The price of Bitcoin surged from $7,000 to $9,275, up more than 20 percent against the U.S. dollar, within a seven-day span between June 11 and 18. Analysts from JPMorgan attribute the recent upside movement to rising institutional demand, according to a report obtained by Zerohedge.

How institutions have been investing in Bitcoin

Over the past several years, investors in the crypto space, such as Ari Paul at Blocktower, have emphasized the inflow of capital from institutional investors as a potential factor for the medium to long term growth of the asset class. However, as institutions entered the crypto market at a slower rate than expected up until 2018, the narrative of institutions driving the market subsided.

In recent months, investment firms including Grayscale, which oversee more than $2 billion in assets under management, have recorded a noticeable increase in the inflow of capital from institutions. Meanwhile, strictly regulated platforms like CME have seen record volumes.

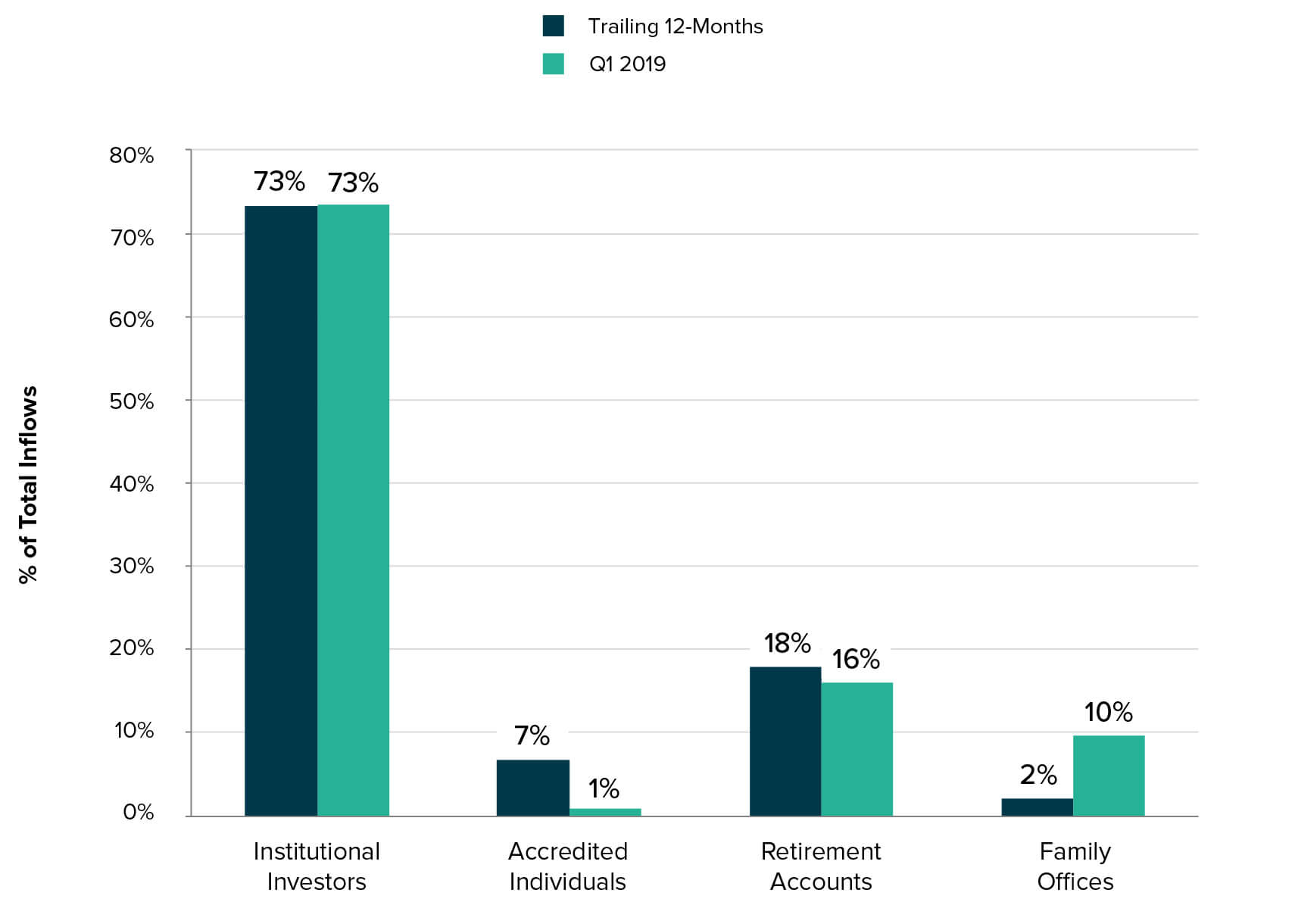

In its 2019 Q1 report, Grayscale disclosed that the overwhelming majority of investments into its products came from institutions, at a stunning 73 percent.

“Institutional investors comprised the highest percentage of total demand for Grayscale products in the first quarter (73%). This was also consistent with their share of inflows over the trailing twelve months (73%). As we have mentioned in previous reports, many institutional investors may view the current drawdown as an attractive entry point to add to their core positions in digital assets,” said the Grayscale team.

Some have suggested that following a dip in the U.S. equities market in December 2018, investors started to panic sell liquid assets like Bitcoin and other crypto assets, causing the price of bitcoin to drop to as low as $3,150.

But, as the equities market began to recover, the appetite for high-risk assets also started to increase, making the asset class more compelling for investors.

Considering the significant increase in demand from institutions as seen in the reports of firms like Grayscale, the JPMorgan report cited by Zerohedge read:

“Recently published work by Bitwise to the SEC as part of an application for a bitcoin ETF suggests that bitcoin trading volumes on many cryptocurrency exchanges are significantly overstated by ‘fake’ trading, and that genuine trading volumes could be around 5% of the reported total. Similarly, the Blockchain Transparency Institute publish monthly market surveillance reports, and estimated in April 2019 that less than 1% of reported volume for some exchanges represented real trades. The market structure has likely changed considerably… with a greater influence from institutional investors.”

Are institutions better?

Institutional investors typically invest in an emerging asset class with a long-term strategy and an investment thesis with the intent of holding onto the asset for extended periods of time.

Although many investors and institutions consider Bitcoin to be a high-risk speculative asset, the fact that it is so speculative may make the asset compelling as a long term hold, incentivizing institutions to hold onto the asset rather than liquidate their positions in the near to medium term.