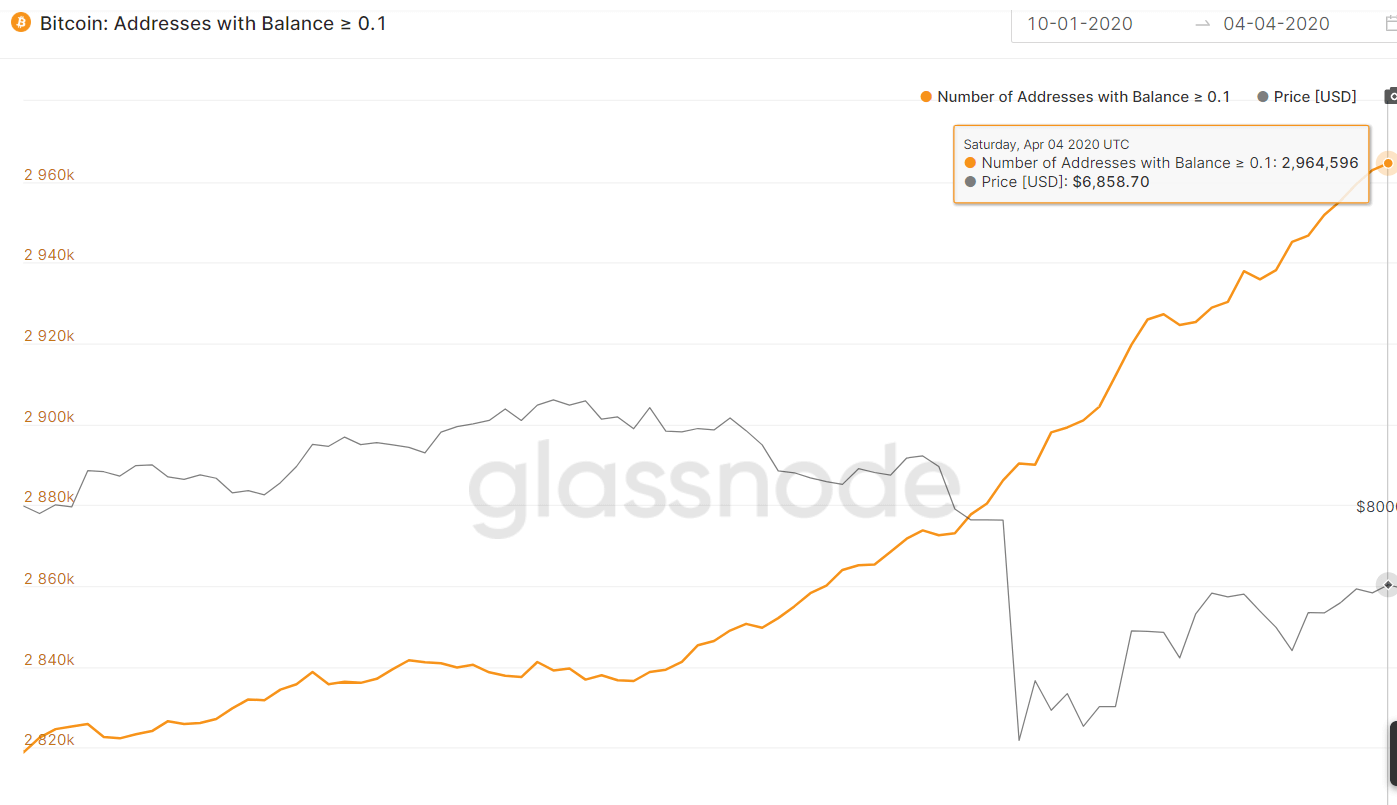

Such data indicates retail buying pressure may only be slowing rising, disproportionate to those searching generally for halving information. Digital asset exchanges echo the sentiment. As CryptoSlate reported last month, bourses like Huobi and OKEx claimed a rise in unique exchange wallets holding between 0.1 – 1 BTC, likely held by individual retail investors.

On-chain metrics by Glassnode further prove the aforementioned:

In 2016, on-chain metrics displayed a similar trajectory. Users with wallets holding similar Bitcoin amounts drove up sharply before halving. However, despite the similarities, it’s important to note that Bitcoin wallets are not unique to users. One person may hold several wallets, meaning millions of wallet does not necessarily equal millions of users.