Glassnode data analyzed by CryptoSlate suggests that investors are confident holding Bitcoin and Ethereum, over stablecoins, during the current risk-off environment

As previously mentioned, billions in stablecoins have been redeemed for fiat in recent months. A significant factor in this was the Binance insolvency FUD, which sparked a run on the exchange.

However, as the FUD died down, on-chain metrics show Bitcoin and Ethereum’s buying power, relative to stablecoins, is on the up.

BTC & ETH purchasing power on the up

Stablecoins fulfill multiple functions, including facilitating on/off ramping and as a store of value, particularly in Southern Hemisphere countries that typically experience high inflation.

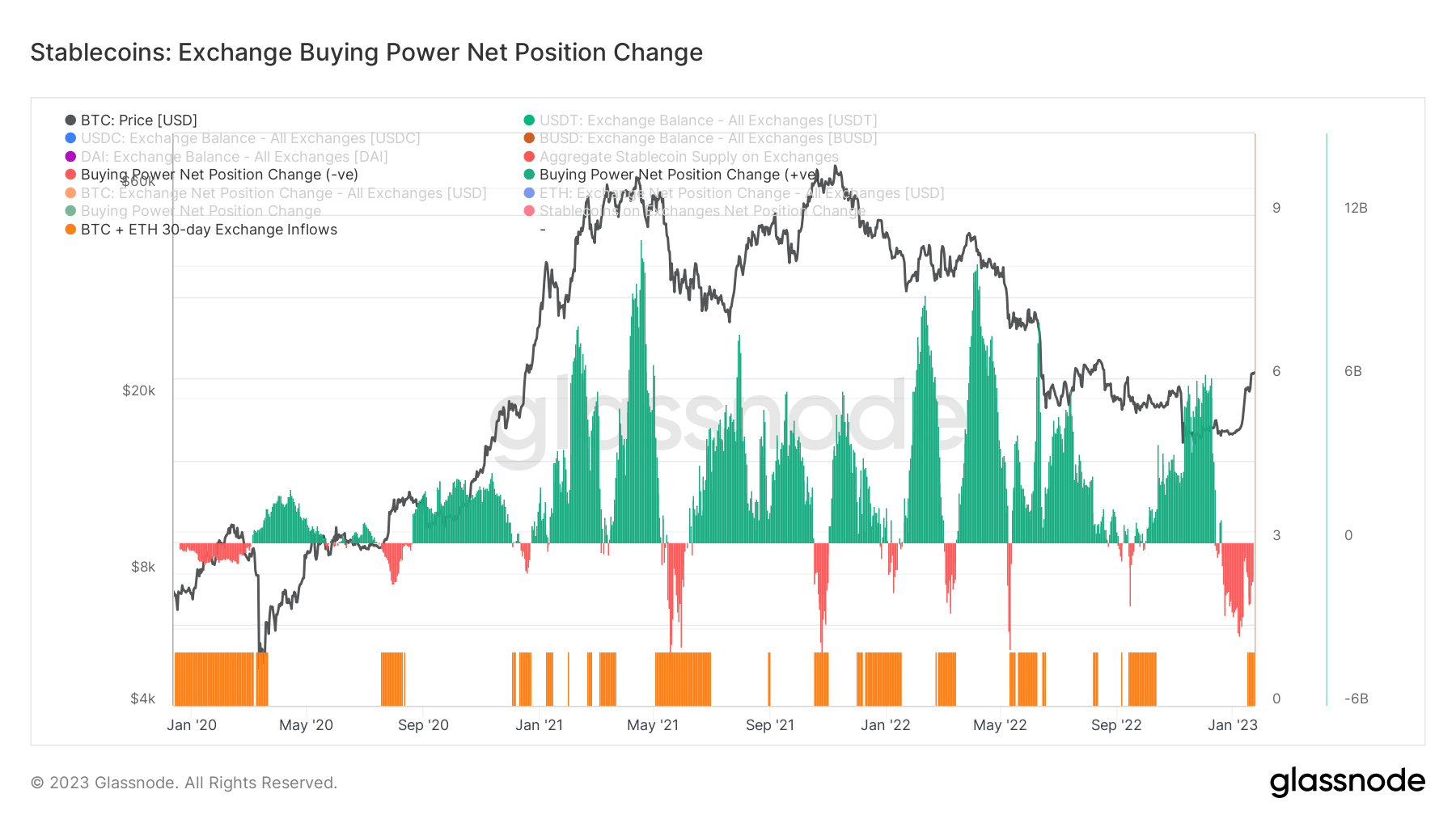

The chart below shows the 30-day change in stablecoin buying power on exchanges. It works by taking into account the supply of the top four stablecoins, USDT, USDC, BUSD, and DAI, then subtracting the USD-denominated change in BTC and ETH exchange flows over the period.

Charting in green denotes an increase in stablecoin volume flowing into exchanges relative to BTC and ETH flows. This suggests there is greater stablecoin-denominated buying power in proportion to BTC and ETH buying power.

By contrast, the red charting signifies a decrease in stablecoin volume relative to BTC and ETH. In other words, BTC and ETH-denominated buying power is greater relative to stablecoin buying power.

