MicroStrategy said it spent roughly $150 million to acquire 6,455 Bitcoin (BTC) between February 16 and March 23, according to a March 27 SEC filing.

The pro-Bitcoin firm added that it prepaid the principal of $161 million on its loan from failed crypto-friendly bank Silvergate Bank.

According to the filing, the 34,619 BTC held as collateral for the loan has been released.

MicroStrategy had taken a $205 million loan from Silvergate in March 2022. The loan was collateralized with the firm’s BTC holdings and $5.0 million cash reserve held at the failed bank.

As of March 23, the firm said it held 138,955 BTC acquired for approximately $4.14 billion at an average price of $29,817.

With BTC trading around $27,000, MicroStrategy has an unrealized loss of over $340 million as its holdings are valued at $3.8 billion.

Saylor remains bullish on Bitcoin

The company’s founder Michael Saylor remains bullish on the flagship digital asset.

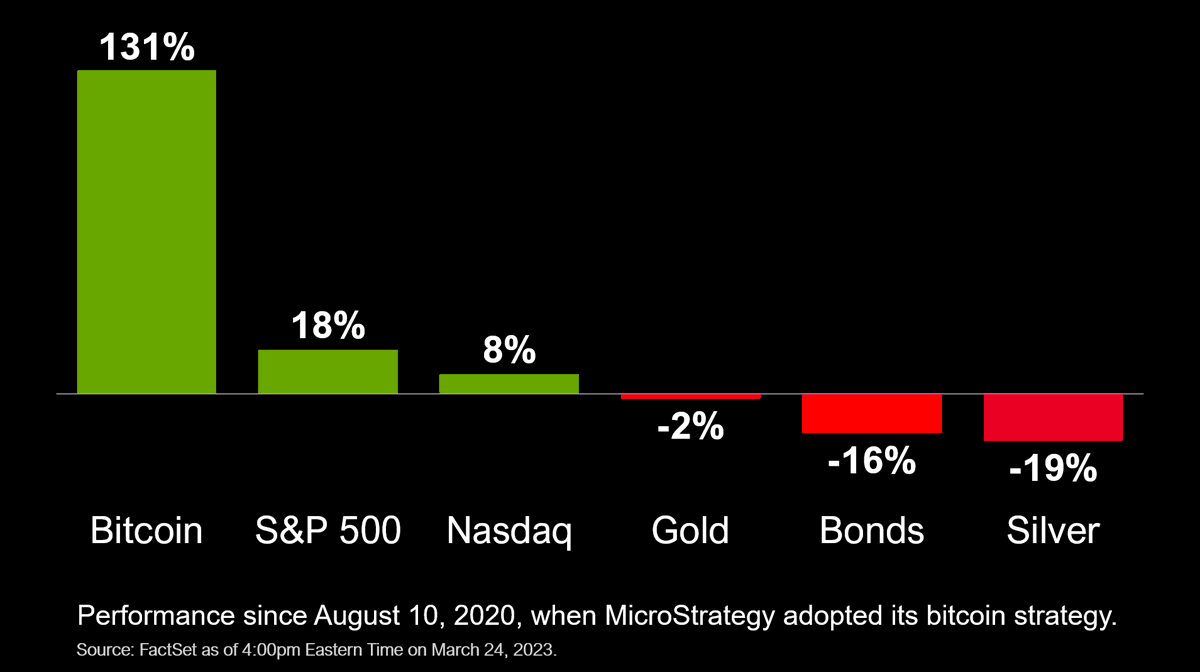

A March 25 tweet from Saylor showed that Bitcoin had outperformed other traditional assets like gold, silver, bonds, Nasdaq, and S$P 500 since his company adopted the BTC strategy.

In a separate tweet, Saylor noted that Bitcoin replaces the broken banking system with something better. This was in reference to the recent banking crisis that has claimed several crypto-friendly banks like Silicon Valley Bank and Signature Bank.

Meanwhile, MicroStrategy said it raised $339.4 million between January 1 and March 23 through the sales agreement for its class A common stock with sales agents — Cowen and Company, LLC and BTIG, LLC.

The news had no impact on BTC’s price performance. The flagship digital asset is down 0.44% on the 1-hour candle to $27,745, according to CryptoSlate’s data.

MicroStrategy shares are up 2.72% premarket. The stock has increased 81% on the year-to-date metric.

(Updated throughout to include more details)