According to Brian Armstrong, the CEO of Coinbase, one of the largest cryptocurrency exchanges in the global market valued at $8 billion, institutional customers have been depositing $200 million to $400 million per week into the crypto market.

Up until mid-2018, major exchanges and regulated investment vehicle operators had struggled to see a consistent inflow of capital from institutions into the sector likely because of the inexistence of reliable custodial solutions and regulated investment vehicles.

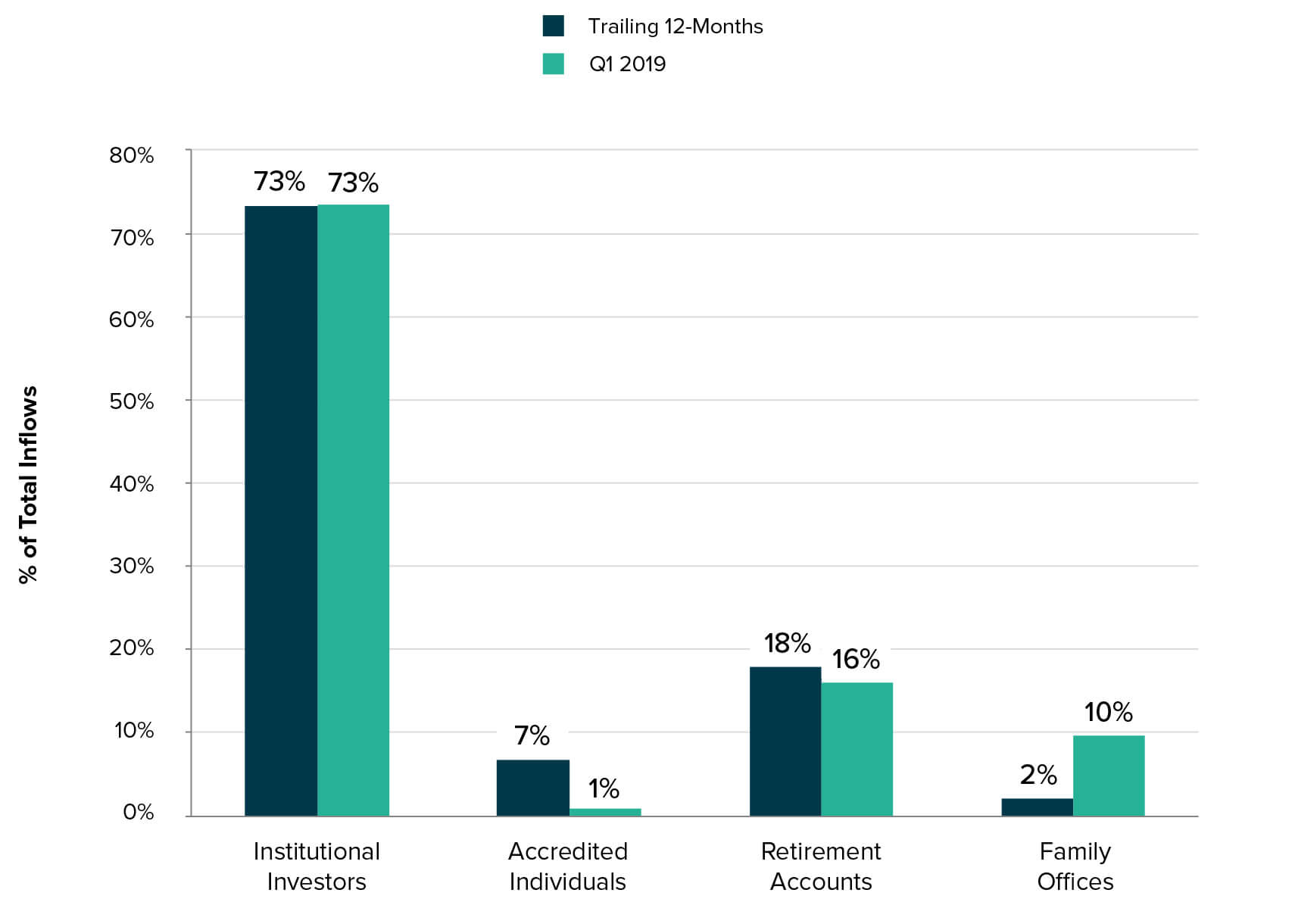

In the past 12 months, as seen in the steep increase in the inflow of institutional capital into cryptocurrency investment firms like Grayscale Investments, companies have started to observe rising optimism towards crypto by institutional investors.

Why is institutional interest towards cryptocurrency on the rise?

As of August 2019, the market valuation of bitcoin, the most dominant cryptocurrency in the market, is estimated to be around $181 billion.

Possibly due to its relatively low market capitalization in comparison to traditional safe-haven assets, short term price movements of bitcoin and the rest of the cryptocurrency market have shown that investors prefer gold, bonds, and other forms of safe-havens over digital currencies for now.

Although cryptocurrencies have not been moving in tandem with gold and safe-haven assets in general, digital assets have shown independent movements that could indicate a lack of clear correlation with the performance of the global equities market and economy.

Such independence in price movements could enable bitcoin to evolve into a stronger alternative store of value over the medium to long term, a narrative that many institutional investors seem to consider as a part of their thesis of investing into the market.

“Whether institutions were going to adopt crypto or not was an open question about 12 months ago. I think it’s safe to say we now know the answer. We’re seeing $200-400M a week in new crypto deposits come in from institutional customers,” said Coinbase CEO Brian Armstrong.

The statement of Armstrong followed the acquisition of Xapo’s institutional business by Coinbase, making Coinbase the largest crypto custodian in the global market by combining the firm’s in-house custodial business and Xapo’s institutional client base.

The official document released by Coinbase read:

“Xapo has long been a pioneer in the storage of crypto assets, leading the industry in the creation of security techniques that have kept their customers’ cryptocurrency safe since 2014. Xapo was founded with the mission of making Bitcoin more secure and accessible. Coinbase will extend Xapo’s legacy and bring it yet another step closer to achieving its mission.”

The increasing emergence of regulated custodial services and investment vehicles would serve as a foundation for institutional investors entering the cryptocurrency market, facilitating the demand from investors that previously were largely uninvolved in the sector.