The orange bars refer to the 30-day USD volume of BTC and ETH being positive, i.e. when stablecoins are converted to BTC and ETH rather than USD.

Typically, during risk-off sentiment, stablecoins increase in volume as investors move to minimize the impacts of price volatility. Yet the chart below shows investors are acting contrary to expectations by increasing BTC and ETH inflows to exchanges.

The last time this happened was in October, for a brief period. Notably, the current dominance of BTC and ETH exchange volume over stablecoins has extended for approximately seven weeks at this point. This suggests confidence in the top two tokens holding current price levels.

Bitcoin Stablecoin Supply Ratio

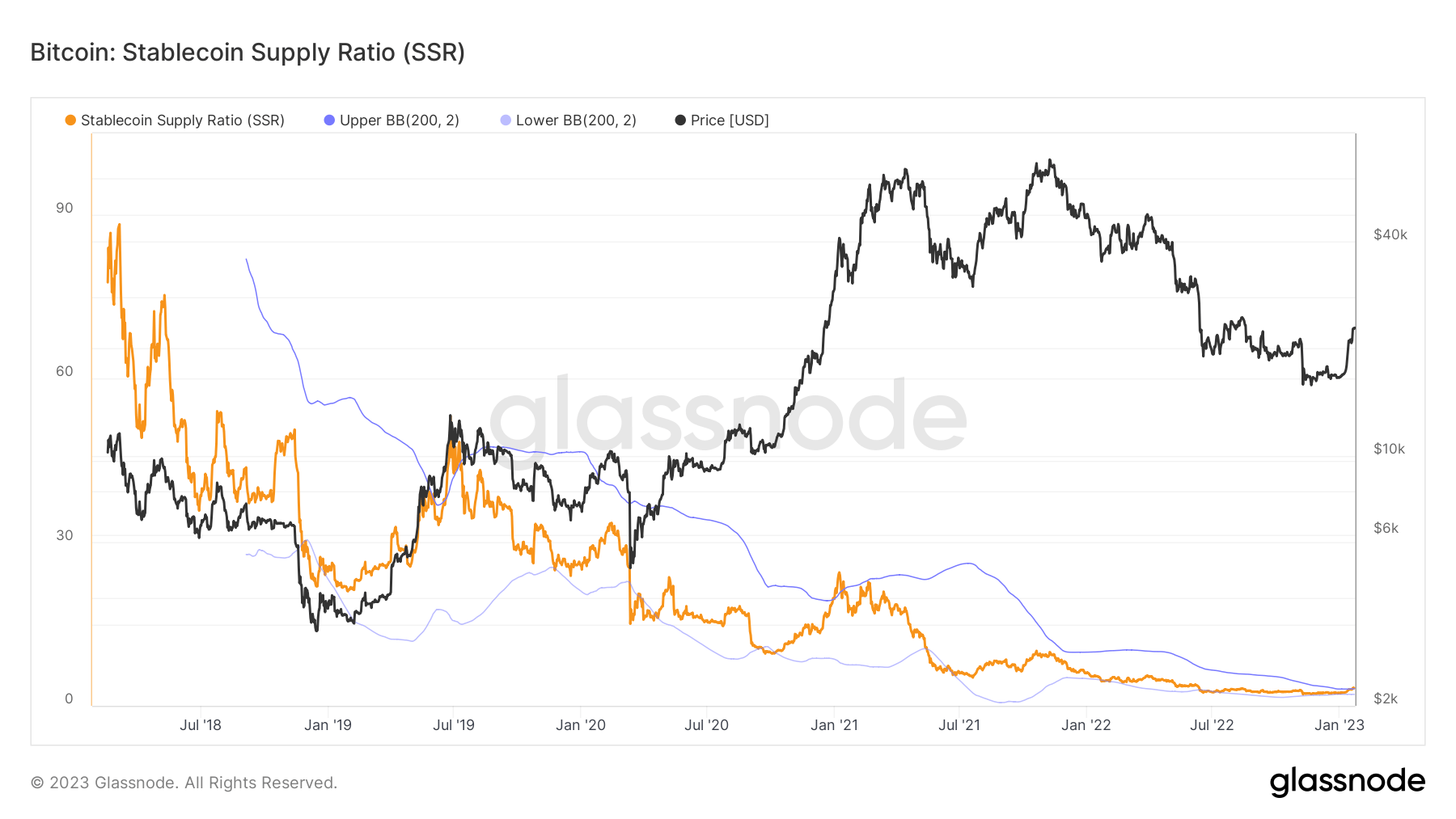

The Stablecoin Supply Ratio (SSR) metric refers to the proportion of Bitcoin supply against stablecoin supply, denoted in BTC.

A high SSR indicates low potential buying pressure and is considered bearish. Conversely, a low SSR means high potential buying pressure making this situation bullish. When the SSR is low, the current stablecoin supply has more “buying power” to purchase BTC.

The chart below shows SSR breaching the upper bound line for the first since Jan 2021, which coincided with BTC’s run to $65,000. The previous instance of breaking the upper bound line was in July 2019, as BTC spiked to $14,000 after the $3,300 market bottom.

The above indicates bullish tailwinds, despite the current risk-off environment.